Stock Analysis

- Hong Kong

- /

- Hospitality

- /

- SEHK:1128

Investors in Wynn Macau (HKG:1128) have unfortunately lost 65% over the last five years

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Wynn Macau, Limited (HKG:1128) share price managed to fall 66% over five long years. That is extremely sub-optimal, to say the least. The falls have accelerated recently, with the share price down 16% in the last three months.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Wynn Macau

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Wynn Macau became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The modest 1.2% dividend yield is unlikely to be guiding the market view of the stock. It could be that the revenue decline of 30% per year is viewed as evidence that Wynn Macau is shrinking. This has probably encouraged some shareholders to sell down the stock.

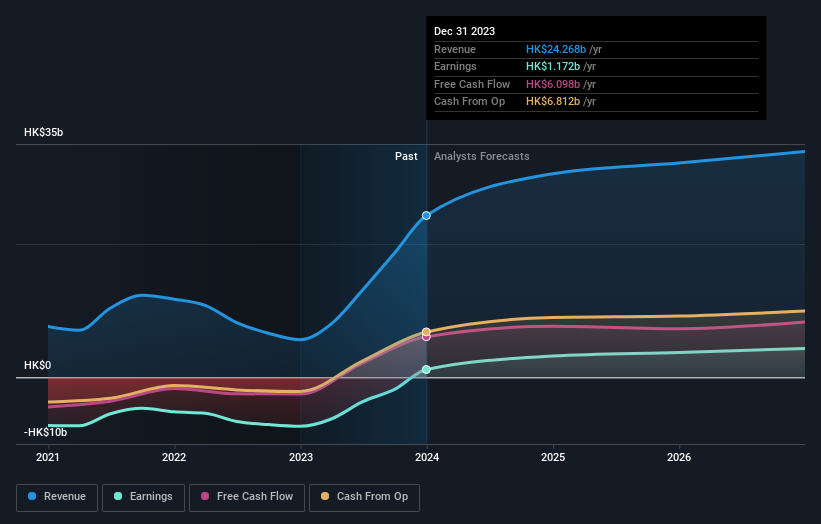

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Wynn Macau is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Wynn Macau shareholders are down 10.0% for the year (even including dividends), but the market itself is up 9.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Wynn Macau (of which 2 are a bit concerning!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Macau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1128

Wynn Macau

Engages in the development, ownership, and operation of integrated destination casino resorts in the People’s Republic of China.

Reasonable growth potential and fair value.