- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:9876

It Looks Like The CEO Of Ocean One Holding Ltd. (HKG:8476) May Be Underpaid Compared To Peers

Key Insights

- Ocean One Holding to hold its Annual General Meeting on 22nd of August

- Salary of HK$948.0k is part of CEO Tsan Fong Chan Chan's total remuneration

- The total compensation is 61% less than the average for the industry

- Ocean One Holding's total shareholder return over the past three years was 217% while its EPS grew by 14% over the past three years

The solid performance at Ocean One Holding Ltd. (HKG:8476) has been impressive and shareholders will probably be pleased to know that CEO Tsan Fong Chan Chan has delivered. At the upcoming AGM on 22nd of August, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

View our latest analysis for Ocean One Holding

Comparing Ocean One Holding Ltd.'s CEO Compensation With The Industry

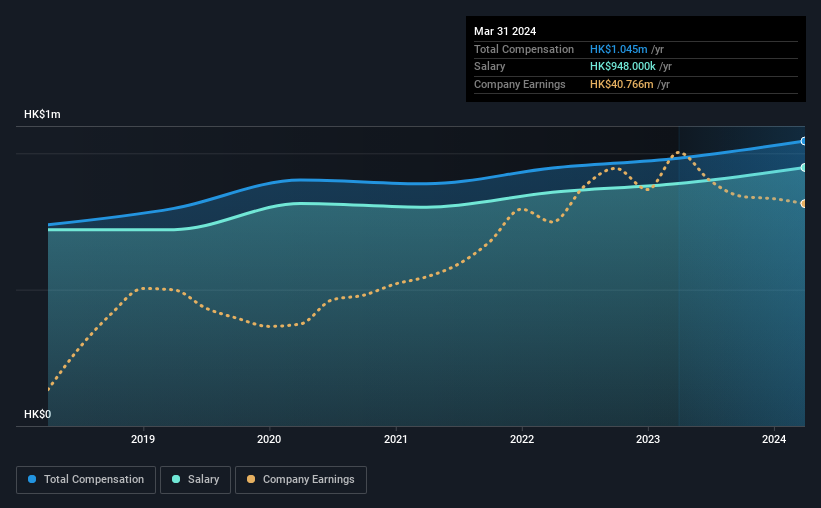

Our data indicates that Ocean One Holding Ltd. has a market capitalization of HK$633m, and total annual CEO compensation was reported as HK$1.0m for the year to March 2024. That's just a smallish increase of 6.4% on last year. Notably, the salary which is HK$948.0k, represents most of the total compensation being paid.

For comparison, other companies in the Hong Kong Consumer Retailing industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.6m. In other words, Ocean One Holding pays its CEO lower than the industry median. What's more, Tsan Fong Chan Chan holds HK$465m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$948k | HK$889k | 91% |

| Other | HK$97k | HK$93k | 9% |

| Total Compensation | HK$1.0m | HK$982k | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. It's interesting to note that Ocean One Holding pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Ocean One Holding Ltd.'s Growth

Over the past three years, Ocean One Holding Ltd. has seen its earnings per share (EPS) grow by 14% per year. It saw its revenue drop 1.8% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ocean One Holding Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Ocean One Holding Ltd. for providing a total return of 217% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Ocean One Holding that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9876

Ocean One Holding

An investment holding company, engages in the import and wholesale of frozen seafood products in Hong Kong, Macau, Mainland China, Taiwan, and Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives