- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6808

Sun Art Retail Group (SEHK:6808) Eyes Profitability with 93.95% Growth and Cost Efficiency Focus

Reviewed by Simply Wall St

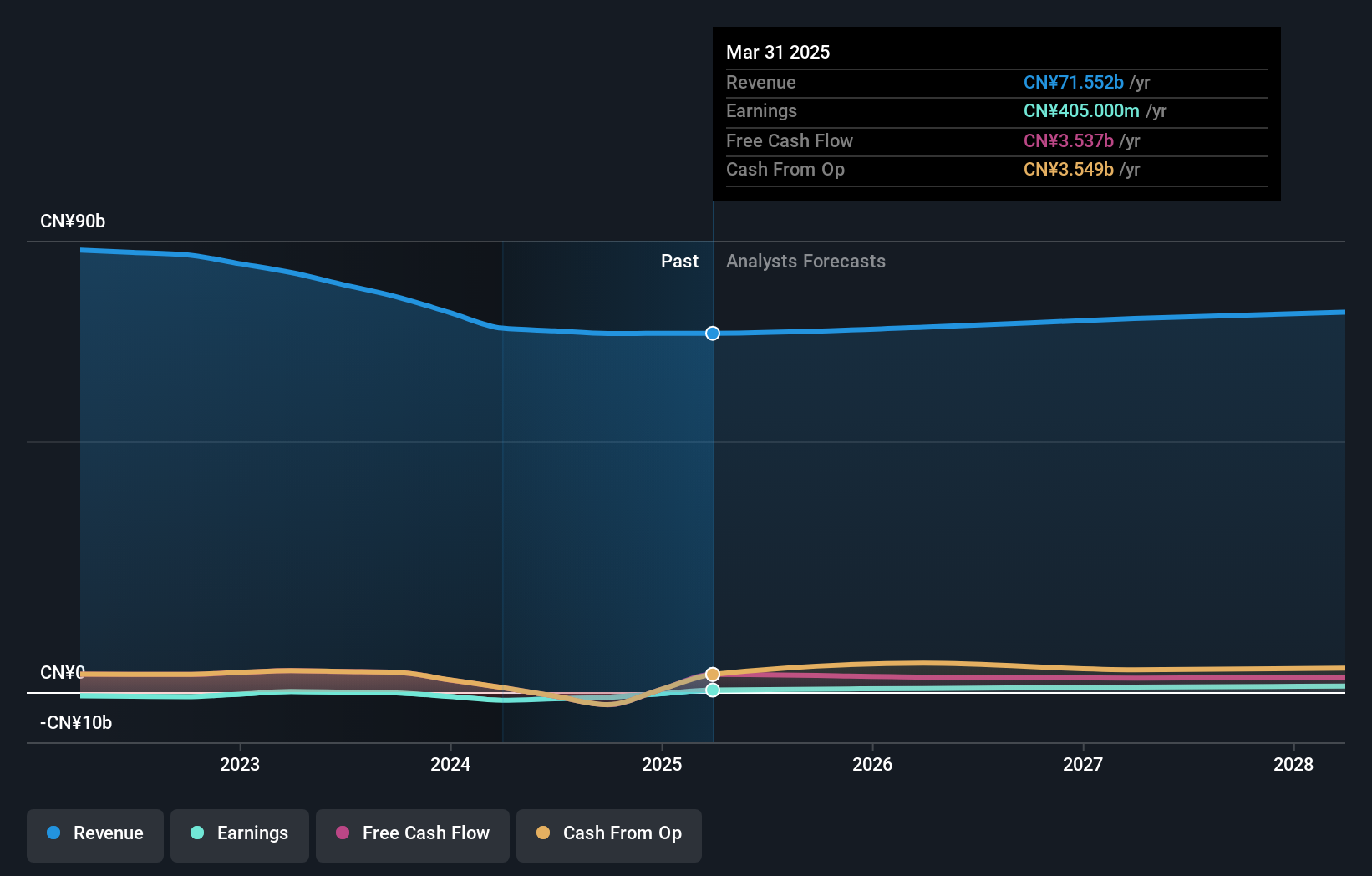

Sun Art Retail Group (SEHK:6808) is on a promising trajectory with expectations of achieving profitability within the next three years, driven by a forecasted annual profit growth rate of 93.95%. The company has recently improved its financial performance, achieving a gross profit margin of 24.6%, reflecting its strategic focus on cost reduction. However, challenges such as increasing losses and a -5.06% return on equity remain. This report will cover key areas including financial health, growth strategies, and regulatory challenges impacting Sun Art's market position.

Navigate through the intricacies of Sun Art Retail Group with our comprehensive report here.

Core Advantages Driving Sustained Success for Sun Art Retail Group

Sun Art Retail Group is on a promising trajectory, expected to achieve profitability within the next three years. This optimism is bolstered by a forecasted profit growth rate of 93.95% annually, surpassing average market growth. The company's financial health is strong, with more cash than total debt, ensuring solid liquidity. Additionally, Sun Art earns more interest than it pays, indicating effective interest coverage. The company trades at HK$2.56, significantly below its estimated fair value of HK$5.50. According to Desory Wan, CFO, the company has turned around its financial performance, achieving a gross profit margin of 24.6%, an increase of RMB 600 million from the previous year, which underscores its operational efficiency and strategic focus on cost reduction.

Vulnerabilities Impacting Sun Art Retail Group

Sun Art faces challenges, including a current lack of profitability with losses increasing by 63.1% annually over the past five years. The company also reports a -5.06% return on equity, reflecting financial inefficiencies. Revenue growth stands at 3.3% per year, lagging behind the Hong Kong market's 7.8% growth rate. Additionally, the absence of notable dividend payments suggests limited returns for shareholders. Desory Wan has acknowledged a 4.1% decrease in gross profit margin, attributing it to a low-price strategy aimed at reshaping price competitiveness. Rental income has also declined due to store closures and tenant mix adjustments.

Potential Strategies for Leveraging Growth and Competitive Advantage

Sun Art is poised for significant growth opportunities, particularly through store expansion and new formats. The company has been focusing on increasing its hypermarkets and developing multi-format and omnichannel strategies, including RTE supers, as noted by Xiaobei Gu, Head of Investor. Online sales growth is another major driver, with every online sale proving profitable. The company is also optimizing its product strategy by strengthening its private label offerings, which could enhance its market position and drive revenue growth to match or exceed market averages.

Regulatory Challenges Facing Sun Art Retail Group

Sun Art must navigate several external threats, including a competitive market environment where a drop in market share is evident, according to Lo Chen from Merrill. Regulatory changes, particularly in prepaid card regulations, pose additional challenges, as highlighted by CEO Hui Shen. Economic headwinds and shifts in consumer behavior, such as a preference for home-cooked meals over dining out, further complicate the situation. These factors may impact the company's ability to maintain growth and market share in the long term.

Conclusion

Sun Art Retail Group is strategically positioned to capitalize on its strengths, with a forecasted annual profit growth rate of 93.95% and a strong liquidity position, which indicates a promising path to profitability within the next three years. The company's efforts in store expansion, omnichannel strategies, and private label enhancement are expected to drive revenue growth and improve market position. The current trading price of HK$2.56, significantly below the estimated fair value of HK$5.50, presents an attractive investment opportunity, suggesting potential for substantial shareholder returns if the company successfully navigates regulatory challenges and market competition. This comprehensive strategy, coupled with a focus on cost reduction and operational efficiency, highlights Sun Art's potential to overcome its vulnerabilities and achieve sustained success in the evolving retail sector.

Seize The Opportunity

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:6808

Sun Art Retail Group

An investment holding company, operates brick-and-mortar stores and online sales channels in the People’s Republic of China.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives