- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Undiscovered Gems in Hong Kong for August 2024

Reviewed by Simply Wall St

As global markets face volatility and economic data reveals mixed signals, the Hong Kong market remains a focal point for investors seeking opportunities in undervalued stocks. Despite broader market challenges, small-cap companies in Hong Kong may offer unique growth potential due to their innovative approaches and niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited (SEHK:1277) is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$9.78 billion.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company's financials reflect a market cap of HK$9.78 billion, with significant revenue contributions from its core operations.

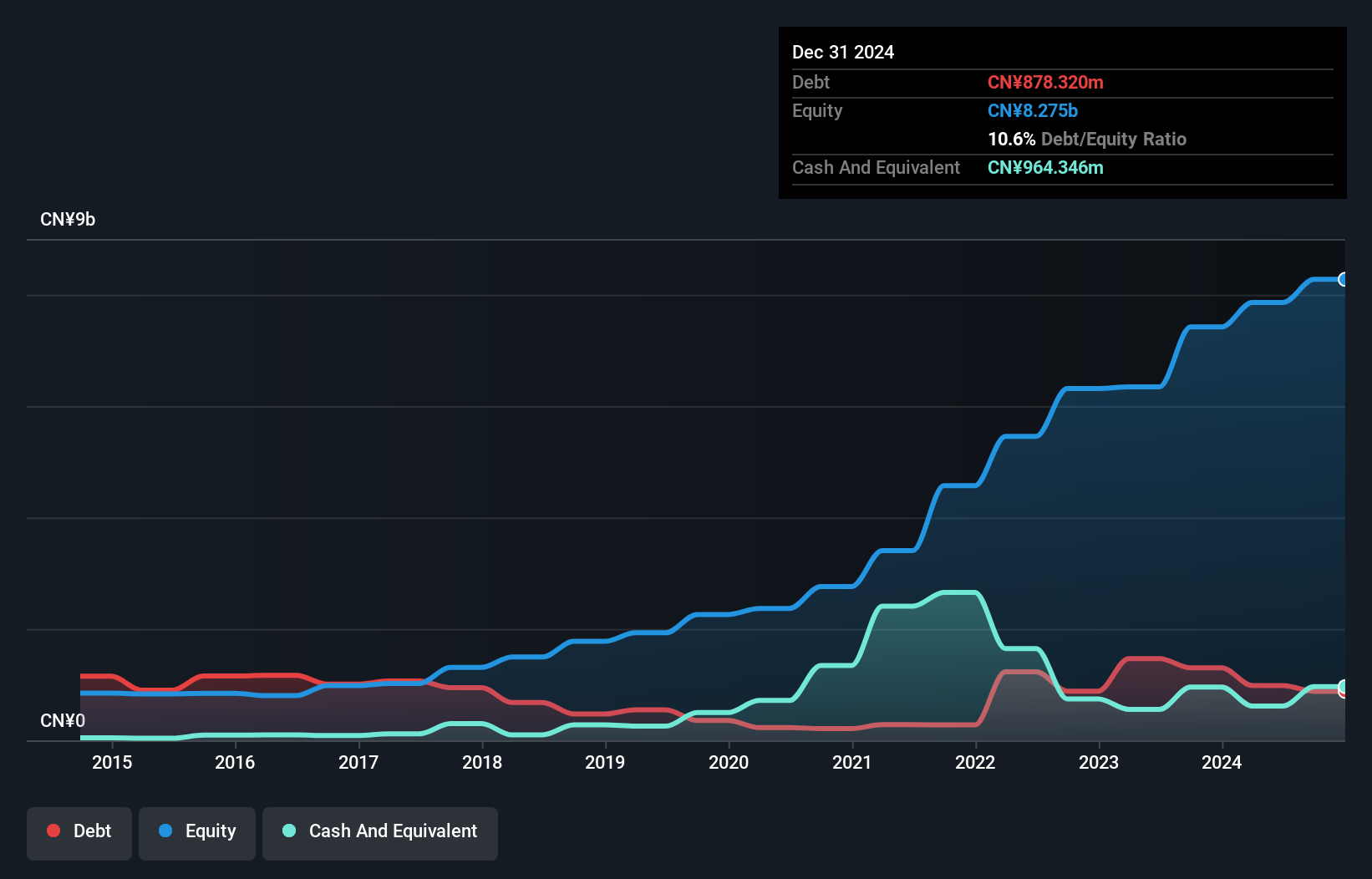

Kinetic Development Group, a small-cap player in Hong Kong, has shown significant financial improvements. Its net debt to equity ratio stands at 4.7%, down from 26.6% over five years, indicating prudent debt management. Despite negative earnings growth of -22% last year compared to the industry average of -6.8%, its interest payments are well covered by EBIT at 55.7x coverage. Recently, it declared a final dividend of HK$0.05 per share for 2023 and amended its company bylaws in May 2024.

- Take a closer look at Kinetic Development Group's potential here in our health report.

Learn about Kinetic Development Group's historical performance.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$8.79 billion.

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily through retail sales in grocery stores, amounting to CN¥6.09 billion.

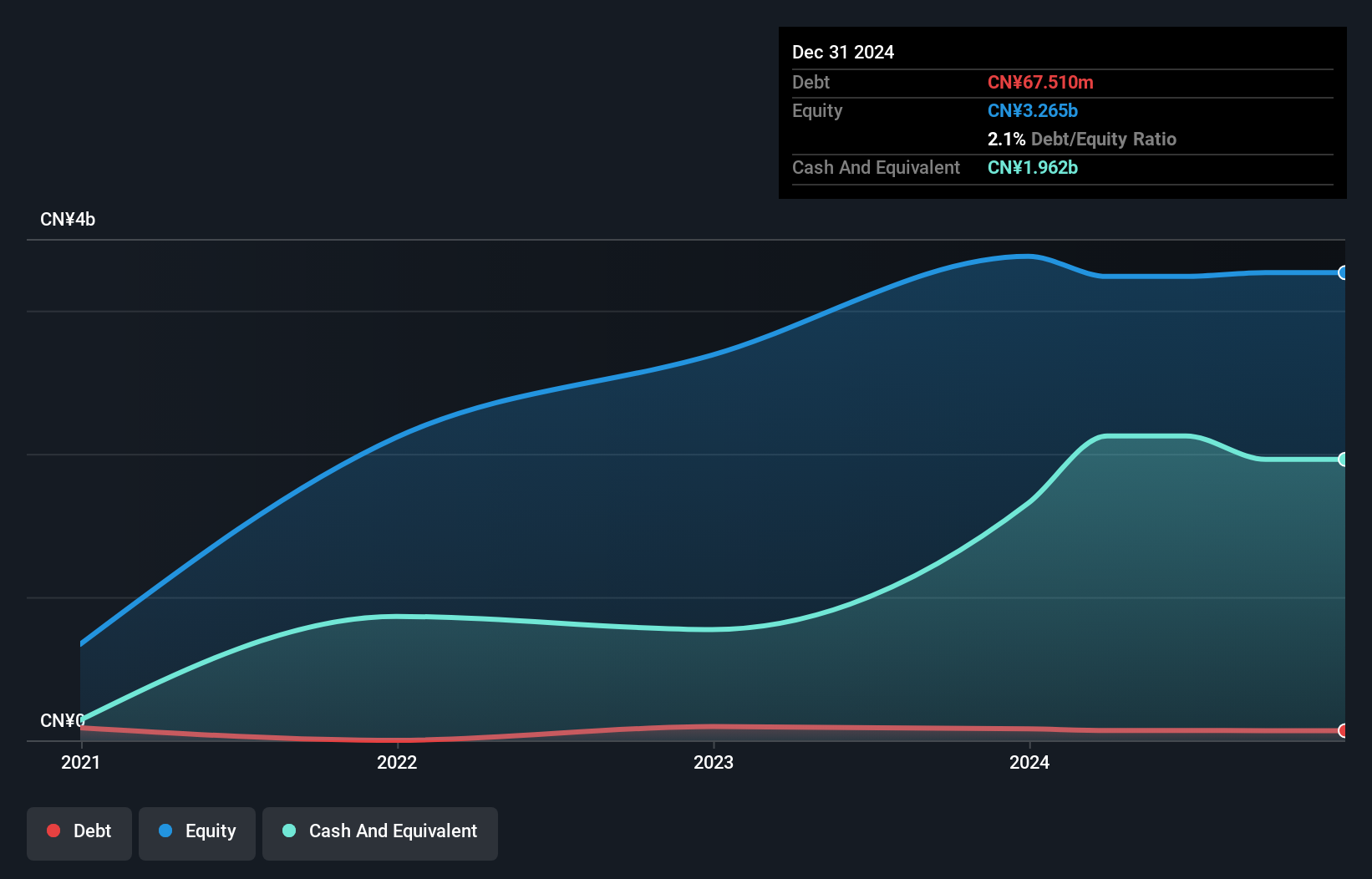

Guoquan Food (Shanghai) has been making strides with a 4.2% earnings growth over the past year, outpacing the Consumer Retailing industry’s 1.6%. The company is profitable and boasts levered free cash flow of RMB 543.34M in 2023, a significant turnaround from negative figures in previous years. Recent board changes include appointing Mr. Cheung as Joint Company Secretary while Mr. Wang continues as CFO, reflecting strong leadership stability and expertise within the firm.

Vtech Holdings (SEHK:303)

Simply Wall St Value Rating: ★★★★★★

Overview: Vtech Holdings Limited, along with its subsidiaries, designs, manufactures, and distributes electronic products globally and has a market cap of HK$12.95 billion.

Operations: The company generates revenue primarily from the design, manufacture, and distribution of consumer electronic products amounting to $2.15 billion.

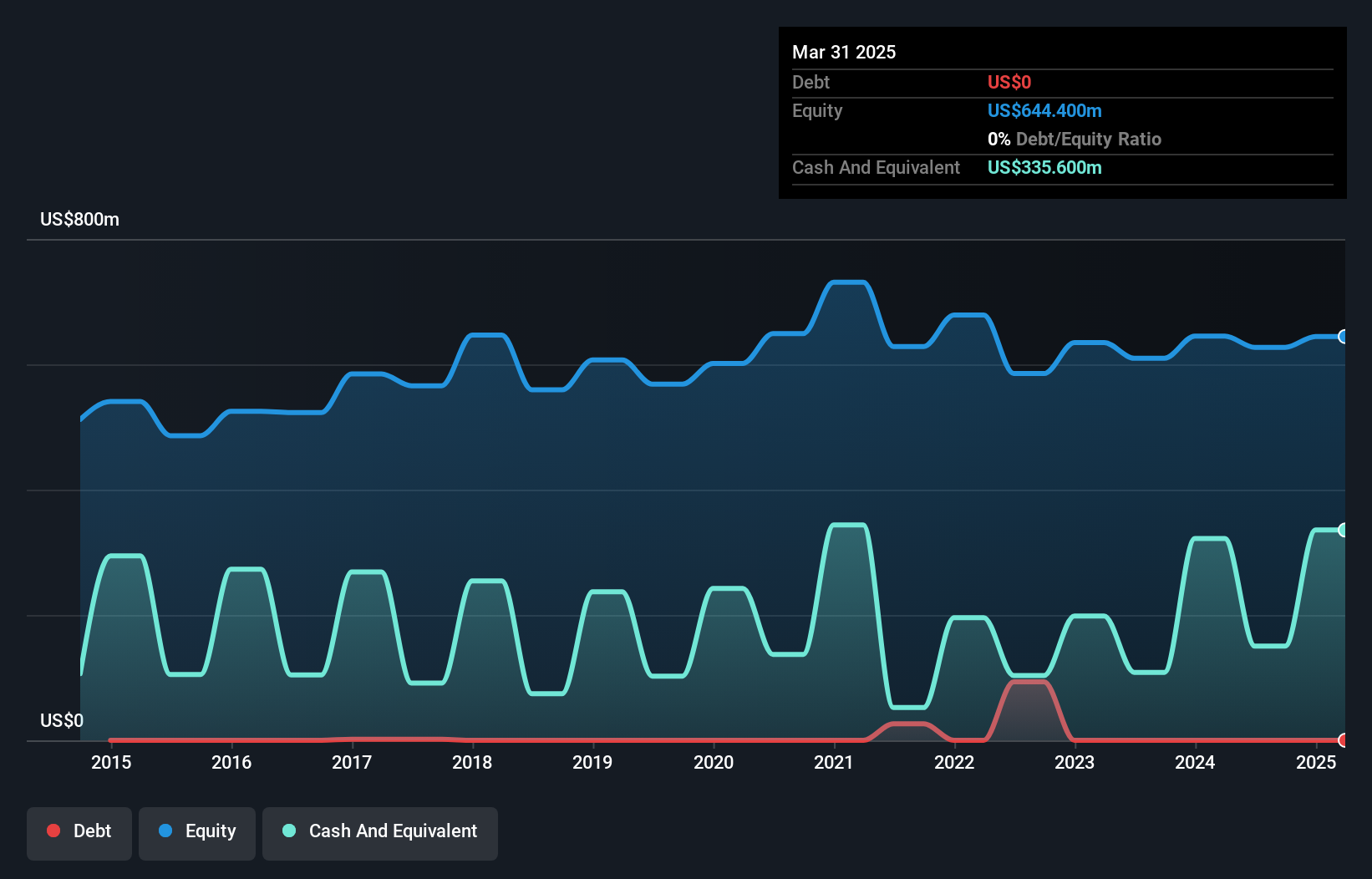

Vtech Holdings, a notable player in the electronics industry, has demonstrated robust financial health with no debt and high-quality earnings. Over the past year, its earnings grew by 11.7%, surpassing the Communications industry’s growth of 10.6%. Recently, Vtech approved a final dividend of US$0.48 per share for FY2024, reflecting an increase from last year’s payout. The company reported net income of US$166.6 million on sales of US$2.15 billion for FY2024, showcasing solid performance despite challenging market conditions.

- Delve into the full analysis health report here for a deeper understanding of Vtech Holdings.

Assess Vtech Holdings' past performance with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 177 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026