Discover Three Undiscovered Gems in Hong Kong This August 2024

Reviewed by Simply Wall St

As global markets experience volatility and economic indicators signal mixed sentiments, the Hong Kong market has shown resilience, particularly in its small-cap sector. With the Russell 2000 Index pulling back sharply, investors are increasingly looking for hidden opportunities that may offer growth potential amidst broader market fluctuations. In this context, identifying stocks with strong fundamentals and unique value propositions becomes crucial. Here are three undiscovered gems in Hong Kong that could be worth exploring this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Value Rating: ★★★★★★

Overview: Tong Ren Tang Technologies Co. Ltd. manufactures and sells Chinese medicine products in Mainland China and internationally, with a market cap of HK$6.67 billion.

Operations: Tong Ren Tang Technologies generates revenue primarily from its own operations (CN¥4.07 billion) and Tong Ren Tang Chinese Medicine (CN¥1.38 billion).

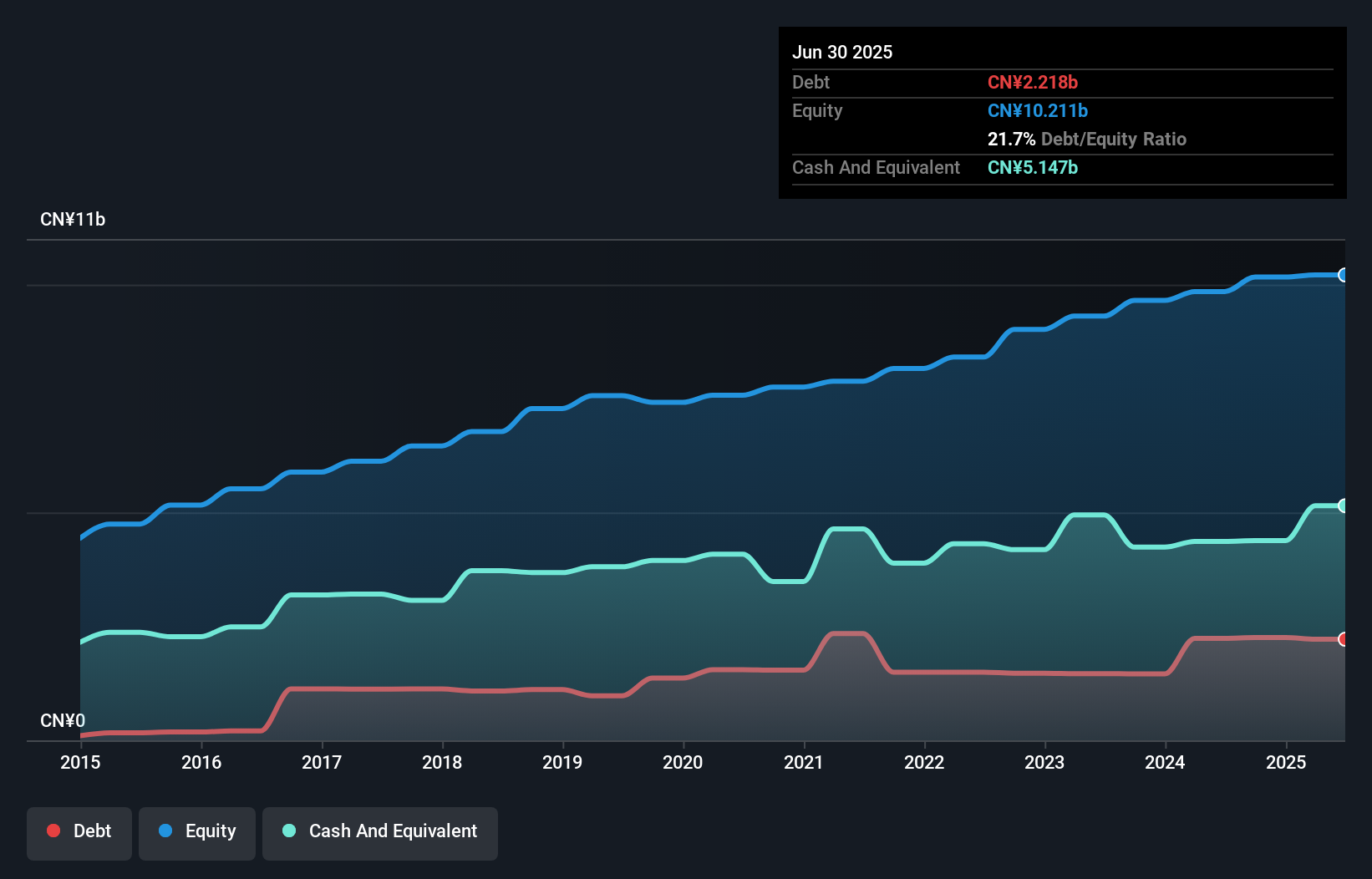

Tong Ren Tang Technologies, a smaller player in Hong Kong's market, has shown promising financial health. The company reported earnings growth of 1.3% over the past year, outpacing the pharmaceutical industry’s 0.1%. It also boasts a net profit margin of 12%, reflecting efficient operations. Recent events include appointing Ernst & Young as auditors and announcing a final dividend of RMB 0.18 per share for FY2023, payable on August 9, 2024.

- Dive into the specifics of Tong Ren Tang Technologies here with our thorough health report.

Learn about Tong Ren Tang Technologies' historical performance.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$8.93 billion.

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily from retail sales through grocery stores, amounting to CN¥6.09 billion.

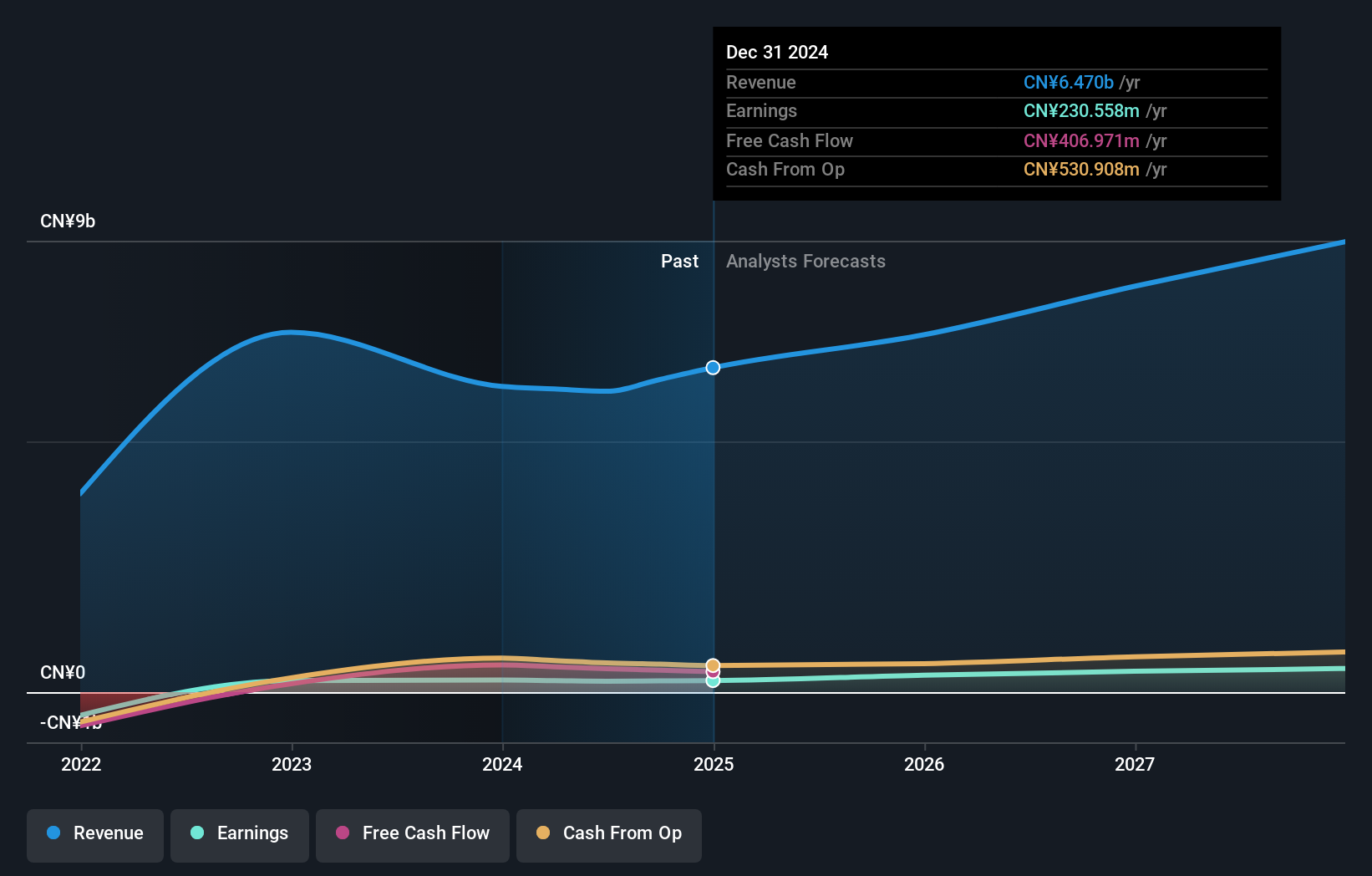

Guoquan Food (Shanghai) has shown promising growth, with earnings increasing by 4.2% over the past year, outpacing the Consumer Retailing industry’s 1.6%. The company’s levered free cash flow turned positive in 2022 at RMB 167 million and surged to RMB 543 million in 2023. Recent board changes include Mr. Wang Hui taking on dual roles as CFO and joint company secretary since February 2024, bringing extensive financial expertise to the table.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinopec Kantons Holdings Limited, an investment holding company, provides crude oil jetty services and has a market cap of HK$10.94 billion.

Operations: Sinopec Kantons Holdings generates revenue primarily from crude oil jetty and storage services, amounting to HK$609.87 million. The company's net profit margin is a key financial metric to consider.

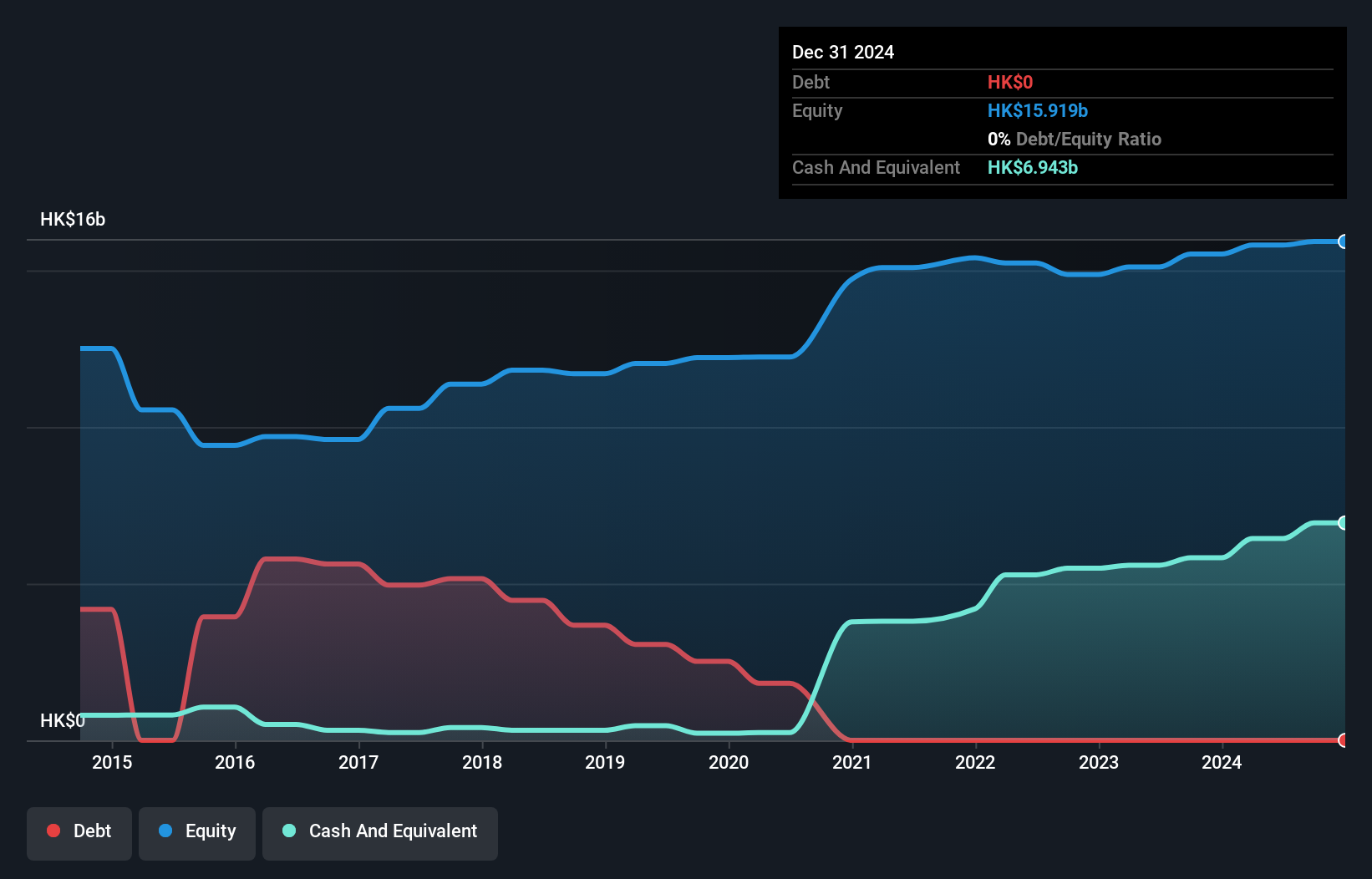

Sinopec Kantons Holdings experienced a remarkable earnings growth of 198.6% over the past year, outpacing the Oil and Gas industry's -6.8%. The company is debt-free, a significant improvement from its 31.4% debt-to-equity ratio five years ago. Trading at 78.3% below its estimated fair value, it also boasts high-quality earnings and positive free cash flow. Recent leadership changes saw Mr. Zhong Fuliang appointed as Chairman, bringing extensive industry experience to the role.

Make It Happen

- Get an in-depth perspective on all 173 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tong Ren Tang Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1666

Tong Ren Tang Technologies

Manufactures and sells Chinese medicine products in Mainland China and internationally.

Adequate balance sheet average dividend payer.