- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

3 Promising Penny Stocks With Market Caps Above US$200M

Reviewed by Simply Wall St

With global markets experiencing a rally fueled by growth and tax hopes following the recent U.S. election, many investors are exploring opportunities beyond traditional large-cap stocks. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their potential for significant returns despite being seen as a relic of past trading days. In this article, we explore three penny stocks that stand out for their financial strength and potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.44B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR292.11M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

Click here to see the full list of 5,739 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

PC Partner Group (SEHK:1263)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics with a market cap of approximately HK$1.97 billion.

Operations: The company generates revenue of HK$9.94 billion from the design, manufacturing, and trading of electronics and PC parts and accessories.

Market Cap: HK$1.97B

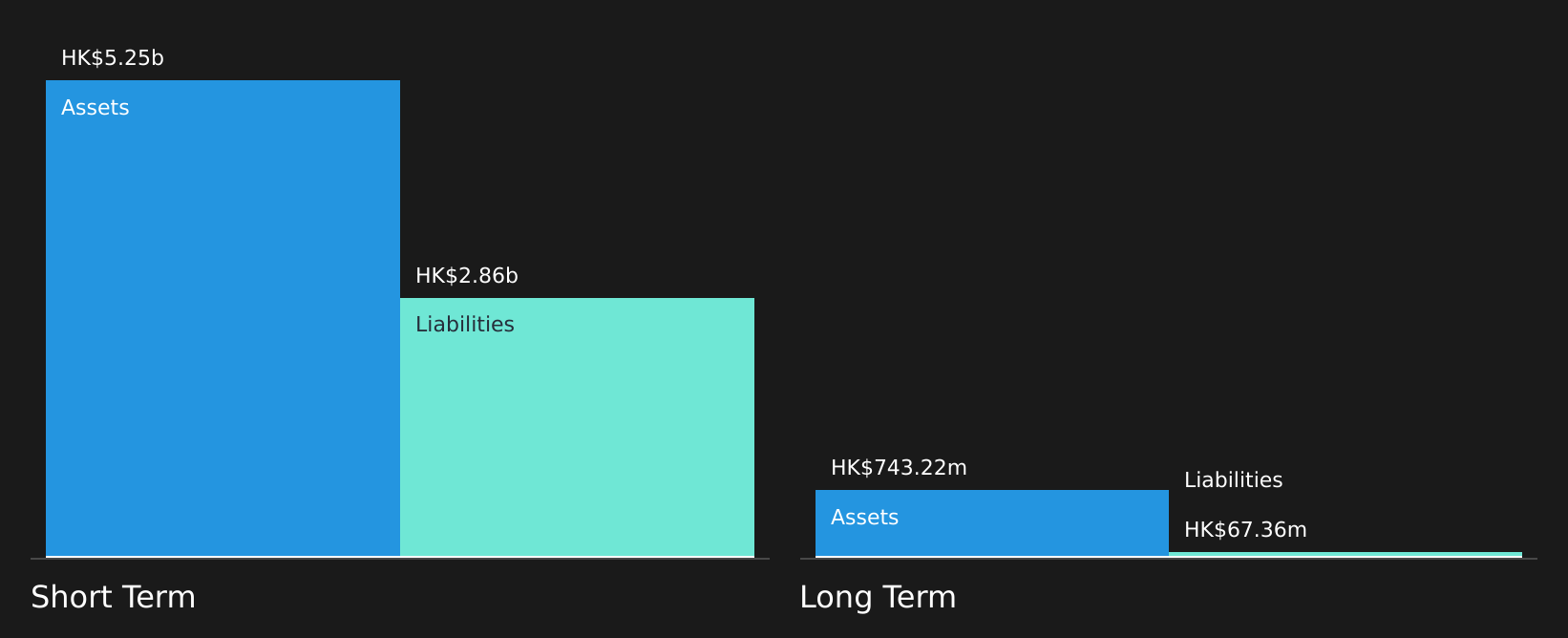

PC Partner Group Limited, with a market cap of HK$1.97 billion, has shown promising financial stability and growth potential. The company reported significant revenue of HK$9.94 billion from its electronics and PC parts business, alongside a notable improvement in net income for the first half of 2024 compared to the previous year. Despite being dropped from the S&P Global BMI Index recently, it maintains strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio substantially over five years. However, insider selling may pose concerns about future confidence in stock performance despite recent profitability improvements.

- Navigate through the intricacies of PC Partner Group with our comprehensive balance sheet health report here.

- Explore historical data to track PC Partner Group's performance over time in our past results report.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings Limited is an investment holding company that researches, develops, manufactures, and sells wireless telecommunications network system equipment and related engineering services globally, with a market cap of HK$2.94 billion.

Operations: The company generates revenue from Operator Telecommunication Services amounting to HK$156.22 million and Wireless Telecommunications Network System Equipment and Services totaling HK$4.94 billion.

Market Cap: HK$2.94B

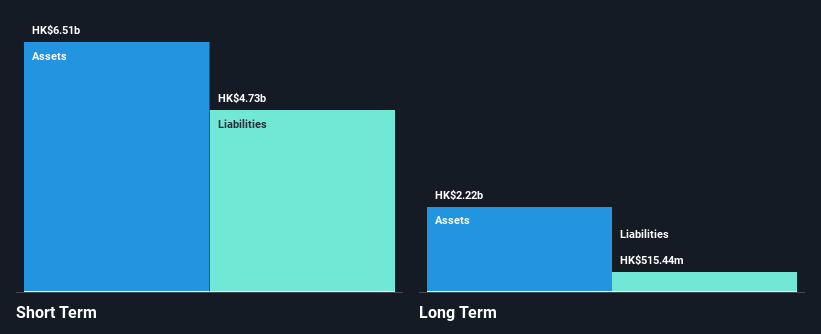

Comba Telecom Systems Holdings has faced challenges recently, with a reported net loss of HK$158.43 million for the first half of 2024, contrasting with a profit in the previous year. Despite this, the company maintains strong liquidity, as its short-term assets of HK$6.5 billion comfortably cover both short and long-term liabilities. The debt-to-equity ratio has improved over five years to 32.6%, indicating better financial management. However, profitability remains elusive with negative return on equity and no interim dividend declared for mid-2024, reflecting ongoing financial pressures despite experienced management and board leadership.

- Take a closer look at Comba Telecom Systems Holdings' potential here in our financial health report.

- Examine Comba Telecom Systems Holdings' past performance report to understand how it has performed in prior years.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$5.79 billion.

Operations: The company generates revenue primarily from its retail segment, specifically grocery stores, amounting to CN¥5.99 billion.

Market Cap: HK$5.79B

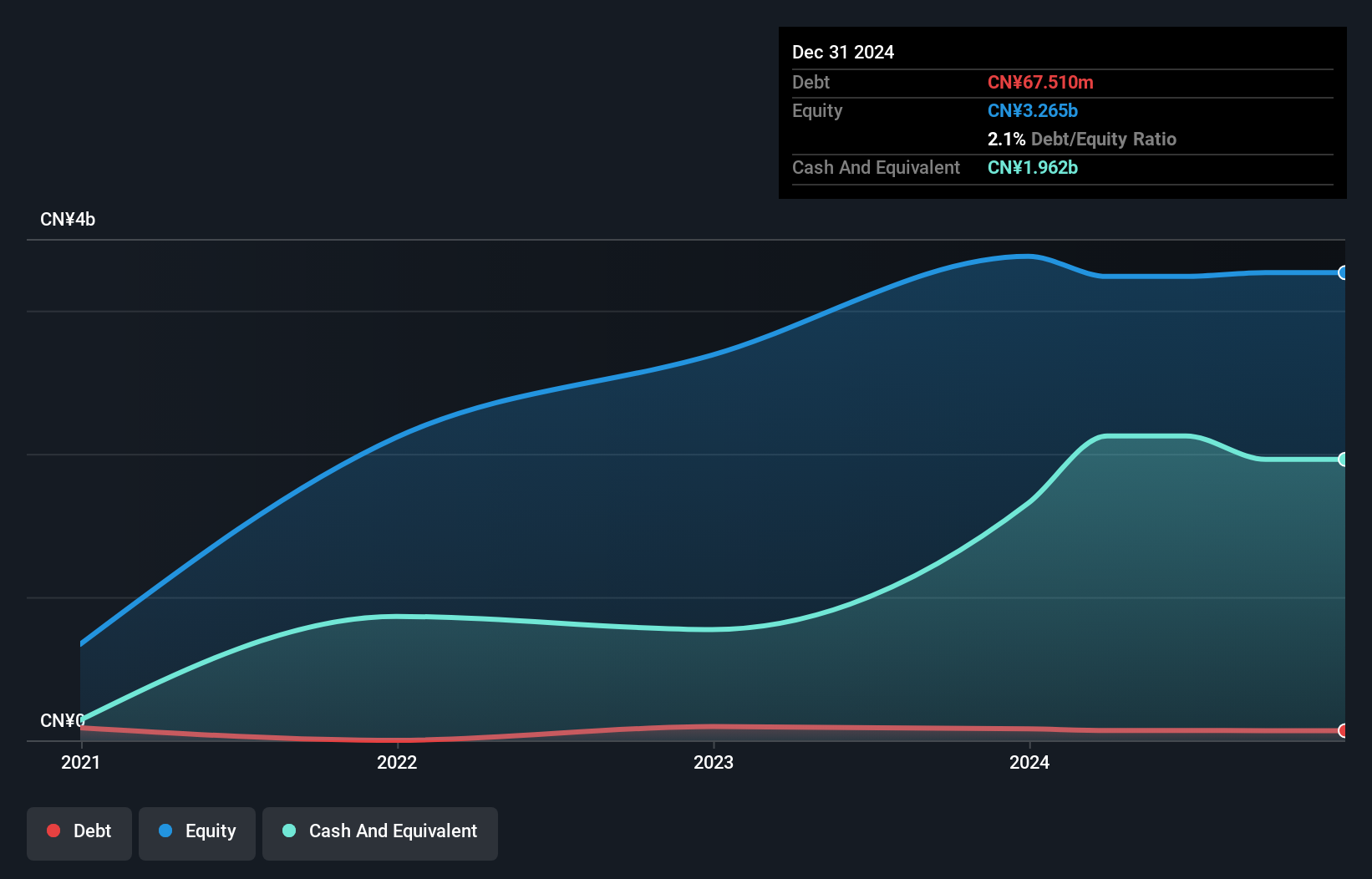

Guoquan Food (Shanghai) shows a mixed financial picture. The company reported sales of CN¥2.67 billion for the first half of 2024, with net income declining to CN¥85.98 million from the previous year. Despite negative earnings growth, it trades significantly below estimated fair value and has not experienced shareholder dilution recently. Financially robust, it holds more cash than debt and covers long-term liabilities with short-term assets of CN¥3.1 billion exceeding both short and long-term liabilities comfortably. Recent share repurchase plans could enhance shareholder value by increasing net asset value per share amidst its volatile stock performance.

- Get an in-depth perspective on Guoquan Food (Shanghai)'s performance by reading our balance sheet health report here.

- Gain insights into Guoquan Food (Shanghai)'s historical outcomes by reviewing our past performance report.

Where To Now?

- Investigate our full lineup of 5,739 Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives