- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

3 Asian Penny Stocks With Market Caps Under US$4B

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global trade policies and easing inflation, Asian markets are navigating a complex economic landscape. In this context, the term 'penny stock' might seem outdated, yet it represents an investment area that remains relevant for those seeking opportunities in smaller or newer companies. These stocks can offer surprising value when backed by solid financials, providing potential for growth and stability that larger firms may not always deliver.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.10 | SGD42.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.178 | SGD35.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.12 | SGD855.97M | ✅ 3 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.31 | HK$49.34B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.97 | HK$1.64B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,161 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in Mainland China with a market cap of HK$8.70 billion.

Operations: The company's revenue is primarily generated from its retail grocery stores segment, amounting to CN¥6.47 billion.

Market Cap: HK$8.7B

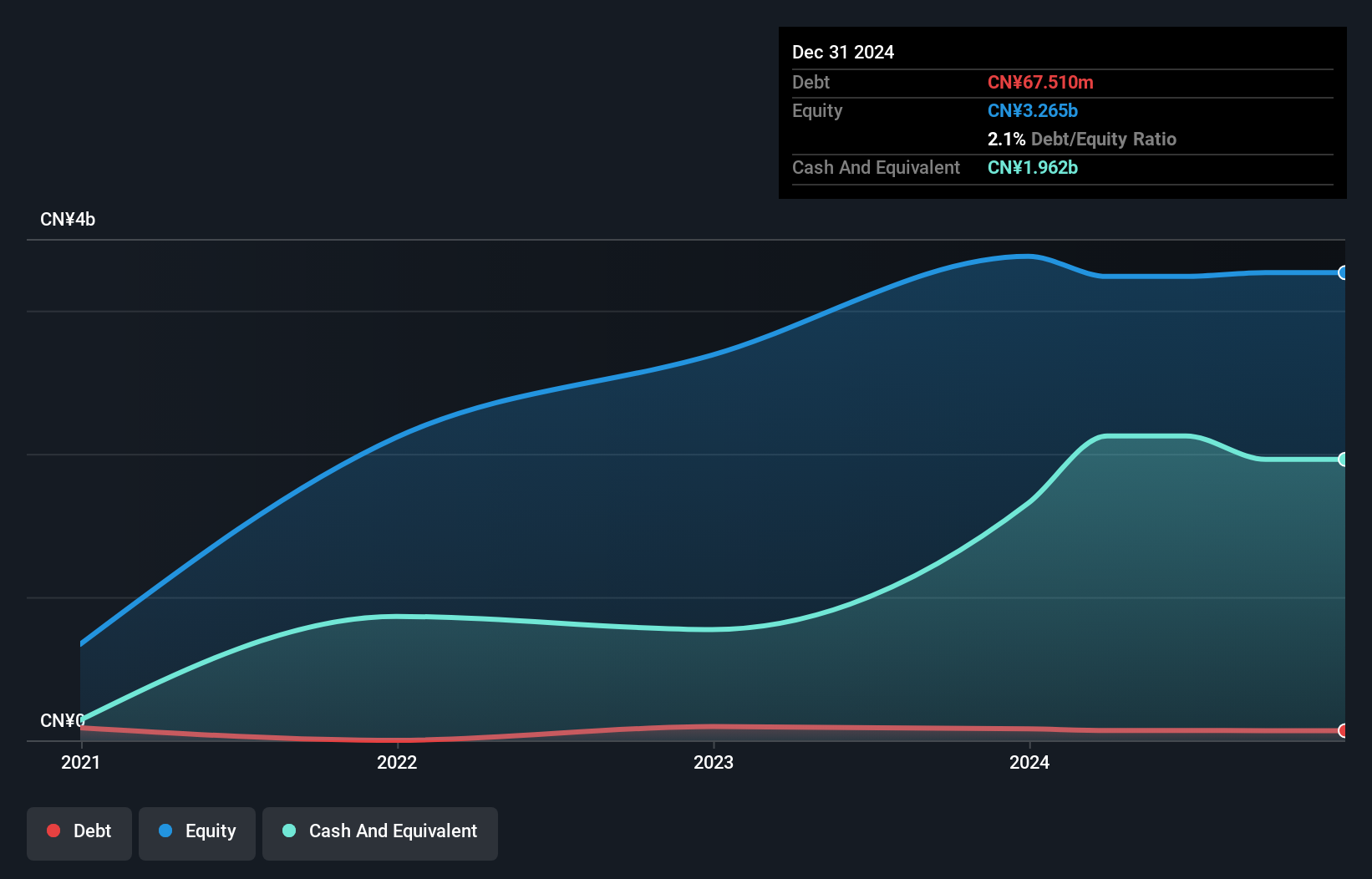

Guoquan Food (Shanghai) demonstrates a mixed financial profile, with its short-term assets of CN¥3.3 billion comfortably covering both short and long-term liabilities. Despite this, the company's return on equity remains low at 7.4%, and recent earnings growth has been negative at -3.8%. However, debt is well covered by operating cash flow, indicating sound financial management. The company has proposed a final dividend of RMB 0.0746 per share for 2024, subject to shareholder approval in June 2025. Guoquan's board lacks experience with an average tenure of just 2.3 years, potentially impacting strategic decisions moving forward.

- Dive into the specifics of Guoquan Food (Shanghai) here with our thorough balance sheet health report.

- Assess Guoquan Food (Shanghai)'s future earnings estimates with our detailed growth reports.

OKP Holdings (SGX:5CF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OKP Holdings Limited, with a market cap of SGD234.83 million, operates as a transport infrastructure and civil engineering company in Singapore and Australia.

Operations: The company generates revenue from Maintenance (SGD61.74 million), Construction (SGD135.13 million), and Rental Income (SGD6.06 million).

Market Cap: SGD234.83M

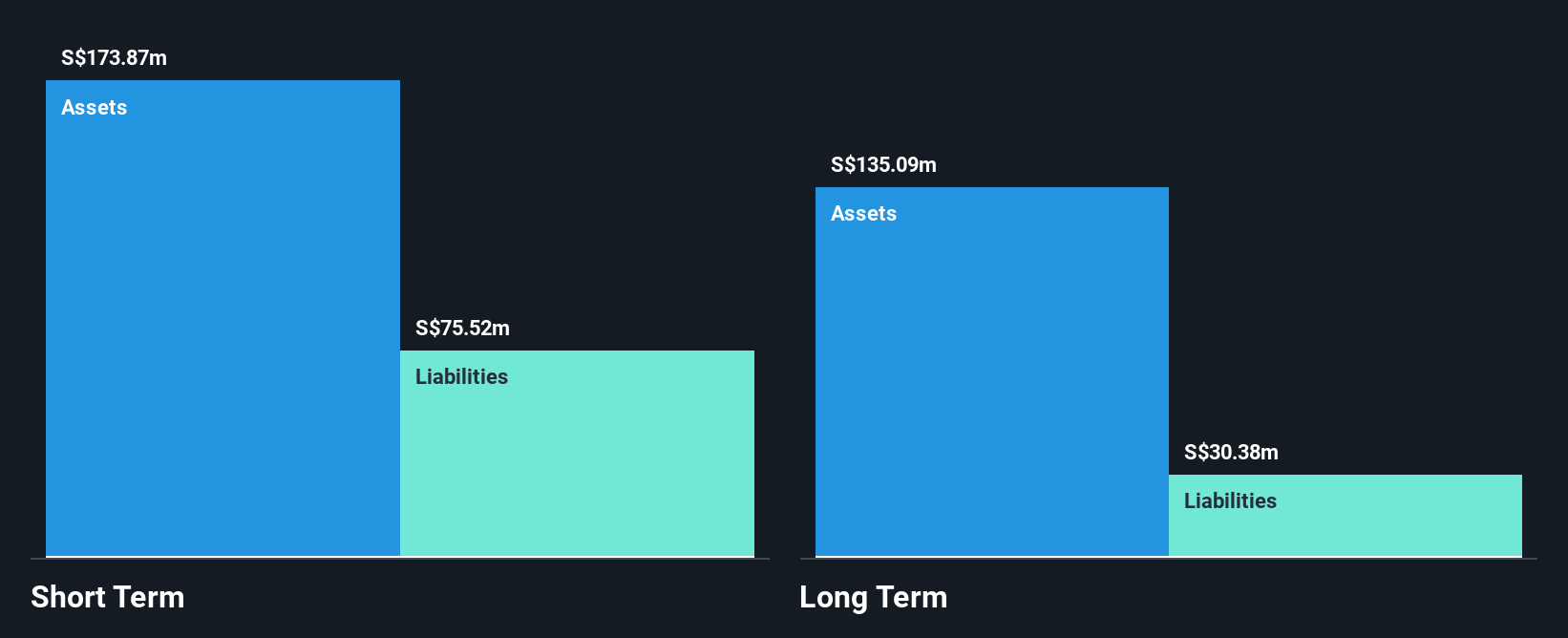

OKP Holdings Limited presents a mixed picture for investors in the penny stock space. The company, with revenues of SGD 181.75 million, has seen a decline in net income to SGD 33.7 million from the previous year. Despite this, OKP's financial health appears stable, supported by short-term assets exceeding liabilities and cash reserves surpassing total debt. The company's Return on Equity is relatively low at 16.1%, and profit margins have decreased to 18.5%. However, its operating cash flow covers debt well, indicating prudent financial management despite recent earnings volatility and an unstable dividend record.

- Jump into the full analysis health report here for a deeper understanding of OKP Holdings.

- Gain insights into OKP Holdings' historical outcomes by reviewing our past performance report.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China with a market cap of CN¥21.70 billion.

Operations: The company generates revenue of CN¥14.59 billion from its operations in China.

Market Cap: CN¥21.7B

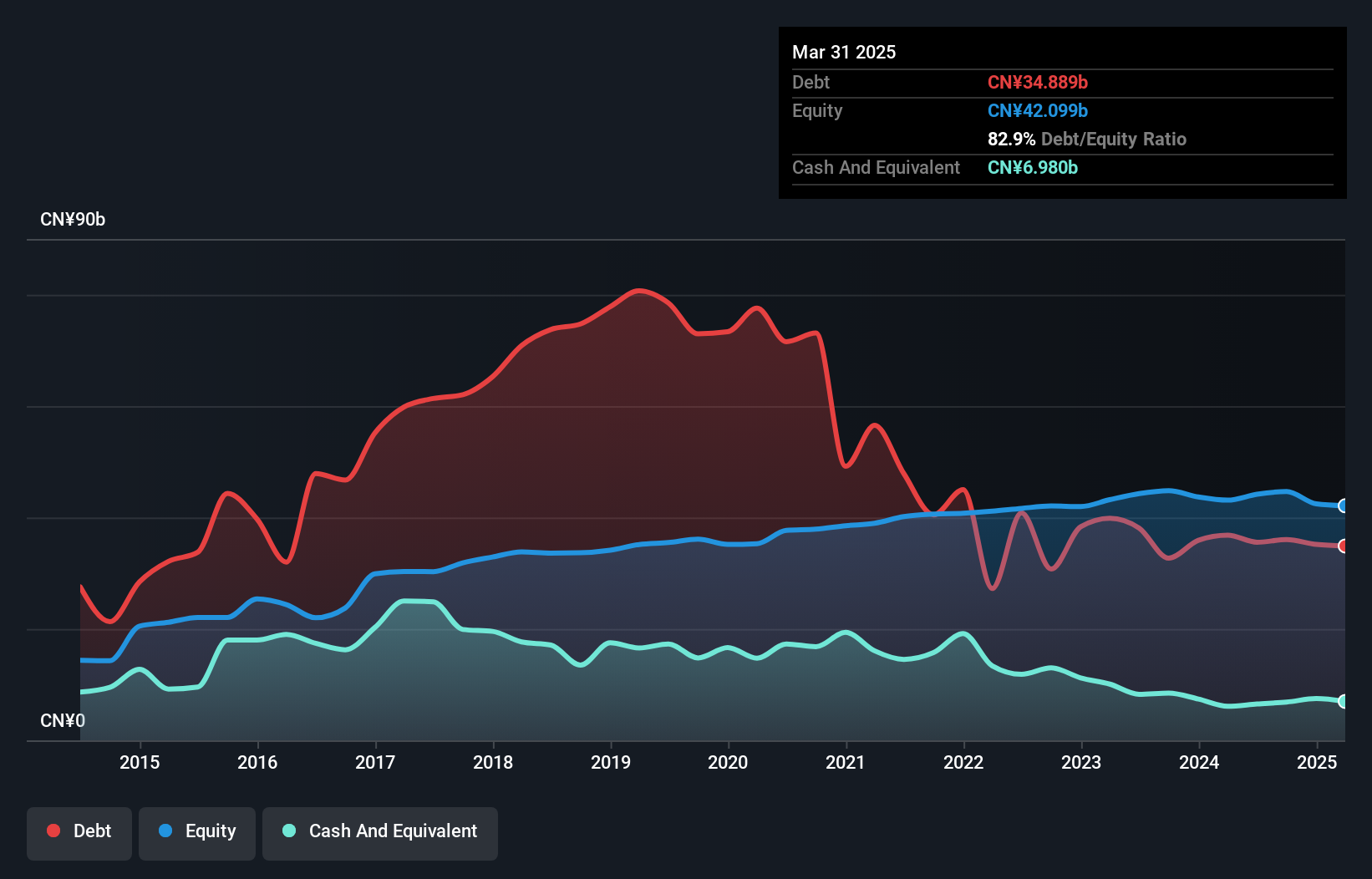

Quzhou Xin'an Development presents a complex picture in the penny stock market. With a market cap of CN¥21.70 billion and revenues of CN¥14.59 billion, it operates across diverse sectors in China, including real estate and financial services. Recent earnings show sales dropped significantly to CN¥344.89 million from CN¥2.24 billion year-on-year, yet net income increased to CN¥423.95 million, reflecting improved profit margins at 7.3%. The company benefits from a seasoned management team and board but faces challenges with high debt levels not fully covered by operating cash flow despite stable short-term asset coverage over liabilities.

- Get an in-depth perspective on Quzhou Xin'an Development's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Quzhou Xin'an Development's future.

Where To Now?

- Dive into all 1,161 of the Asian Penny Stocks we have identified here.

- Curious About Other Options? These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives