- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2429

Beijing UBOX Online Technology Corp.'s (HKG:2429) Popularity With Investors Is Under Threat From Overpricing

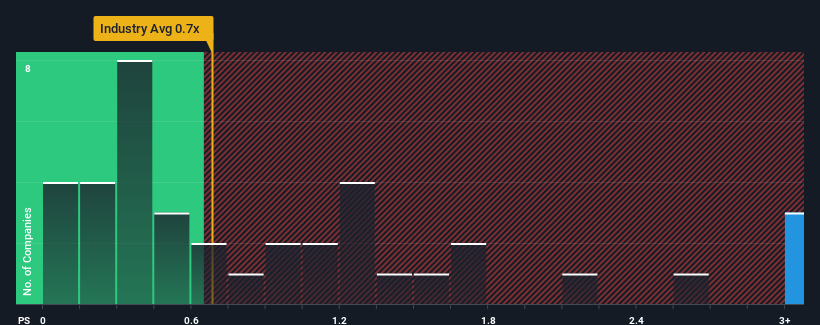

Beijing UBOX Online Technology Corp.'s (HKG:2429) price-to-sales (or "P/S") ratio of 4.4x may look like a poor investment opportunity when you consider close to half the companies in the Consumer Retailing industry in Hong Kong have P/S ratios below 0.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing UBOX Online Technology

How Beijing UBOX Online Technology Has Been Performing

Beijing UBOX Online Technology has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Beijing UBOX Online Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing UBOX Online Technology?

In order to justify its P/S ratio, Beijing UBOX Online Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 6.1% gain to the company's revenues. The latest three year period has also seen an excellent 40% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 13% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Beijing UBOX Online Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Beijing UBOX Online Technology's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Beijing UBOX Online Technology has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Beijing UBOX Online Technology with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing UBOX Online Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2429

Beijing UBOX Online Technology

Operates vending machines in Mainland China.

Excellent balance sheet minimal.

Similar Companies

Market Insights

Community Narratives