- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

Strong week for Alibaba Health Information Technology (HKG:241) shareholders doesn't alleviate pain of three-year loss

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of Alibaba Health Information Technology Limited (HKG:241) investors who have held the stock for three years as it declined a whopping 78%. That would certainly shake our confidence in the decision to own the stock. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. But this could be related to the weak market, which is down 10% in the same period.

On a more encouraging note the company has added HK$3.0b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Alibaba Health Information Technology

While Alibaba Health Information Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Alibaba Health Information Technology saw its revenue grow by 30% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 21% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

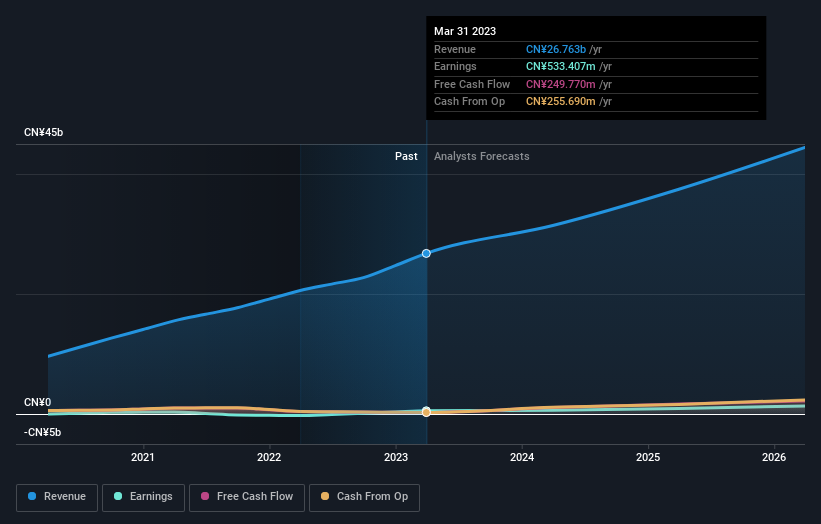

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Alibaba Health Information Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Alibaba Health Information Technology stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's good to see that Alibaba Health Information Technology has rewarded shareholders with a total shareholder return of 24% in the last twelve months. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Alibaba Health Information Technology has 1 warning sign we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

If you're looking to trade Alibaba Health Information Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives