As global markets continue to reach record highs, with indices like the Dow Jones and S&P 500 showing impressive gains, investors are keenly observing the broader economic landscape. Amidst these developments, penny stocks—often representing smaller or newer companies—remain a compelling area for those looking beyond established names. Despite being an outdated term, penny stocks can still offer significant opportunities when backed by strong financials, providing a unique blend of value and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £177.65M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £828.88M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,693 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Spinnova Oyj (HLSE:SPINN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Spinnova Oyj is involved in the production and sale of natural fiber materials both in Finland and internationally, with a market cap of €51.83 million.

Operations: The company generates revenue primarily from its Textile Manufacturing segment, amounting to €2.18 million.

Market Cap: €51.83M

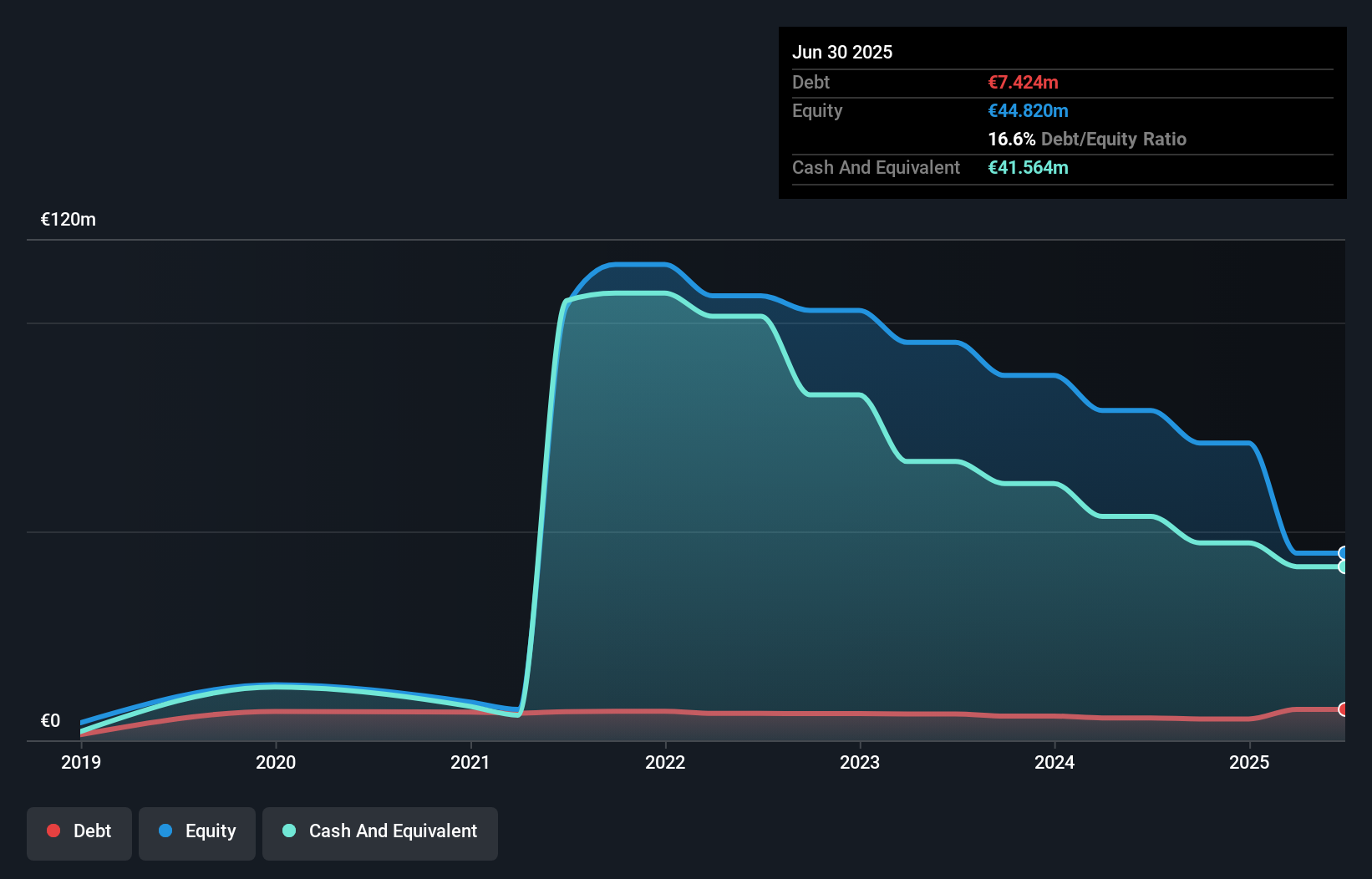

Spinnova Oyj, with a market cap of €51.83 million, is navigating the challenges typical of its segment. Despite being unprofitable and having increased losses over the past five years, Spinnova has managed to reduce its debt significantly from 47.1% to 6.8%. The company holds more cash than total debt and maintains a sufficient cash runway for over three years based on current free cash flow trends. However, revenue remains limited at €2.18 million annually, underscoring its pre-revenue status in practical terms. The volatility in share price adds another layer of risk for potential investors considering this stock.

- Click here and access our complete financial health analysis report to understand the dynamics of Spinnova Oyj.

- Understand Spinnova Oyj's earnings outlook by examining our growth report.

Swang Chai Chuan (SEHK:2321)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Swang Chai Chuan Limited is an investment holding company focused on the distribution and sale of food and beverage products in Malaysia, with a market cap of HK$440.07 million.

Operations: The company generates revenue from its wholesale groceries segment, amounting to MYR 921.94 million.

Market Cap: HK$440.07M

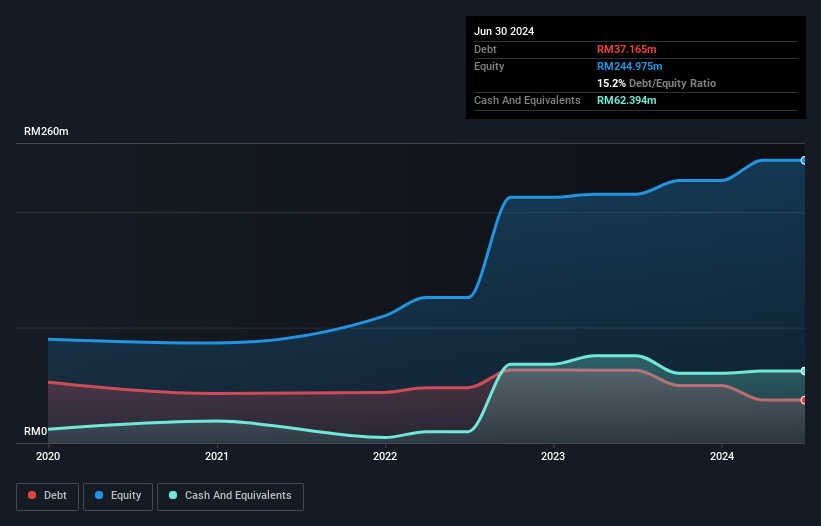

Swang Chai Chuan Limited, with a market cap of HK$440.07 million, demonstrates financial stability through its wholesale groceries revenue of MYR 921.94 million and more cash than total debt. Its operating cash flow covers 70.5% of its debt, indicating strong liquidity management. While the company's net profit margins have slightly declined to 2.7%, it has maintained earnings growth at 8.3% annually over five years and high-quality past earnings suggest operational efficiency despite a low return on equity of 10.2%. The management team is experienced; however, the board's inexperience could pose governance challenges moving forward.

- Get an in-depth perspective on Swang Chai Chuan's performance by reading our balance sheet health report here.

- Learn about Swang Chai Chuan's historical performance here.

Viscom (XTRA:V6C)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscom SE develops, manufactures, and sells inspection systems for industrial production applications across Europe, the Americas, and Asia with a market cap of €31.99 million.

Operations: The company's revenue is derived from various regions, with €68.12 million coming from Europe (excluding Germany), €33.36 million from Germany, €26.21 million from Asia, and €14.3 million from the Americas.

Market Cap: €31.99M

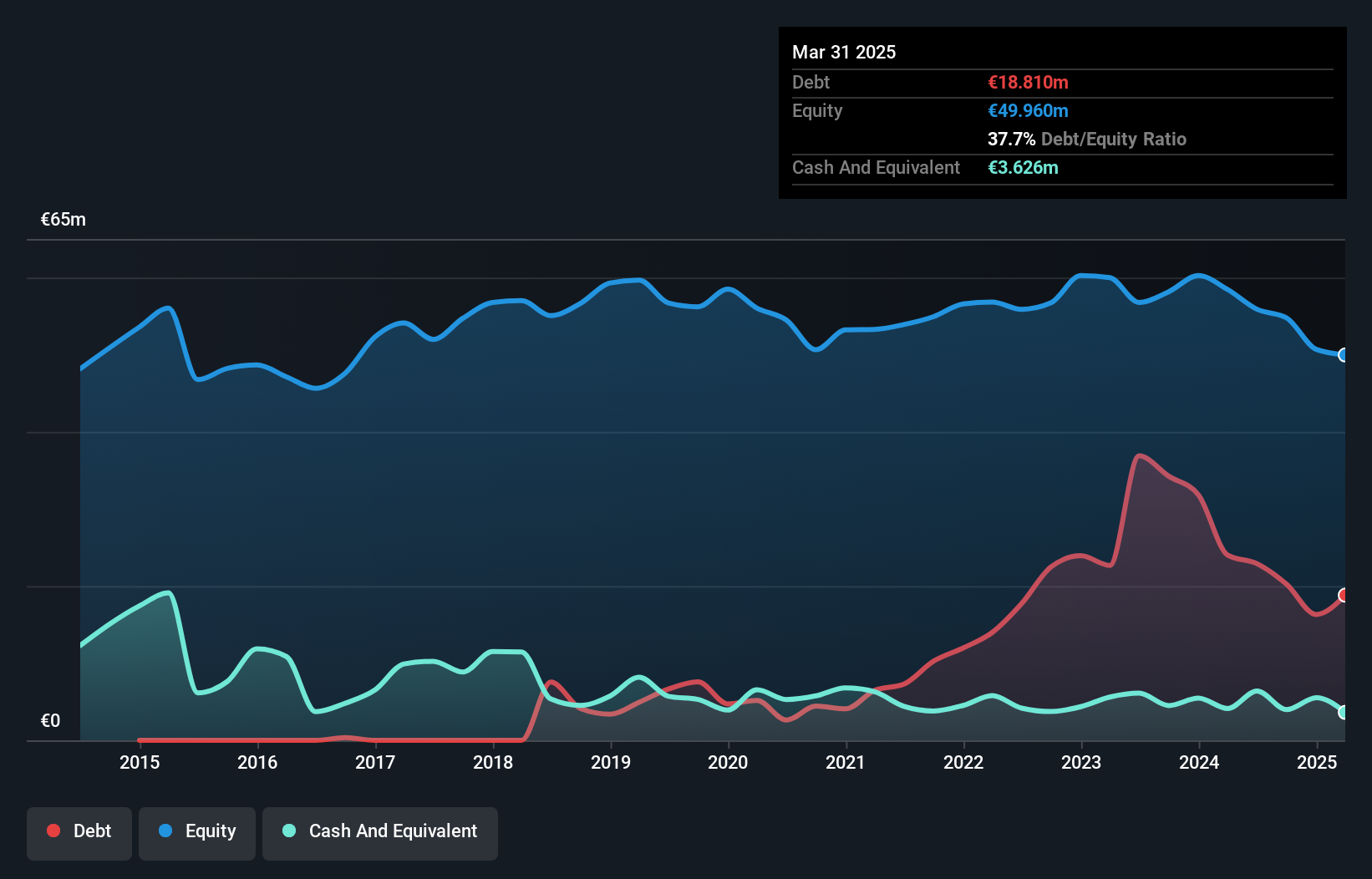

Viscom SE, with a market cap of €31.99 million, has faced challenges with declining revenues and profitability, reporting a net loss of €5.06 million for the first nine months of 2024 compared to a profit last year. Despite this, the company maintains strong liquidity as its short-term assets significantly exceed liabilities and its debt is well covered by operating cash flow. The management team is seasoned, though the company's share price remains volatile. While Viscom's earnings are forecast to grow significantly per year, it remains unprofitable with a negative return on equity and increasing debt levels over time.

- Click to explore a detailed breakdown of our findings in Viscom's financial health report.

- Gain insights into Viscom's future direction by reviewing our growth report.

Next Steps

- Take a closer look at our Penny Stocks list of 5,693 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SPINN

Spinnova Oyj

Engages in the production and sale of natural fibre materials in Finland and internationally.

Flawless balance sheet slight.