- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1936

Ritamix Global Limited (HKG:1936) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Ritamix Global Limited (HKG:1936) shareholders have had their patience rewarded with a 25% share price jump in the last month. But the last month did very little to improve the 60% share price decline over the last year.

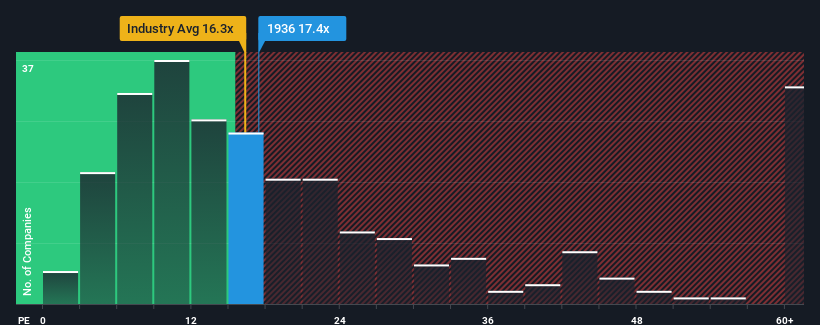

Following the firm bounce in price, Ritamix Global may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 17.4x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

We'd have to say that with no tangible growth over the last year, Ritamix Global's earnings have been unimpressive. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Ritamix Global

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Ritamix Global's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 3.2% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Ritamix Global is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Ritamix Global's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Ritamix Global currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Ritamix Global has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might also be able to find a better stock than Ritamix Global. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1936

Ritamix Global

An investment holding company, engages in the distribution of animal feed additives and human food ingredients in Malaysia, Europe, North America, rest of Asia, Australia, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives