- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1833

Revenues Not Telling The Story For Ping An Healthcare and Technology Company Limited (HKG:1833)

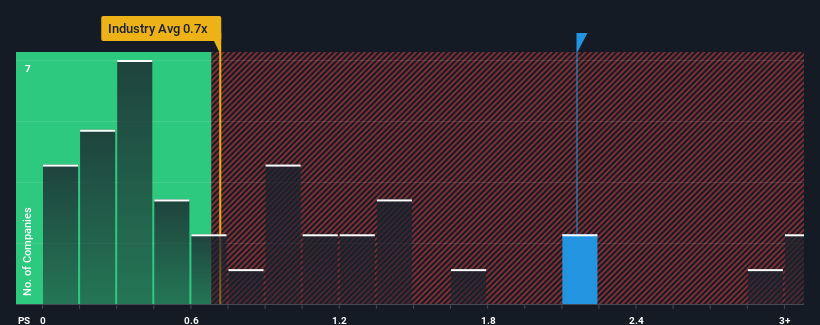

When close to half the companies in the Consumer Retailing industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.7x, you may consider Ping An Healthcare and Technology Company Limited (HKG:1833) as a stock to potentially avoid with its 2.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Ping An Healthcare and Technology

What Does Ping An Healthcare and Technology's P/S Mean For Shareholders?

Ping An Healthcare and Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ping An Healthcare and Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ping An Healthcare and Technology?

The only time you'd be truly comfortable seeing a P/S as high as Ping An Healthcare and Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 32% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 13% per annum growth forecast for the broader industry.

With this information, we find it interesting that Ping An Healthcare and Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Ping An Healthcare and Technology's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Ping An Healthcare and Technology currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Ping An Healthcare and Technology with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1833

Ping An Healthcare and Technology

Operates an online healthcare services platform in China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026