- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

East Buy Holding Limited (HKG:1797) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the East Buy Holding Limited (HKG:1797) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

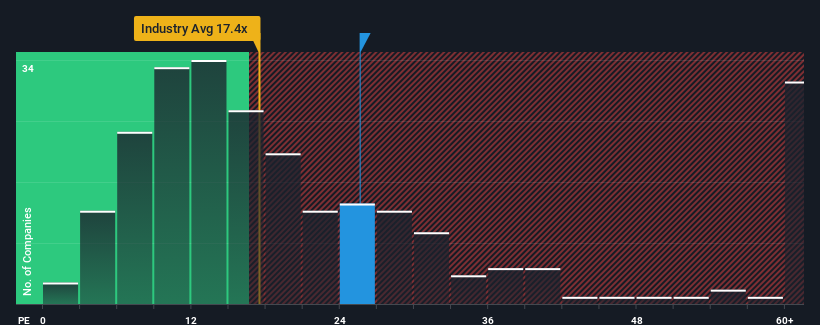

Even after such a large drop in price, East Buy Holding's price-to-earnings (or "P/E") ratio of 25.6x might still make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

East Buy Holding's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for East Buy Holding

How Is East Buy Holding's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like East Buy Holding's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the analysts watching the company. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

With this information, we can see why East Buy Holding is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From East Buy Holding's P/E?

East Buy Holding's shares may have retreated, but its P/E is still flying high. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of East Buy Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for East Buy Holding that we have uncovered.

Of course, you might also be able to find a better stock than East Buy Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade East Buy Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if East Buy Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1797

East Buy Holding

An investment holding company, engages in the livestreaming e-commerce business in the People's Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives