Asian Market Value Picks: East Buy Holding And Two More Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

Amidst the backdrop of renewed U.S.-China trade tensions and mixed economic signals from major global markets, Asian equities have been navigating a complex landscape. In this environment, identifying stocks that are potentially undervalued can offer opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.18 | CN¥38.19 | 49.8% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.80 | CN¥76.69 | 49.4% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.91 | CN¥88.95 | 49.5% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.28 | 49.8% |

| LITALICO (TSE:7366) | ¥1226.00 | ¥2418.14 | 49.3% |

| Japan Eyewear Holdings (TSE:5889) | ¥2036.00 | ¥4037.98 | 49.6% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥959.00 | ¥1906.05 | 49.7% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥60.50 | CN¥119.47 | 49.4% |

| Everest Medicines (SEHK:1952) | HK$52.25 | HK$104.21 | 49.9% |

| EVE Energy (SZSE:300014) | CN¥83.75 | CN¥166.29 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

East Buy Holding (SEHK:1797)

Overview: East Buy Holding Limited is an investment holding company that operates in the livestreaming e-commerce sector, focusing on the sale of private label products in the People's Republic of China, with a market cap of HK$26.98 billion.

Operations: The company's revenue primarily comes from its Online Live Commerce Business, generating CN¥4.39 billion.

Estimated Discount To Fair Value: 36.2%

East Buy Holding is trading at HK$25.6, significantly below its estimated fair value of HK$40.13, highlighting its potential as an undervalued stock based on cash flows. Despite a recent decline in profit margins from 3.8% to 0.1%, earnings are projected to grow by 58.6% annually over the next three years, outpacing the Hong Kong market's growth rate of 12.7%. However, investors should note the volatility in share price and low forecasted return on equity at 8.3%.

- The growth report we've compiled suggests that East Buy Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of East Buy Holding.

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company offering intra-city on-demand delivery services in the People’s Republic of China, with a market cap of HK$12.21 billion.

Operations: The company's revenue primarily comes from its intra-city on-demand delivery service business, generating CN¥19.10 billion.

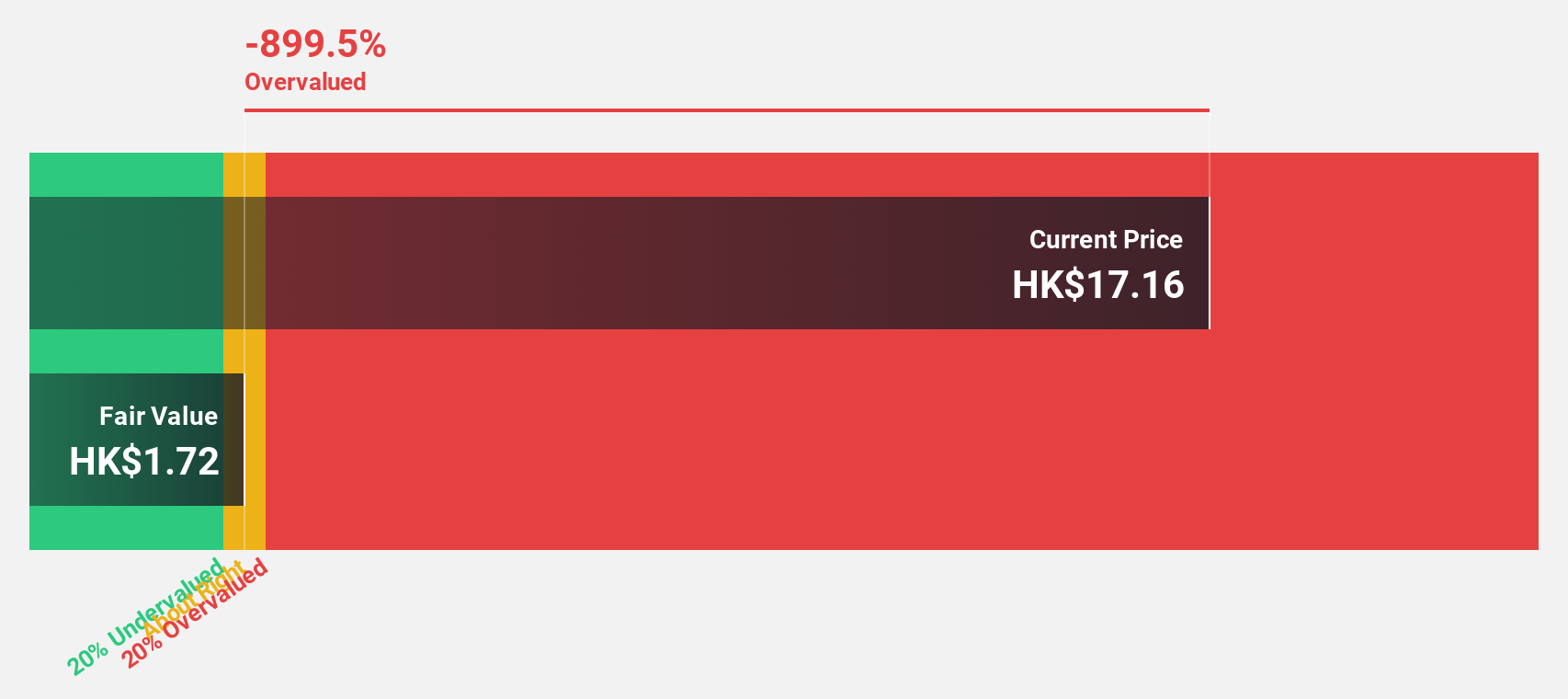

Estimated Discount To Fair Value: 21%

Hangzhou SF Intra-city Industrial is trading at HK$13.36, which is 21% below its estimated fair value of HK$16.91, indicating potential undervaluation based on cash flows. The company has demonstrated significant earnings growth of 151.5% over the past year and forecasts suggest annual revenue growth of 23.2%, surpassing the Hong Kong market's average. However, while earnings are expected to grow significantly at 53.6% annually, return on equity remains low at a forecasted 16.6%.

- Our earnings growth report unveils the potential for significant increases in Hangzhou SF Intra-city Industrial's future results.

- Navigate through the intricacies of Hangzhou SF Intra-city Industrial with our comprehensive financial health report here.

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants and has a market cap of ¥800.29 billion.

Operations: The company's revenue segments include the Japan Sushiro Business at ¥258.59 billion, the Overseas Sushiro Business at ¥119.29 billion, and the Kyotaru Business at ¥23.72 billion.

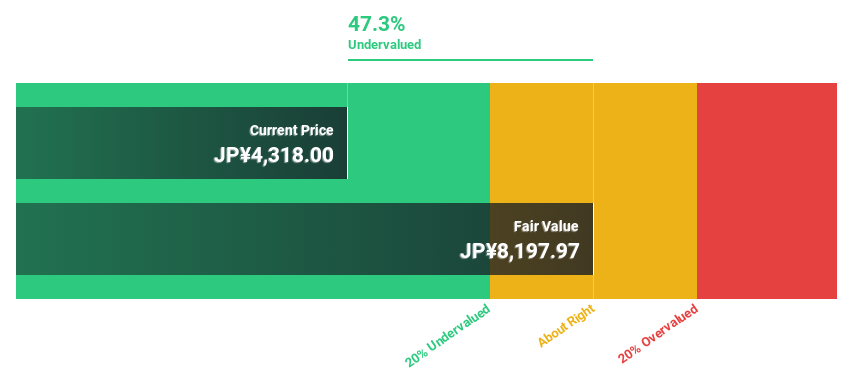

Estimated Discount To Fair Value: 45.5%

Food & Life Companies is trading at ¥7070, significantly below its estimated fair value of ¥12960.73, highlighting undervaluation based on cash flows. Despite high share price volatility recently, earnings grew 77.3% last year and are expected to rise 10.69% annually, outpacing the Japanese market's growth rate. Recent inclusion in the S&P Japan Mid Cap 100 and revised upward earnings guidance further underscore its potential despite anticipated cost pressures in raw materials and labor.

- Our expertly prepared growth report on Food & Life Companies implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Food & Life Companies' balance sheet health report.

Taking Advantage

- Dive into all 278 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou SF Intra-city Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9699

Hangzhou SF Intra-city Industrial

An investment holding company, provides intra-city on-demand delivery services in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives