- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:156

Revenues Not Telling The Story For Lippo China Resources Limited (HKG:156) After Shares Rise 57%

Lippo China Resources Limited (HKG:156) shareholders would be excited to see that the share price has had a great month, posting a 57% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

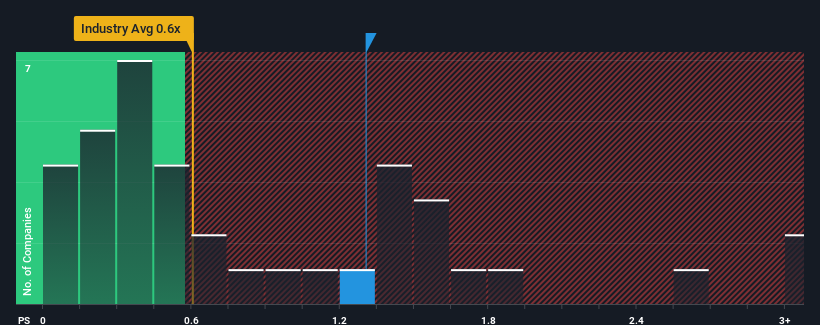

After such a large jump in price, given close to half the companies operating in Hong Kong's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Lippo China Resources as a stock to potentially avoid with its 1.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Lippo China Resources

How Has Lippo China Resources Performed Recently?

Revenue has risen firmly for Lippo China Resources recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lippo China Resources will help you shine a light on its historical performance.How Is Lippo China Resources' Revenue Growth Trending?

Lippo China Resources' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. As a result, it also grew revenue by 13% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 15% shows it's noticeably less attractive.

With this in mind, we find it worrying that Lippo China Resources' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Lippo China Resources' P/S Mean For Investors?

Lippo China Resources shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Lippo China Resources currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Lippo China Resources (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Lippo China Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:156

Lippo China Resources

An investment holding company, engages in the food, property management, and other businesses in Hong Kong, Mainland China, Singapore, Malaysia, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives