Those Who Purchased i.century Holding (HKG:8507) Shares A Year Ago Have A 61% Loss To Show For It

It is a pleasure to report that the i.century Holding Limited (HKG:8507) is up 32% in the last quarter. But that isn't much consolation to those who have suffered through the declines of the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 61% in that time. Some might say the recent bounce is to be expected after such a bad drop. It may be that the fall was an overreaction.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for i.century Holding

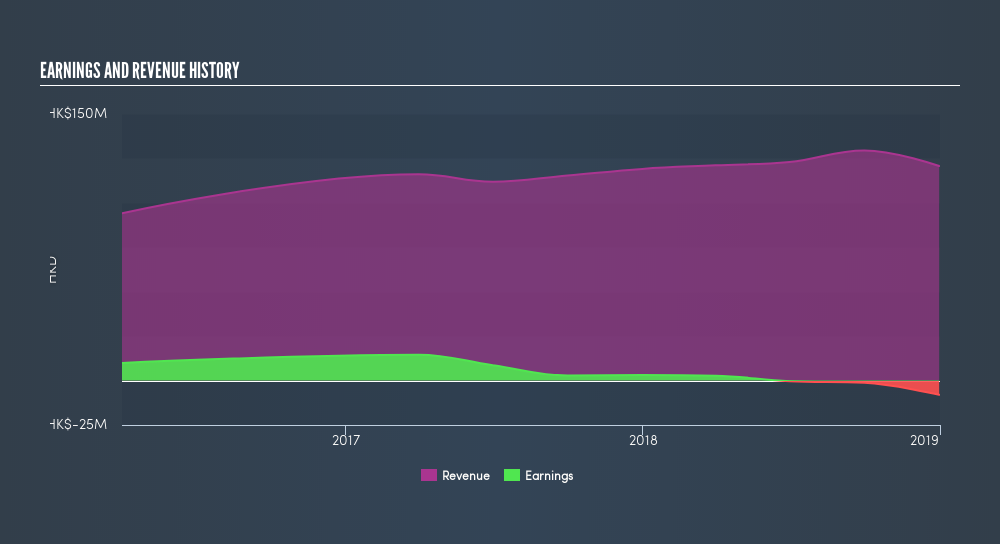

i.century Holding isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, i.century Holding increased its revenue by 1.3%. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 61% in the last year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at i.century Holding's financial health with this free report on its balance sheet.

A Different Perspective

i.century Holding shareholders are down 61% for the year, even worse than the market loss of 12%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 32%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: i.century Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8507

i.century Holding

An investment holding company, provides apparel products and apparel supply chain management services in the United States, France, other European countries, Australia, Canada, Japan, and Internationally.

Acceptable track record with imperfect balance sheet.

Market Insights

Community Narratives