Here's Why We're Not Too Worried About Perfectech International Holdings' (HKG:765) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. By way of example, Perfectech International Holdings (HKG:765) has seen its share price rise 199% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given its strong share price performance, we think it's worthwhile for Perfectech International Holdings shareholders to consider whether its cash burn is concerning. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Perfectech International Holdings

When Might Perfectech International Holdings Run Out Of Money?

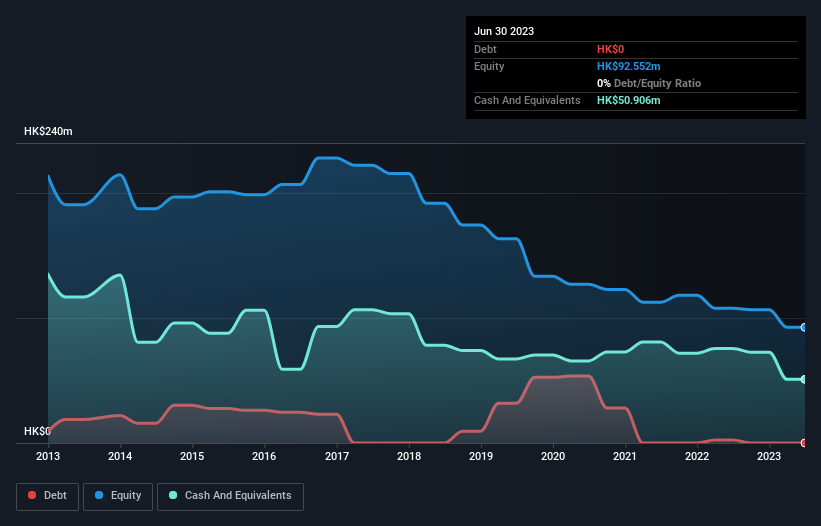

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2023, Perfectech International Holdings had HK$51m in cash, and was debt-free. Importantly, its cash burn was HK$27m over the trailing twelve months. Therefore, from June 2023 it had roughly 22 months of cash runway. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

Is Perfectech International Holdings' Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Perfectech International Holdings actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 4.3%. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Perfectech International Holdings has developed its business over time by checking this visualization of its revenue and earnings history.

Can Perfectech International Holdings Raise More Cash Easily?

Given its problematic fall in revenue, Perfectech International Holdings shareholders should consider how the company could fund its growth, if it turns out it needs more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Perfectech International Holdings has a market capitalisation of HK$396m and burnt through HK$27m last year, which is 6.9% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Perfectech International Holdings' Cash Burn?

On this analysis of Perfectech International Holdings' cash burn, we think its cash burn relative to its market cap was reassuring, while its falling revenue has us a bit worried. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Perfectech International Holdings that potential shareholders should take into account before putting money into a stock.

Of course Perfectech International Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:765

Perfectech International Holdings

An investment holding company, engages in the manufacture and sale of novelties, decoration, and toy products in Hong Kong, rest of Asia, Europe, the United States of America, and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives