Honma Golf (SEHK:6858) Net Loss Deepens to ¥2.4B, Reinforcing Margin Concern Narratives

Reviewed by Simply Wall St

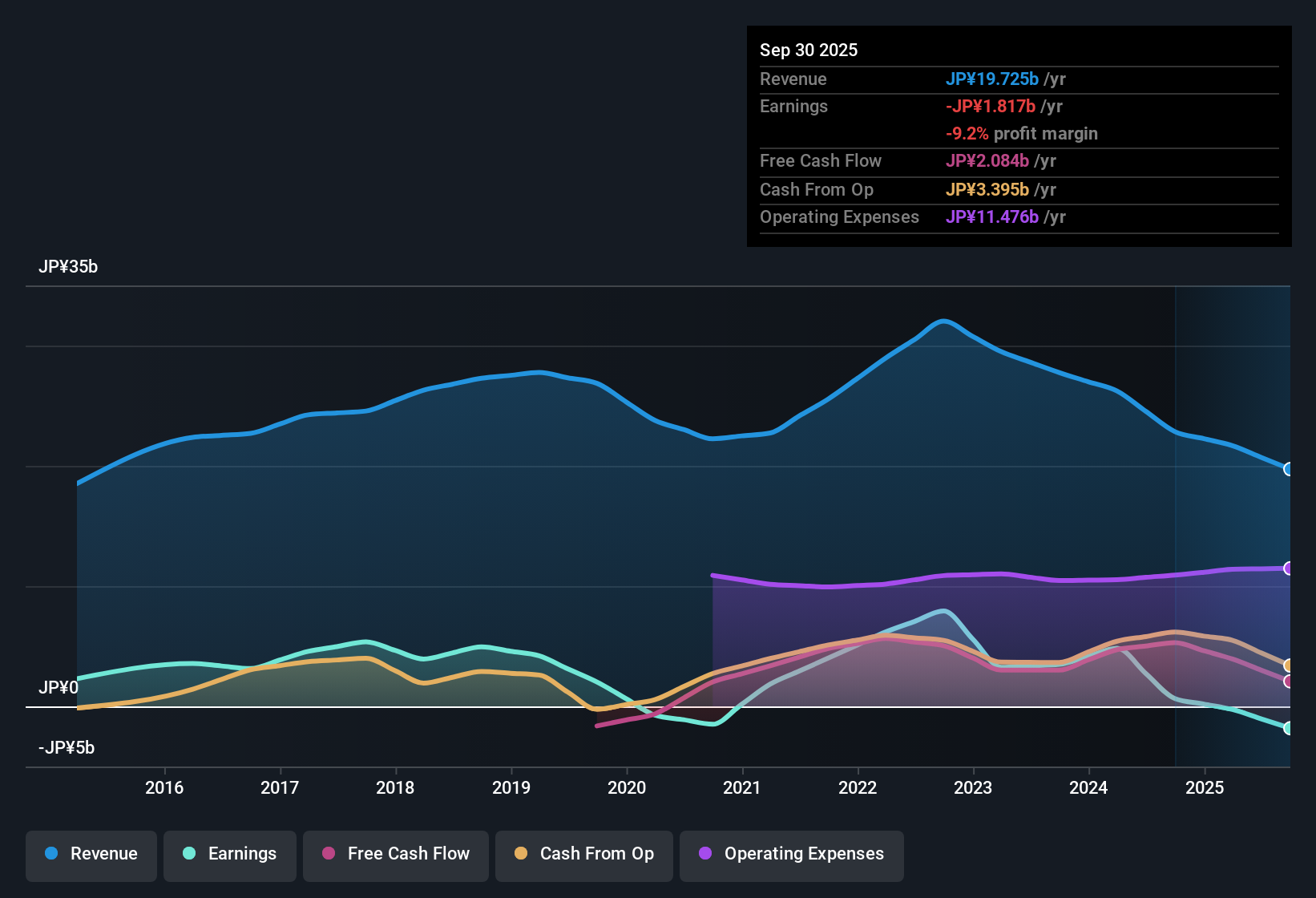

Honma Golf (SEHK:6858) just posted its H1 2026 results, reporting revenue of ¥7.9 billion and a basic EPS of -3.96 JPY as net loss deepened to -¥2.4 billion. Looking at recent trends, revenue fell from ¥9.8 billion in H1 2025 and ¥11.9 billion in H2 2025. Net income shifted from -¥846 million to ¥581 million before dropping to the current loss. The company’s sustained margin pressure and growing losses continue to weigh heavily on sentiment as investors search for any hint of a turnaround.

See our full analysis for Honma Golf.The real test is how these numbers stack up against the prevailing narratives. Some expectations may need rethinking as the latest results get unpacked.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Loss Deepens Despite Revenue Base of $7.9 Billion

- Honma Golf reported a net loss of ¥2.4 billion for H1 2026, following a profitable H2 2025 (net income of ¥581 million). This reversal highlights the persistence of negative earnings momentum over multiple periods.

- Consensus narrative highlights ongoing decline in margins, noting that the loss was not just a one-off event, but is consistent with a five-year annualized loss growth of 17.3%.

- What stands out is the lack of any margin improvement, with the net loss in H1 2026 even wider than in the comparable H1 2025 period (net loss of ¥846 million).

- There is no evidence of a profit growth turnaround, so concerns about the company's earnings durability remain front and center.

Expensive Valuation Versus Peers and DCF Fair Value

- At a price-to-sales ratio of 2.1x versus 1.2x for peers and 0.6x for the broader industry, Honma Golf stock appears expensive relative to its fundamentals.

- Critics spotlight the stock's premium valuation, emphasizing that the current price of 3.34 JPY is above the DCF fair value estimate of 1.01 JPY.

- This premium is not backed by profit growth acceleration or margin expansion, raising questions about how long investors will be willing to pay up for the stock.

- With losses mounting and the stock trading above fair value, valuation risk is amplified for existing shareholders.

Sustained Earnings Decline Lacks a Turnaround Catalyst

- Earnings have compounded lower at a 17.3% annualized rate over the last five years, underlining a multi-year downtrend with no visible inflection point in the latest results.

- Bears point to the absence of any clear profit growth engine, with the trailing twelve months net loss at ¥1.8 billion and no improvement in net profit margin.

- Every recent reporting period has shown volatility, but the overall trajectory remains negative. Neither revenue stabilization nor expense control has shifted the narrative.

- Without a catalyst for margin recovery, the bear case remains heavily supported by ongoing financial trends.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Honma Golf's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Honma Golf’s mounting losses, lack of margin improvement, and overvalued share price compared to peers signal ongoing risks for investors seeking earnings and valuation stability.

If you want assurance that you aren’t overpaying for weak fundamentals, check out these 914 undervalued stocks based on cash flows for stocks offering better value based on their current cash flows and fair price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honma Golf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6858

Honma Golf

An investment holding company, designs, develops, manufactures, and sells a range of golf club equipment in Japan, Korea, Hong Kong, Macau, rest of China, North America, Europe, and internationally.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026