Laopu Gold (SEHK:6181): Assessing Valuation Following Board Approval of Dividend and Governance Changes

Reviewed by Simply Wall St

Laopu Gold (SEHK:6181) announced two key moves at its recent EGM. The company approved an interim dividend and amendments to its Articles of Association. Both steps signal immediate implications for current shareholders.

See our latest analysis for Laopu Gold.

Laopu Gold’s recent board decisions seem to have reignited interest, as reflected in its remarkable year-to-date share price return of 142.62% and a one-year total shareholder return of 225.6%. While momentum has cooled a bit in the last month, long-term gains remain undeniably strong and signal that investors may be factoring in both growth potential and improved shareholder policies.

If the blend of rising returns and policy changes has you curious about what else is out there, now is a good time to broaden your outlook and discover fast growing stocks with high insider ownership

The question now is whether Laopu Gold’s impressive run leaves it undervalued compared to its true potential, or if the market has already priced in this growth and policy shift. This could mean there is limited room for additional upside.

Price-to-Earnings of 32.6x: Is it justified?

At a price-to-earnings (P/E) ratio of 32.6x, Laopu Gold’s shares trade significantly above both peers and industry benchmarks. This is the case even after recent price consolidation from its prior run.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings and is a popular tool for assessing value in sectors like luxury goods. It indicates market expectations for growth, profitability, or unique business strength. In Laopu Gold’s case, the high P/E suggests that the market has high expectations for future earnings expansion, given the company’s recent profit growth and strong returns.

Compared to the Hong Kong luxury industry average of 10x and peer average of 15x, Laopu Gold appears very expensive. Even when compared to the estimated fair P/E of 20.2x, the stock trades well above what the broader market might eventually consider justified, suggesting that optimism is running far ahead of sector norms.

Explore the SWS fair ratio for Laopu Gold

Result: Price-to-Earnings of 32.6x (OVERVALUED)

However, if revenue or net income growth slows, or if the market revises its lofty expectations, Laopu Gold’s share price could face pressure.

Find out about the key risks to this Laopu Gold narrative.

Another View: What Does Discounted Cash Flow Say?

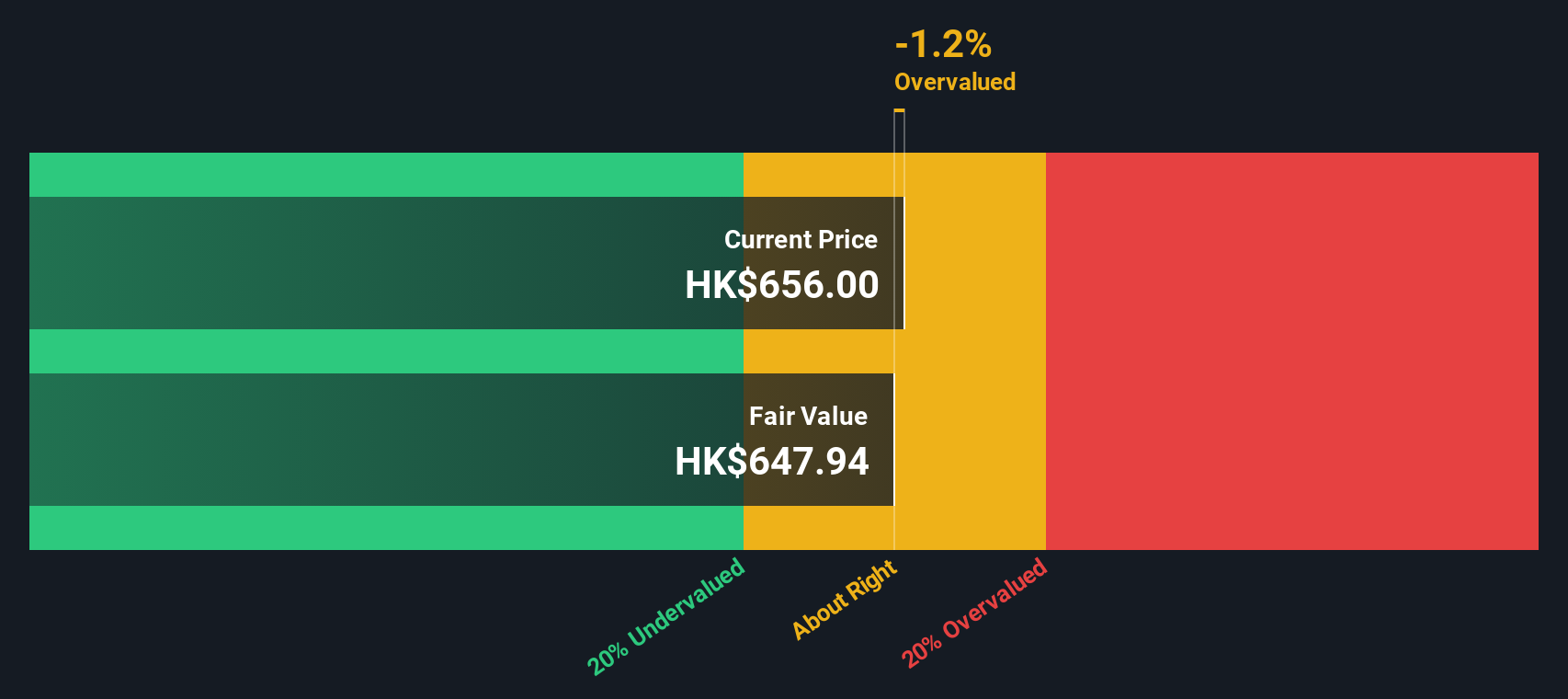

While Laopu Gold appears expensive when judged by its price-to-earnings ratio, our SWS DCF model offers a different perspective. The stock trades just 0.8% below its estimated fair value, which suggests it is roughly in line with underlying cash flow expectations. Is this fair value indicating a ceiling, or is there still potential for further upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Laopu Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Laopu Gold Narrative

If you want to see the bigger picture or prefer hands-on research, it takes just a few minutes to create and shape your own view on Laopu Gold, so why not Do it your way

A great starting point for your Laopu Gold research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. Tap into new trends and smart sectors that could help you get ahead before the crowd does.

- Grow your income potential when you tap into the most reliable picks on the market with these 15 dividend stocks with yields > 3% for strong yields and solid fundamentals.

- Spot high-upside opportunities by jumping into these 927 undervalued stocks based on cash flows and targeting companies trading below their fair value before broader attention catches on.

- Ride the momentum in cutting-edge technology by searching these 25 AI penny stocks, giving yourself an edge in AI’s rapid advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success