3 SEHK Growth Stocks With High Insider Ownership And Earnings Growth Up To 69%

Reviewed by Simply Wall St

As global markets navigate escalating tensions in the Middle East and fluctuating oil prices, Hong Kong's market has shown resilience with significant gains, driven by optimism surrounding Beijing’s support measures. In this environment, growth companies with high insider ownership can be particularly appealing as they often align management interests with those of shareholders, potentially fostering earnings growth even amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 32.7% |

| Akeso (SEHK:9926) | 20.5% | 52.6% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Xiamen Yan Palace Bird's Nest Industry (SEHK:1497) | 26.7% | 23.8% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

Let's explore several standout options from the results in the screener.

Pacific Textiles Holdings (SEHK:1382)

Simply Wall St Growth Rating: ★★★★★☆

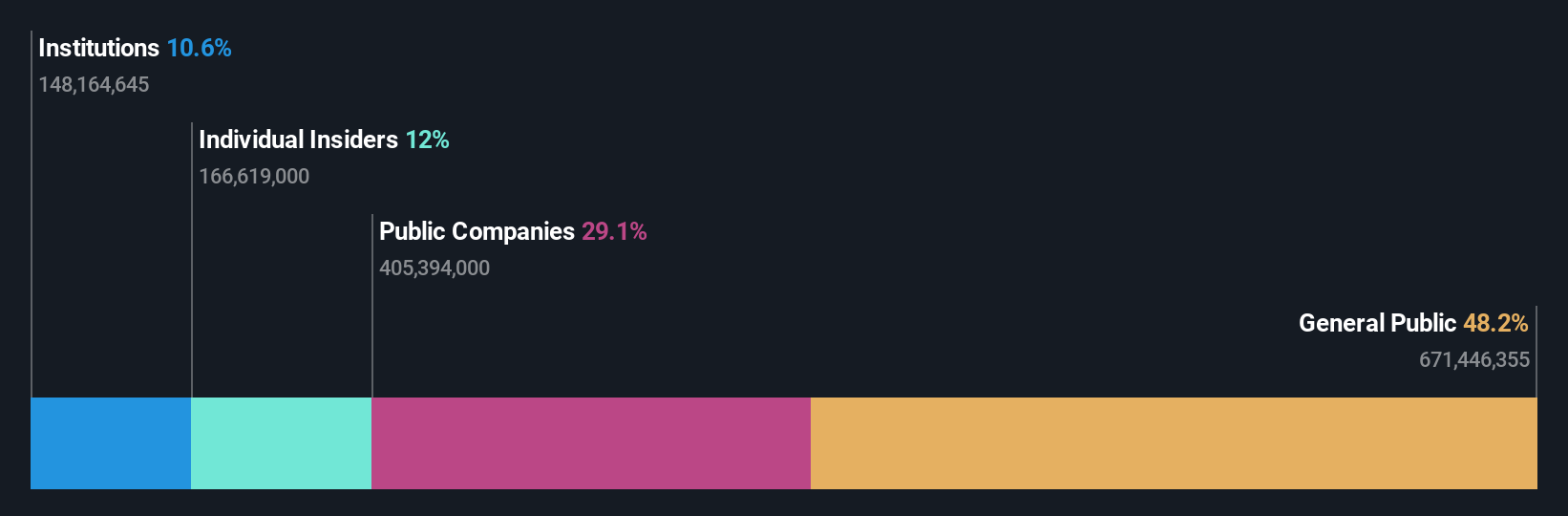

Overview: Pacific Textiles Holdings Limited manufactures and trades textile products across multiple countries, including China, Vietnam, and the United States, with a market cap of HK$2.29 billion.

Operations: The company generates HK$4.67 billion in revenue from its manufacturing and trading of textile products segment.

Insider Ownership: 11.2%

Earnings Growth Forecast: 37.7% p.a.

Pacific Textiles Holdings is navigating a challenging period following Typhoon Yagi, which temporarily halted operations at its Vietnam Hai Duong Plant. Despite this setback, the company swiftly reallocated production to other facilities. Revenue growth is forecast at 12% annually, outpacing the Hong Kong market's 7.3%. However, profit margins have declined from last year. Earnings are expected to grow significantly at 37.7% per year, although dividends remain unsustainable based on current earnings and cash flows.

- Dive into the specifics of Pacific Textiles Holdings here with our thorough growth forecast report.

- The analysis detailed in our Pacific Textiles Holdings valuation report hints at an inflated share price compared to its estimated value.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Simply Wall St Growth Rating: ★★★★★☆

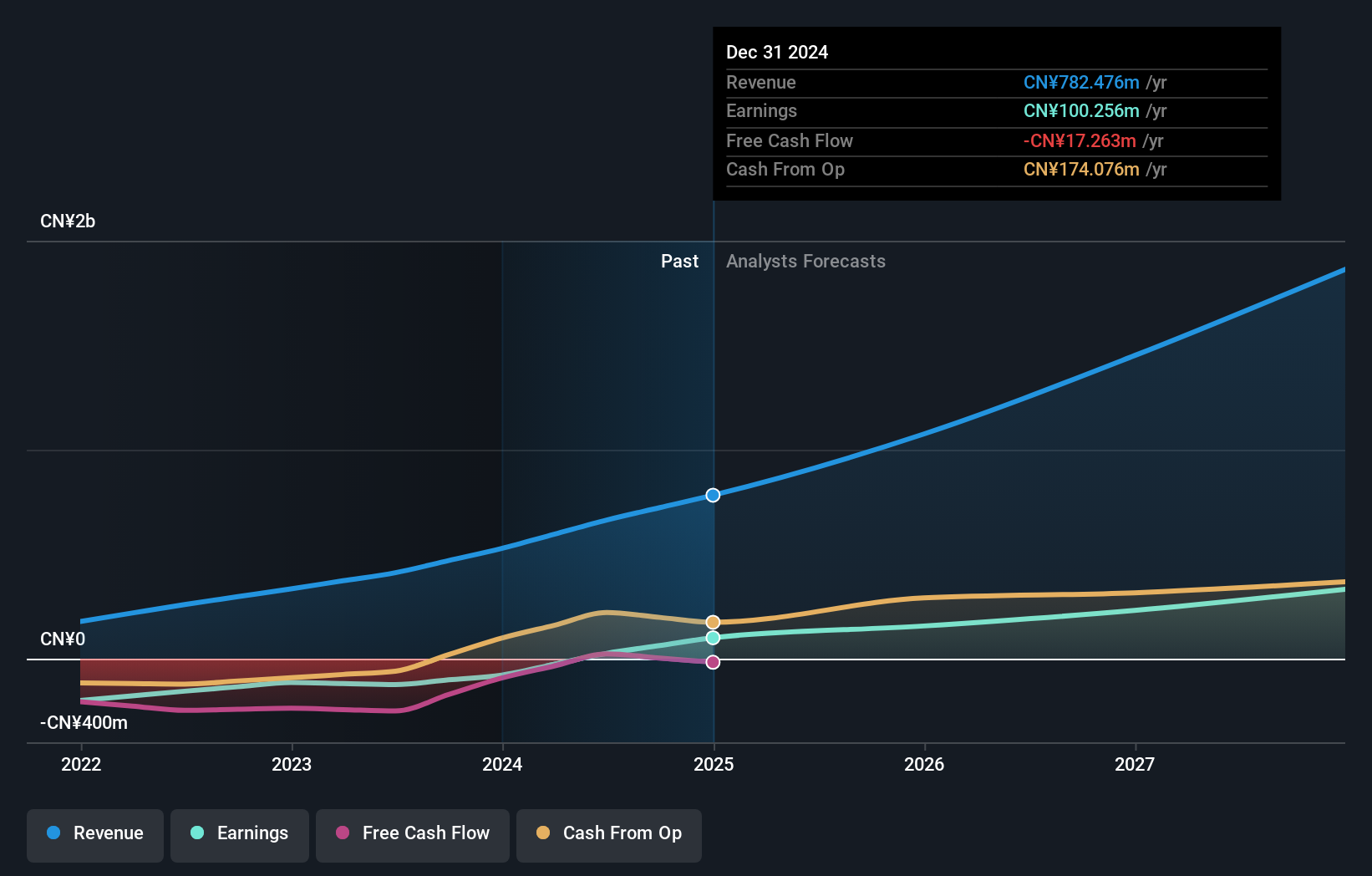

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional devices, serving both the People's Republic of China and international markets, with a market cap of HK$3.95 billion.

Operations: The company generates revenue from the sales of neurovascular and peripheral-vascular interventional surgical devices, amounting to CN¥663.61 million.

Insider Ownership: 18.8%

Earnings Growth Forecast: 69.8% p.a.

Zylox-Tonbridge Medical Technology is experiencing robust growth, with revenue expected to increase by 23.8% annually, surpassing the Hong Kong market's average. The company recently reported a significant turnaround to profitability, posting CNY 68.87 million in net income for the first half of 2024. It has initiated a share buyback program, potentially enhancing earnings per share and net assets. Despite low forecasted return on equity, analyst consensus suggests a potential stock price rise of 28.1%.

- Click here and access our complete growth analysis report to understand the dynamics of Zylox-Tonbridge Medical Technology.

- Insights from our recent valuation report point to the potential undervaluation of Zylox-Tonbridge Medical Technology shares in the market.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

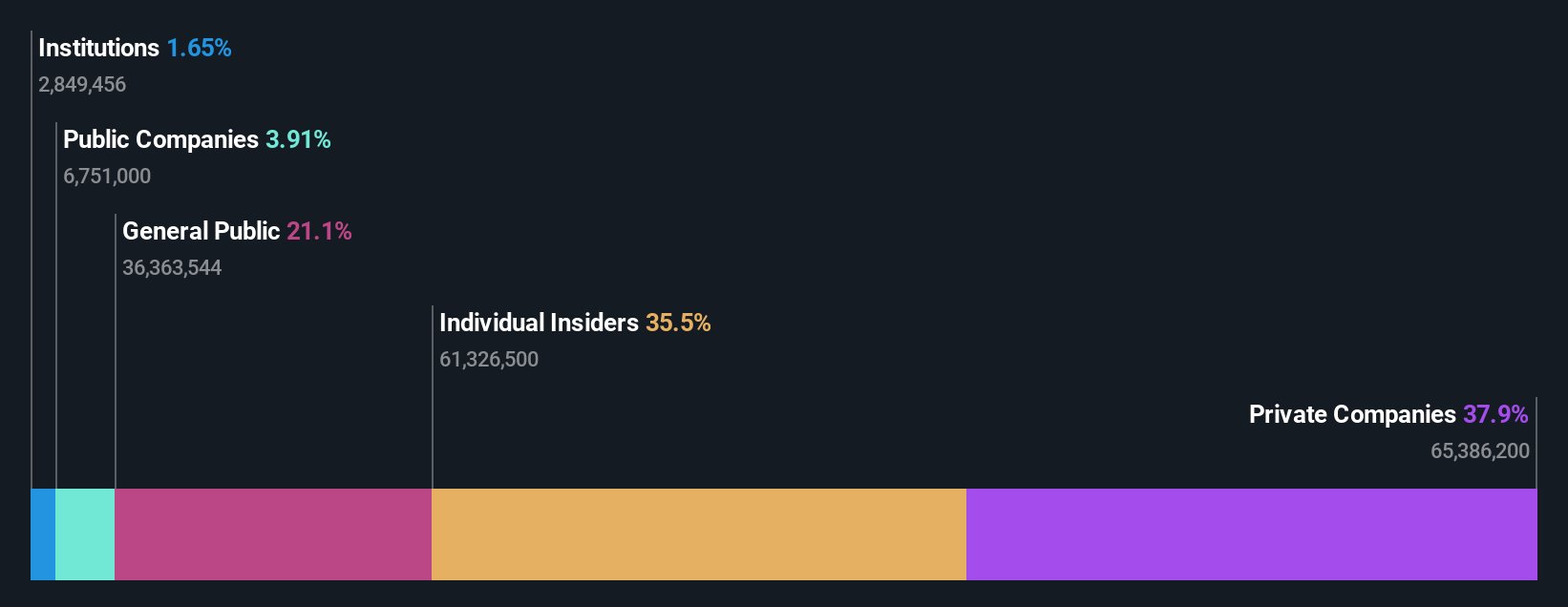

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$28.66 billion.

Operations: The company's revenue segment includes Jewelry & Watches, generating CN¥5.28 billion.

Insider Ownership: 36.4%

Earnings Growth Forecast: 32.7% p.a.

Laopu Gold shows strong growth potential, with earnings projected to increase by 32.7% annually, outpacing the Hong Kong market. Recent financial results reveal a significant rise in revenue and net income for the first half of 2024, with sales reaching CNY 3.52 billion and net income at CNY 587.81 million. Despite trading at a substantial discount to its estimated fair value, recent amendments to company bylaws reflect ongoing regulatory alignment efforts and structural adjustments following share capital changes.

- Delve into the full analysis future growth report here for a deeper understanding of Laopu Gold.

- According our valuation report, there's an indication that Laopu Gold's share price might be on the expensive side.

Seize The Opportunity

- Gain an insight into the universe of 47 Fast Growing SEHK Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1382

Pacific Textiles Holdings

Manufactures and trades in textile products in the People’s Republic of China, Vietnam, Bangladesh, Hong Kong, Indonesia, Sri Lanka, Cambodia, the United States, Jordan, Africa, Haiti, India, rest of Asia, and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives