Yue Yuen (SEHK:551): Assessing Valuation After Latest Earnings Show Decline in Sales and Profit

Reviewed by Simply Wall St

Yue Yuen Industrial (Holdings) (SEHK:551) just released its earnings for the nine months ended September 30, 2025, showing both sales and net income have slipped compared to the prior year’s period.

See our latest analysis for Yue Yuen Industrial (Holdings).

While Yue Yuen’s latest earnings showed weaker sales and profit, investors seem encouraged. The share price is up 17.7% over the last month alone. Momentum is picking up, and the total shareholder return for the past year now stands at nearly 10%.

If strong turnarounds pique your interest, this could be a great moment to discover fast growing stocks with high insider ownership.

But after this substantial rally, investors face a familiar question: is Yue Yuen trading at a bargain after its drop in sales, or does the current price already reflect expectations for a turnaround ahead?

Price-to-Earnings of 9.5x: Is it justified?

Yue Yuen Industrial (Holdings) trades at a price-to-earnings (P/E) ratio of 9.5x, placing it below both its industry peers and historical averages. With the last close at HK$15.60, this valuation metric signals that the company appears undervalued compared to direct competitors.

The P/E ratio measures how much investors are paying for each dollar of current earnings, and is particularly useful for companies with stable or growing profits like Yue Yuen. Given the company's return to profitability over the past five years and ongoing earnings growth forecasts, a lower P/E implies that the market may be underestimating its future potential.

Compared to its industry, Yue Yuen's P/E of 9.5x sits below the Hong Kong Luxury sector average of 10.1x. This is also below the estimated fair P/E of 10.2x. The fair P/E represents the level the market could converge toward if expectations improve. These comparisons reinforce the notion that the stock is attractively valued relative to its peers and the level justified by fundamentals.

Explore the SWS fair ratio for Yue Yuen Industrial (Holdings)

Result: Price-to-Earnings of 9.5x (UNDERVALUED)

However, slowing sales growth and only modest analyst upside remain key risks that could limit further share price gains in the near term.

Find out about the key risks to this Yue Yuen Industrial (Holdings) narrative.

Another View: What Does the SWS DCF Model Say?

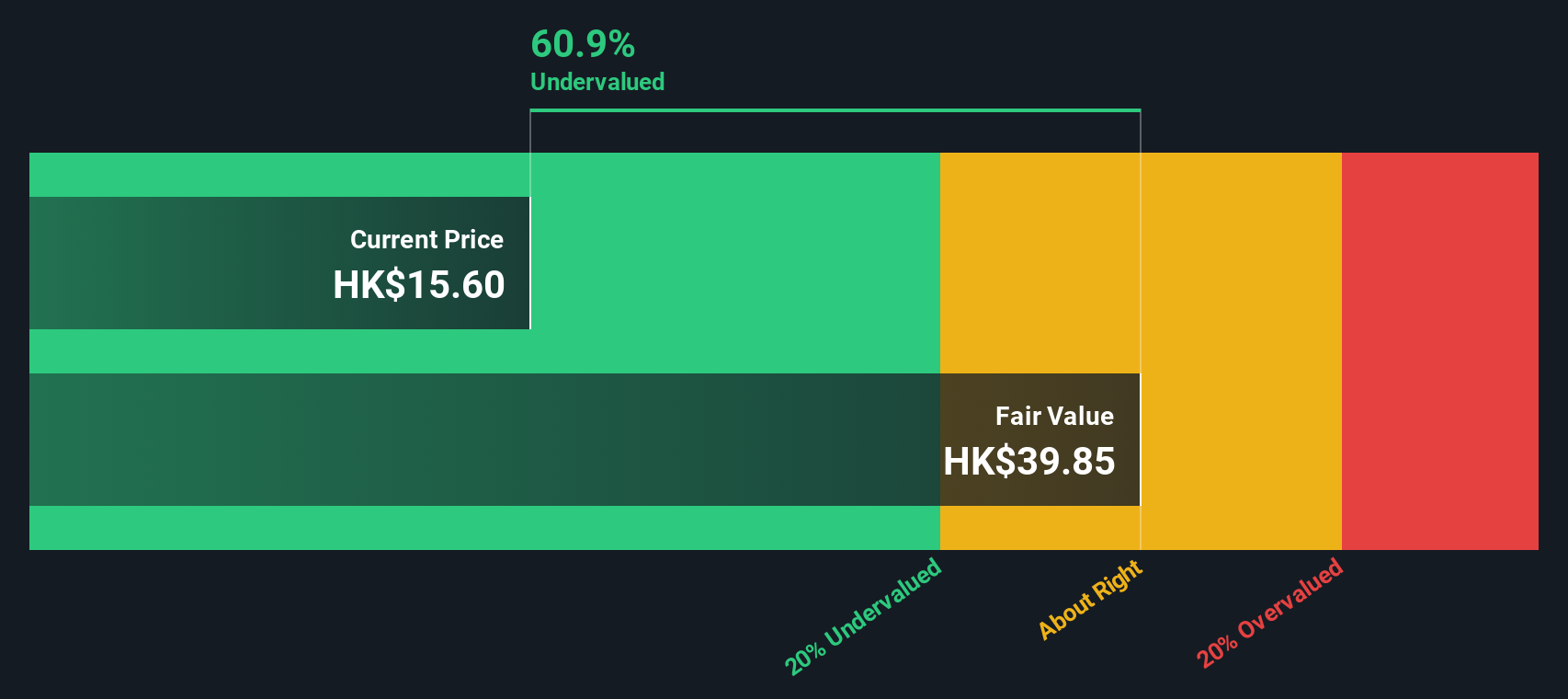

Taking a different tack, our DCF model puts Yue Yuen’s fair value much higher than its current price. The shares are trading about 61% below our estimate of fair value (HK$39.85). This suggests the market might be overlooking deeper potential. Could there be more upside than investors realize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yue Yuen Industrial (Holdings) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yue Yuen Industrial (Holdings) Narrative

If you see things differently or want to dig deeper for yourself, you can craft your own research story in just a few minutes. Do it your way.

A great starting point for your Yue Yuen Industrial (Holdings) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio with fresh opportunities beyond single stocks. Don’t let new trends pass you by; there’s a world of potential waiting on Simply Wall St.

- Unlock passive income streams by tapping into these 16 dividend stocks with yields > 3%, offering reliable yields greater than 3% across diverse sectors.

- Access the innovators of tomorrow when you check out these 25 AI penny stocks, driving advances in artificial intelligence and shaping entire industries.

- Tap into value with these 878 undervalued stocks based on cash flows, designed to spotlight stocks trading below their fair price based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:551

Yue Yuen Industrial (Holdings)

An investment holding company, manufactures and sells athletic, athleisure, casual, and outdoor footwear in the People’s Republic of China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives