The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Kingdom Holdings Limited (HKG:528) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Kingdom Holdings

How Much Debt Does Kingdom Holdings Carry?

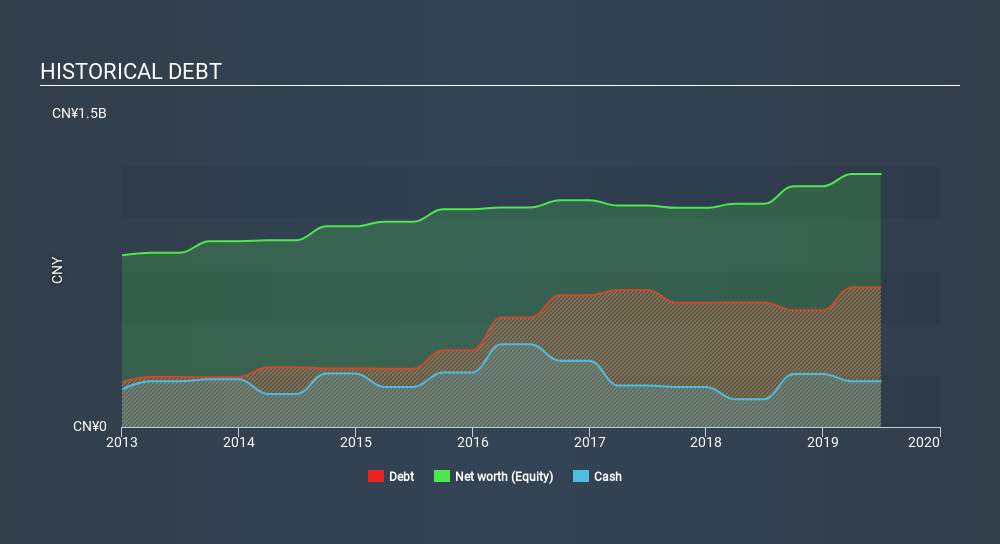

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Kingdom Holdings had CN¥668.4m of debt, an increase on CN¥597.0m, over one year. However, because it has a cash reserve of CN¥219.7m, its net debt is less, at about CN¥448.6m.

How Healthy Is Kingdom Holdings's Balance Sheet?

According to the last reported balance sheet, Kingdom Holdings had liabilities of CN¥1.09b due within 12 months, and liabilities of CN¥61.5m due beyond 12 months. Offsetting this, it had CN¥219.7m in cash and CN¥299.7m in receivables that were due within 12 months. So its liabilities total CN¥636.9m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of CN¥948.3m, so it does suggest shareholders should keep an eye on Kingdom Holdings's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Kingdom Holdings's net debt is only 1.4 times its EBITDA. And its EBIT easily covers its interest expense, being 11.7 times the size. So we're pretty relaxed about its super-conservative use of debt. Better yet, Kingdom Holdings grew its EBIT by 429% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kingdom Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Kingdom Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Kingdom Holdings is not finding it easy conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its EBIT growth rate. When we consider all the factors mentioned above, we do feel a bit cautious about Kingdom Holdings's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Given Kingdom Holdings has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:528

Kingdom Holdings

An investment holding company, engages in the manufacture and sale of linen yarns in Mainland China, the European Union, and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives