Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Continental Holdings Limited (HKG:513) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Continental Holdings

How Much Debt Does Continental Holdings Carry?

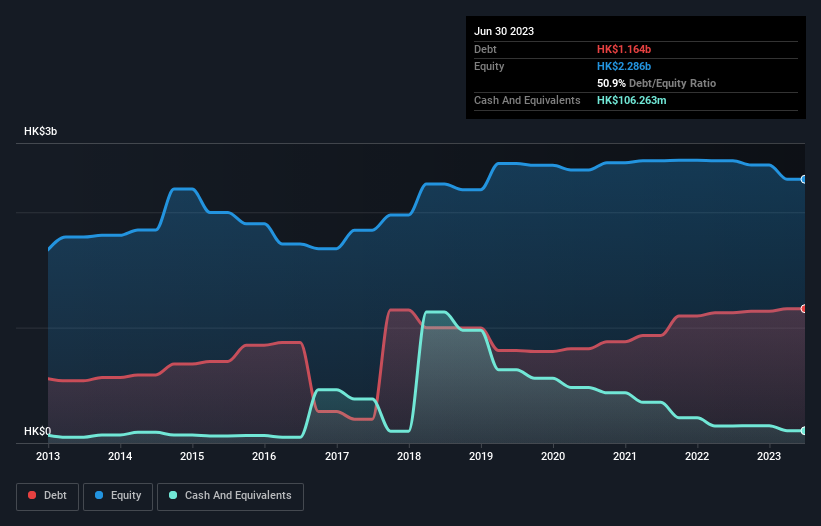

As you can see below, Continental Holdings had HK$1.16b of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has HK$106.3m in cash leading to net debt of about HK$1.06b.

How Strong Is Continental Holdings' Balance Sheet?

We can see from the most recent balance sheet that Continental Holdings had liabilities of HK$1.02b falling due within a year, and liabilities of HK$416.5m due beyond that. Offsetting these obligations, it had cash of HK$106.3m as well as receivables valued at HK$64.6m due within 12 months. So its liabilities total HK$1.27b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the HK$204.9m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Continental Holdings would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Continental Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Continental Holdings had a loss before interest and tax, and actually shrunk its revenue by 25%, to HK$456m. To be frank that doesn't bode well.

Caveat Emptor

While Continental Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping HK$42m. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it burned through HK$61m in the last year. So we consider this a high risk stock, and we're worried its share price could sink faster than than a dingy with a great white shark attacking it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Continental Holdings has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:513

Continental Holdings

An investment holding company, designs, manufactures, markets, wholesales, retails, and trades in fine jewellery and diamonds.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026