Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Continental Holdings Limited (HKG:513) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Continental Holdings

How Much Debt Does Continental Holdings Carry?

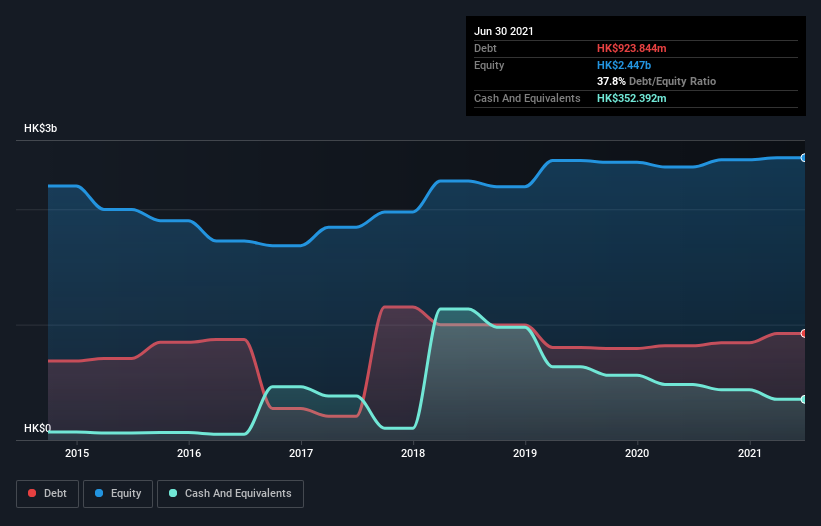

The image below, which you can click on for greater detail, shows that at June 2021 Continental Holdings had debt of HK$923.8m, up from HK$816.6m in one year. However, it does have HK$352.4m in cash offsetting this, leading to net debt of about HK$571.5m.

A Look At Continental Holdings' Liabilities

According to the last reported balance sheet, Continental Holdings had liabilities of HK$910.2m due within 12 months, and liabilities of HK$361.6m due beyond 12 months. On the other hand, it had cash of HK$352.4m and HK$99.9m worth of receivables due within a year. So it has liabilities totalling HK$819.4m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the HK$297.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Continental Holdings would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is Continental Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Continental Holdings reported revenue of HK$536m, which is a gain of 28%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Continental Holdings still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable HK$42m at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it vaporized HK$38m in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Continental Holdings that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:513

Continental Holdings

An investment holding company, designs, manufactures, markets, wholesales, retails, and trades in fine jewellery and diamonds.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026