- Hong Kong

- /

- Consumer Durables

- /

- SEHK:496

Kasen International Holdings Limited's (HKG:496) Share Price Boosted 37% But Its Business Prospects Need A Lift Too

The Kasen International Holdings Limited (HKG:496) share price has done very well over the last month, posting an excellent gain of 37%. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

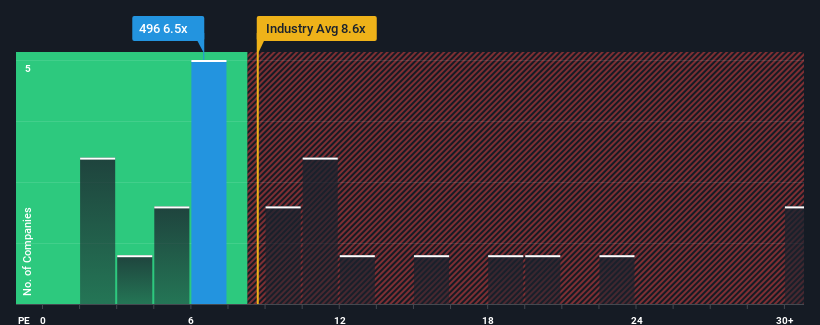

Although its price has surged higher, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Kasen International Holdings as an attractive investment with its 6.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Kasen International Holdings' financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Kasen International Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Kasen International Holdings' to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 54% drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Kasen International Holdings' P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Kasen International Holdings' P/E?

Despite Kasen International Holdings' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Kasen International Holdings maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Kasen International Holdings has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on Kasen International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kasen International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:496

Kasen International Holdings

An investment holding company, engages in manufacturing and trading of upholstered furniture in the United States, the People’s Republic of China, Cambodia, Europe, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives