Revenues Tell The Story For Central Development Holdings Limited (HKG:475) As Its Stock Soars 27%

Despite an already strong run, Central Development Holdings Limited (HKG:475) shares have been powering on, with a gain of 27% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

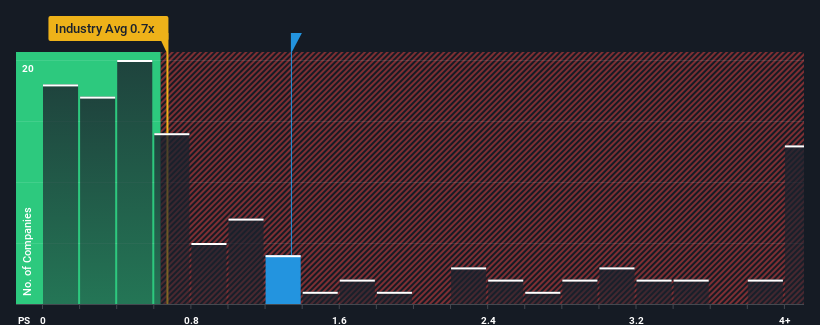

After such a large jump in price, given close to half the companies operating in Hong Kong's Luxury industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Central Development Holdings as a stock to potentially avoid with its 1.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Central Development Holdings

What Does Central Development Holdings' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Central Development Holdings over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Central Development Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Central Development Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 246% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Central Development Holdings is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Central Development Holdings' P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Central Development Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about these 2 warning signs we've spotted with Central Development Holdings.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:475

Central Development Holdings

An investment holding company, engages in the design, manufacture, and wholesale of jewelry products in the People's Republic of China and Hong Kong.

Low risk and overvalued.

Market Insights

Community Narratives