Bosideng (SEHK:3998) Net Profit Margin Rises to 13.7%, Underscoring Earnings Quality Concerns

Reviewed by Simply Wall St

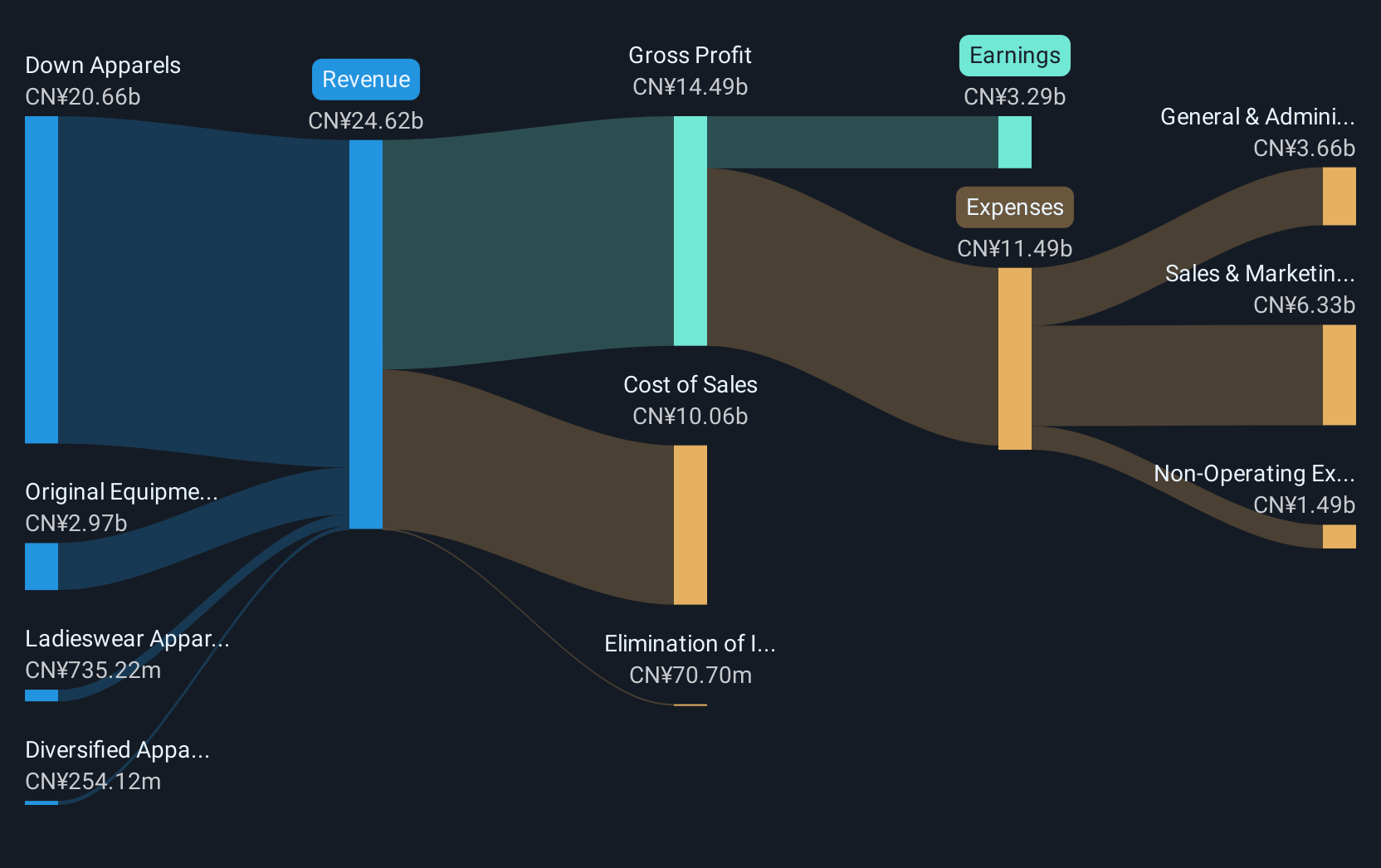

Bosideng International Holdings (SEHK:3998) just posted its H1 2026 financial results, reporting revenue of $13.1 billion and basic EPS of 0.31 CNY. Looking back, the company has seen revenue rise from $15.7 billion in H2 2024 to $17.1 billion in H2 2025. Basic EPS moved from 0.20 CNY to 0.21 CNY over the same periods. Margins held up well, keeping overall profitability in focus for investors.

See our full analysis for Bosideng International Holdings.Next up, we’re putting these numbers to the test against the stories circulating in the market. We will see which narratives hold up and which are challenged by the fresh data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Edge Up to 13.7%

- Net profit margins rose to 13.7%, up from 13.4% in the prior year. This reflects stronger underlying profitability even as revenue growth paced at 9.3% year over year.

- A notable point is that the consensus narrative indicates Bosideng’s margin expansion comes even as earnings growth (8.8%) runs below its own five-year average of 18.4%.

- This trajectory suggests profitability is more resilient than pure earnings growth would indicate, providing quality upside in the context of slower headline expansion.

- Consensus also notes that investors will be monitoring whether this margin resilience is sustainable, as market-wide expectations for Hong Kong listed companies are trending higher.

- Consensus expects that margin and earnings quality will influence sentiment as much as headline growth in the coming periods.

- Bulls may need to reconcile this with the company’s projected earnings growth of 9.3% per year, which is below its own five-year pace as well as the market’s projected 11.7%.

Valuation Trades Above DCF Fair Value

- The stock currently trades at HK$4.96 per share, which is above its DCF fair value estimate of HK$4.74, and at a P/E of 14.6x compared to a peer average of 18.1x and the broader Hong Kong luxury industry’s 10x.

- Critics highlight the tension that while Bosideng appears attractively valued versus direct peers, it is relatively expensive compared to the industry and its own DCF fair value.

- This valuation difference means bullish investors must weigh perceived quality growth and above-consensus profitability against the risk that the stock may need to deliver standout results to justify its current premium price.

- The consensus narrative also points out that this perspective depends on management continuing to exceed margin and cash flow expectations or potentially facing a pullback toward DCF fair value.

Dividend and Insider Activity Send Mixed Signals

- Bosideng’s 5.65% dividend yield is noted as a potential risk because it is not well covered by free cash flow, and significant insider selling occurred in the last three months.

- Bears argue that these combined signals—an uncovered dividend and insider sales—present a watchpoint for those investing primarily for income stability.

- However, the consensus narrative tempers these concerns by noting that the company’s solid record of profit growth and margin improvement provides some measure of confidence for long-term holders.

- Nonetheless, dividend-focused investors and skeptics alike will look for evidence of a sustainable payout and alignment from management in upcoming reporting periods.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bosideng International Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Bosideng’s margin resilience, the company’s dividend is not well covered by free cash flow. In addition, recent insider selling raises concerns about income stability.

For investors seeking reliable payouts and stronger alignment, check out these 1926 dividend stocks with yields > 3% where you’ll find companies delivering sustainable yields backed by healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosideng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3998

Bosideng International Holdings

Engages in the apparel business in the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.