China Dongxiang (SEHK:3818) Returns to Profitability, Challenging Years of Losses and Market Skepticism

Reviewed by Simply Wall St

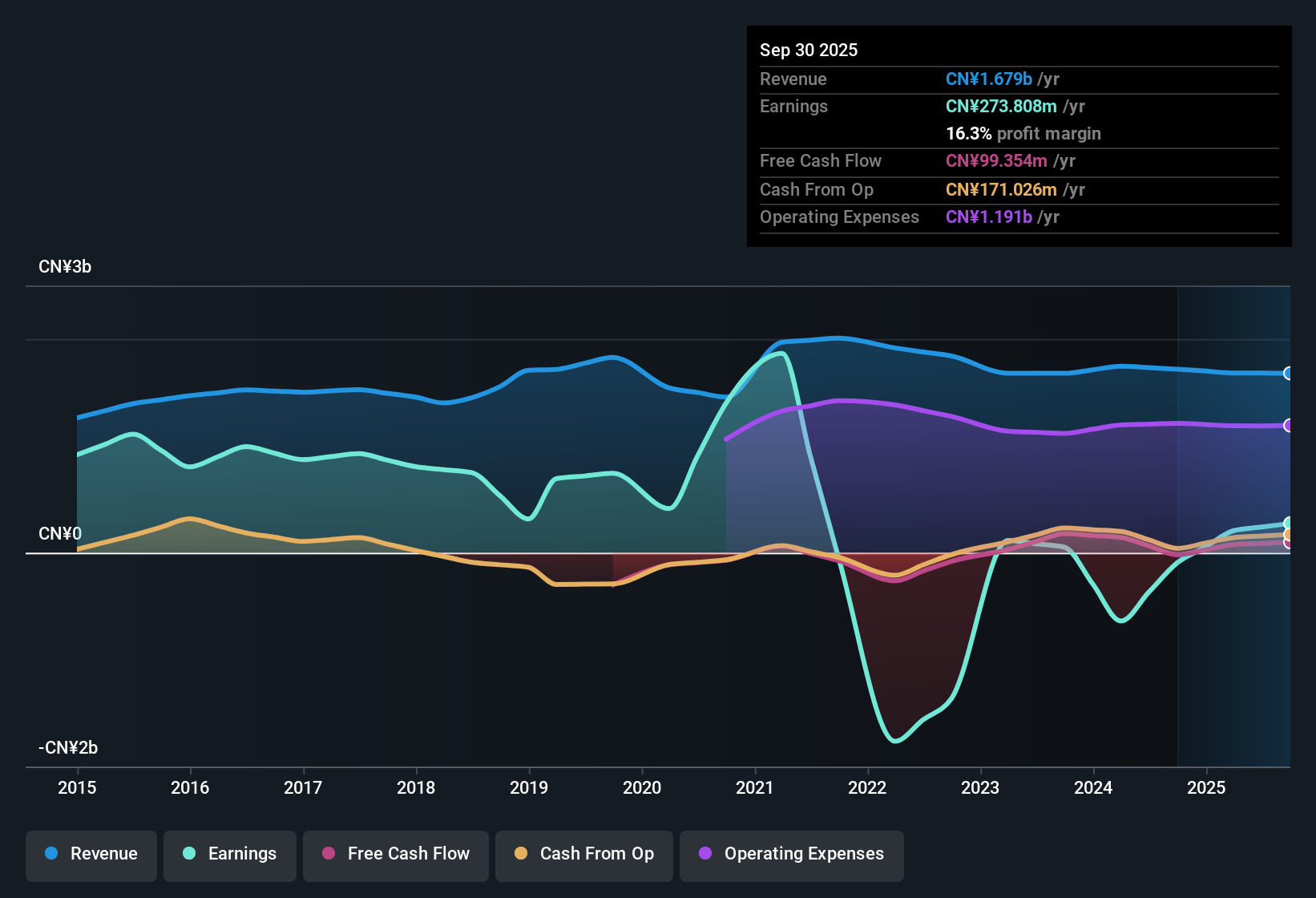

China Dongxiang (Group) (SEHK:3818) just released its half-year 2026 earnings, posting revenue of 931 million CNY and basic EPS of 0.012 CNY. Looking back, revenue had fluctuated over the last periods, ranging from 968 million CNY in H2 2024 to 749 million CNY in H1 2025, while EPS shifted from -0.039 CNY in H2 2024 to 0.023 CNY in H1 2025. Margins took the spotlight as the company swung into the black following last year’s loss, a development that may indicate a changing profitability story for investors to consider.

See our full analysis for China Dongxiang (Group).Next, we will see how these headline figures stack up against the widely discussed narratives in the market and where the numbers might contradict or confirm what investors expect.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Widened Despite One-Off Loss

- Trailing twelve month net income reached 273.8 million CNY on 1.68 billion CNY revenue, but included a large one-time loss of 99.4 million CNY within the period.

- Consistent with recent profitability, market commentary highlights how the turnaround is anchored by improved margins, but also notes the temporary impact of one-off events:

- While net income swung from losses in previous years to profitability, questions remain about durability due to the material effect of this non-recurring loss.

- This creates both support for the bullish view, as the company is now profitable, and caution since the underlying quality of earnings is still subject to these swings.

Valuation Screening Attractively on Earnings Multiple

- China Dongxiang's price-to-earnings ratio of 9.7x is significantly below the Hong Kong market average of 12.2x and peer group average of 20.3x.

- Analysts point to the company's discounted valuation as a key support for its case as a value pick:

- The below-average P/E suggests the stock could appeal to investors seeking affordable exposure to an improving earnings story and sector recovery.

- Yet, the current share price of 0.50 HKD still trades above the DCF fair value of 0.18 HKD, signaling a potential disconnect between market optimism and intrinsic value estimates.

Dividend Yield High, But Coverage Remains a Concern

- The dividend yield sits at 5.46%, which stands out versus most Hong Kong-listed peers, but is not well supported by free cash flow according to analysis.

- General market opinion acknowledges the appeal of the high yield, but raises flags about long-term sustainability:

- Despite the attractive yield, coverage metrics indicate stretched payout ratios and reinforce the risk that dividends could be reduced if profitability or cash generation fails to stabilize.

- Investors are prompted to balance the income potential with the company’s volatility in past earnings and uncertainty regarding future cash flows.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Dongxiang (Group)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite swinging back to profitability, China Dongxiang’s elevated payout ratio and weak dividend coverage raise concerns about the reliability of future income.

For more consistent dividend income, check out these 1933 dividend stocks with yields > 3% for a shortlist of companies with higher yields backed by stronger financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3818

China Dongxiang (Group)

Engages in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories in the People’s Republic of China and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success