China Dongxiang (Group) Co., Ltd.'s (HKG:3818) CEO Compensation Looks Acceptable To Us And Here's Why

Performance at China Dongxiang (Group) Co., Ltd. (HKG:3818) has been reasonably good and CEO Zhiyong Zhang has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18 August 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for China Dongxiang (Group)

How Does Total Compensation For Zhiyong Zhang Compare With Other Companies In The Industry?

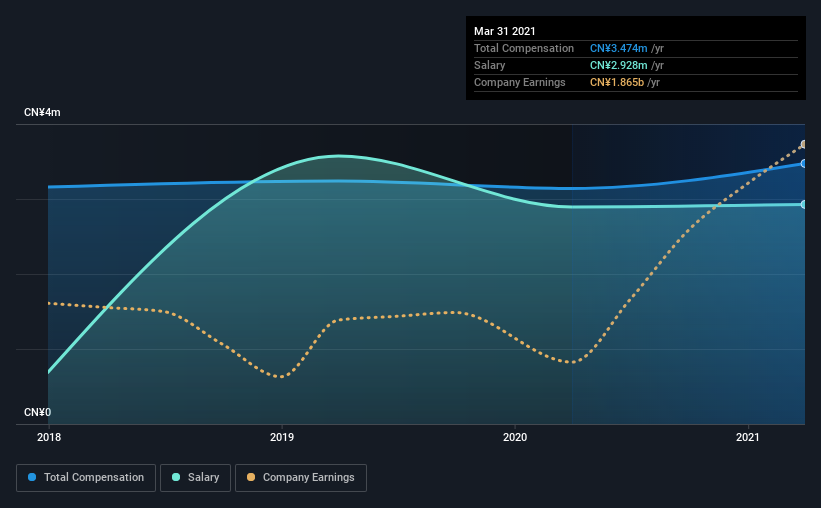

According to our data, China Dongxiang (Group) Co., Ltd. has a market capitalization of HK$6.3b, and paid its CEO total annual compensation worth CN¥3.5m over the year to March 2021. That's a notable increase of 11% on last year. Notably, the salary which is CN¥2.93m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from HK$3.1b to HK$12b, we found that the median CEO total compensation was CN¥4.3m. So it looks like China Dongxiang (Group) compensates Zhiyong Zhang in line with the median for the industry. What's more, Zhiyong Zhang holds HK$178m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CN¥2.9m | CN¥2.9m | 84% |

| Other | CN¥546k | CN¥247k | 16% |

| Total Compensation | CN¥3.5m | CN¥3.1m | 100% |

Speaking on an industry level, nearly 91% of total compensation represents salary, while the remainder of 9% is other remuneration. Although there is a difference in how total compensation is set, China Dongxiang (Group) more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at China Dongxiang (Group) Co., Ltd.'s Growth Numbers

China Dongxiang (Group) Co., Ltd. has seen its earnings per share (EPS) increase by 32% a year over the past three years. It achieved revenue growth of 28% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has China Dongxiang (Group) Co., Ltd. Been A Good Investment?

China Dongxiang (Group) Co., Ltd. has not done too badly by shareholders, with a total return of 6.2%, over three years. It would be nice to see that metric improve in the future. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 4 warning signs for China Dongxiang (Group) (of which 2 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3818

China Dongxiang (Group)

Engages in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories in the People’s Republic of China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026