Perfect Group International Holdings (HKG:3326) Will Pay A Dividend Of HK$0.02

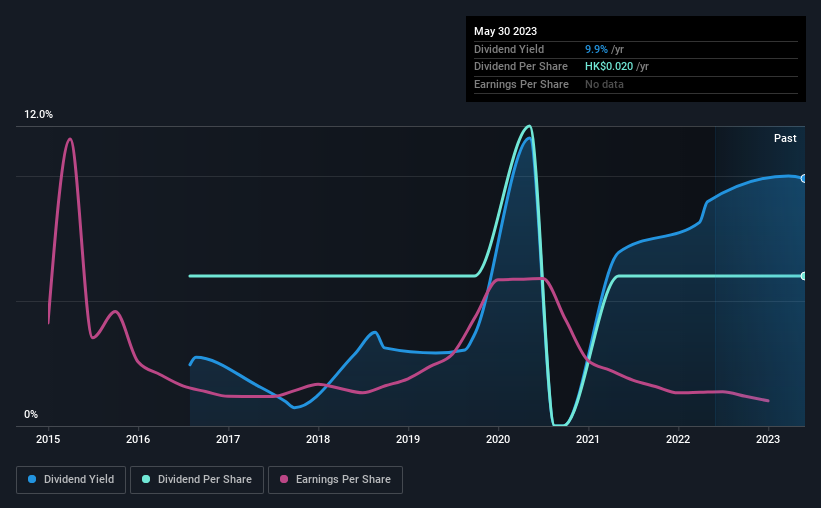

Perfect Group International Holdings Limited (HKG:3326) will pay a dividend of HK$0.02 on the 20th of June. This means the annual payment is 9.9% of the current stock price, which is above the average for the industry.

See our latest analysis for Perfect Group International Holdings

Perfect Group International Holdings Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Perfect Group International Holdings' dividend made up quite a large proportion of earnings but only 45% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Looking forward, EPS could fall by 9.5% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 105%, which could put the dividend under pressure if earnings don't start to improve.

Perfect Group International Holdings' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. This makes us cautious about the consistency of the dividend over a full economic cycle. The last annual payment of HK$0.02 was flat on the annual payment from7 years ago. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth Is Doubtful

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's not great to see that Perfect Group International Holdings' earnings per share has fallen at approximately 9.5% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

Our Thoughts On Perfect Group International Holdings' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Perfect Group International Holdings (1 is a bit unpleasant!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade Perfect Group International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3326

Perfect Group International Holdings

An investment holding company, engages in the design, manufacture, exporting, and sale of fine jewelry products primarily mounted with diamonds in the People’s Republic of China and Dubai.

Flawless balance sheet moderate.

Market Insights

Community Narratives