Win Hanverky Holdings' (HKG:3322) Shareholders Are Down 80% On Their Shares

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Win Hanverky Holdings Limited (HKG:3322) during the five years that saw its share price drop a whopping 80%. And we doubt long term believers are the only worried holders, since the stock price has declined 33% over the last twelve months. The falls have accelerated recently, with the share price down 11% in the last three months.

Check out our latest analysis for Win Hanverky Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

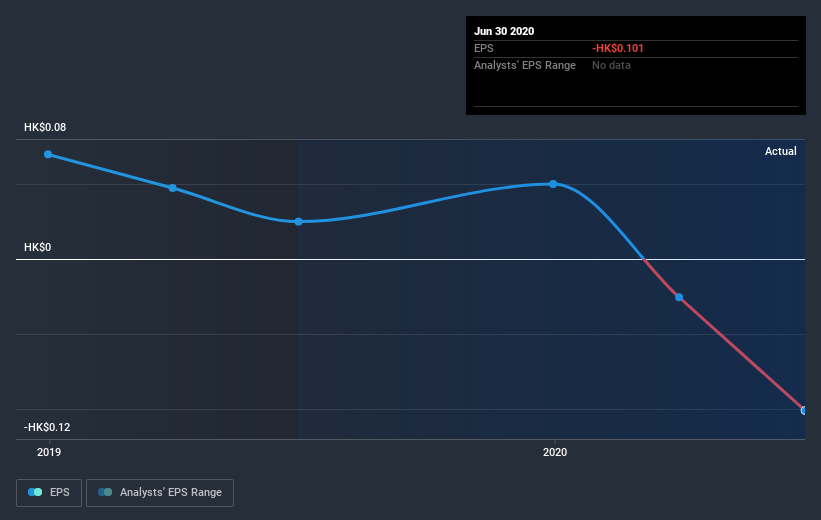

Over five years Win Hanverky Holdings' earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Win Hanverky Holdings' key metrics by checking this interactive graph of Win Hanverky Holdings's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Win Hanverky Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Win Hanverky Holdings' TSR of was a loss of 74% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Win Hanverky Holdings had a tough year, with a total loss of 33%, against a market gain of about 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Win Hanverky Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Win Hanverky Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Win Hanverky Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Win Hanverky Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3322

Win Hanverky Holdings

Engages in the manufacture, retail and sale of sports, fashion and outdoor brands in Mainland China, Europe, Other Asian countries, the United States, Hong Kong, Canada, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives