Here's Why It's Unlikely That Win Hanverky Holdings Limited's (HKG:3322) CEO Will See A Pay Rise This Year

Key Insights

- Win Hanverky Holdings will host its Annual General Meeting on 13th of June

- Salary of HK$3.27m is part of CEO Alan Lee's total remuneration

- The total compensation is 65% higher than the average for the industry

- Win Hanverky Holdings' three-year loss to shareholders was 57% while its EPS was down 33% over the past three years

The results at Win Hanverky Holdings Limited (HKG:3322) have been quite disappointing recently and CEO Alan Lee bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 13th of June. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Win Hanverky Holdings

How Does Total Compensation For Alan Lee Compare With Other Companies In The Industry?

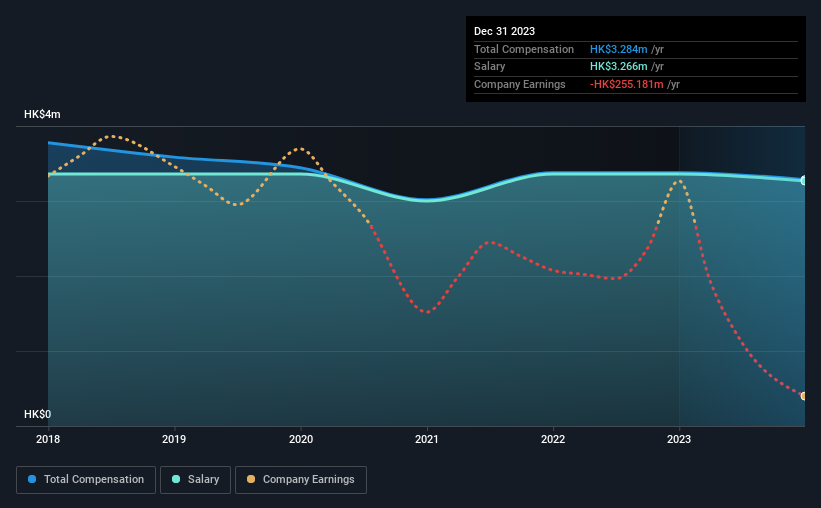

According to our data, Win Hanverky Holdings Limited has a market capitalization of HK$186m, and paid its CEO total annual compensation worth HK$3.3m over the year to December 2023. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at HK$3.27m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Hong Kong Luxury industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$2.0m. This suggests that Alan Lee is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$3.3m | HK$3.4m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$3.3m | HK$3.4m | 100% |

On an industry level, around 94% of total compensation represents salary and 6% is other remuneration. Win Hanverky Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Win Hanverky Holdings Limited's Growth Numbers

Win Hanverky Holdings Limited has reduced its earnings per share by 33% a year over the last three years. Its revenue is down 25% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Win Hanverky Holdings Limited Been A Good Investment?

Few Win Hanverky Holdings Limited shareholders would feel satisfied with the return of -57% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Alan receives almost all of their compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Win Hanverky Holdings (1 doesn't sit too well with us!) that you should be aware of before investing here.

Switching gears from Win Hanverky Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Win Hanverky Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3322

Win Hanverky Holdings

Engages in the manufacture, retail and sale of sports, fashion and outdoor brands in Mainland China, Europe, Other Asian countries, the United States, Hong Kong, Canada, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026