Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Yangtzekiang Garment Limited (HKG:294) from a dividend investor's perspective. Owning a strong dividend company and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

A high yield and a long history of paying dividends is an appealing combination for Yangtzekiang Garment. It would not be a surprise to discover that many investors buy it for the dividends. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Yangtzekiang Garment!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to be form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 62% of Yangtzekiang Garment's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Yangtzekiang Garment paid out 1103% of its free cash last year. Cash flows can be lumpy, but paying out this much cash is not ideal. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely.

With a strong net cash balance, Yangtzekiang Garment investors may not have much to worry about in the near term from a dividend perspective.

With margins thinner than Enron's compliance division, timing effects could lead Yangtzekiang Garment to have sharp fluctuations in its earnings and cashflow, which could explain this seemingly-extreme payout ratio. Further investigation may be warranted.

Consider getting our latest analysis on Yangtzekiang Garment's financial position here.

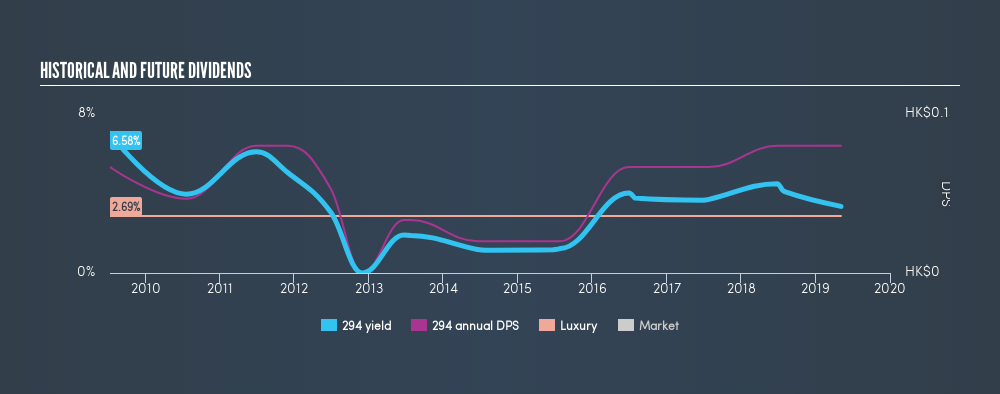

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Yangtzekiang Garment's dividend payments. Its dividend payments have fallen by 20% or more on at least one occasion over the past ten years. During the past ten-year period, the first annual payment was HK$0.10 in 2009, compared to HK$0.12 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.8% a year over that time. The dividends haven't grown at precisely 1.8% every year, but this is a useful way to average out the historical rate of growth.

We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments, we don't think this is an attractive combination.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's not great to see that Yangtzekiang Garment's have fallen at approximately 5.5% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Yangtzekiang Garment has an acceptable payout ratio, although its dividend was not well covered by cashflow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. There are a few too many issues for us to get comfortable with Yangtzekiang Garment from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Yangtzekiang Garment stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:294

Yangtzekiang Garment

Engages in the manufacture and sale of garment and textile products.

Adequate balance sheet very low.

Market Insights

Community Narratives