A Piece Of The Puzzle Missing From Billion Industrial Holdings Limited's (HKG:2299) Share Price

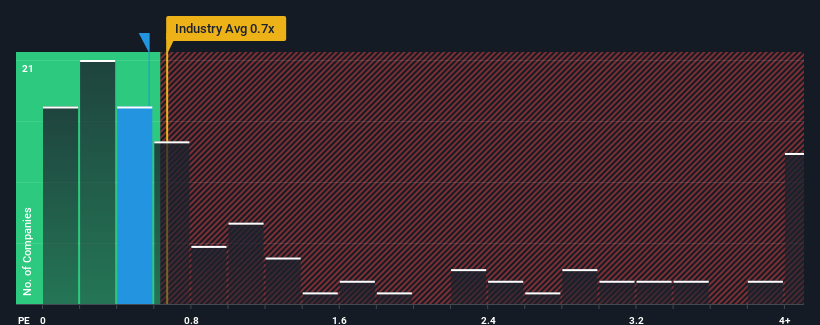

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Luxury industry in Hong Kong, you could be forgiven for feeling indifferent about Billion Industrial Holdings Limited's (HKG:2299) P/S ratio of 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Billion Industrial Holdings

What Does Billion Industrial Holdings' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Billion Industrial Holdings over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Billion Industrial Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Billion Industrial Holdings?

Billion Industrial Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. Even so, admirably revenue has lifted 79% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Billion Industrial Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Billion Industrial Holdings' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, Billion Industrial Holdings revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Billion Industrial Holdings (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of Billion Industrial Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Billion Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2299

Billion Industrial Holdings

Engages in manufacturing and sales of polyester filament yarns, polyester, polyester industrial yarns, and ES fiber products in the People’s Republic of China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives