Is Cosmo Lady (China) Holdings (HKG:2298) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Cosmo Lady (China) Holdings Company Limited (HKG:2298) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Cosmo Lady (China) Holdings

What Is Cosmo Lady (China) Holdings's Net Debt?

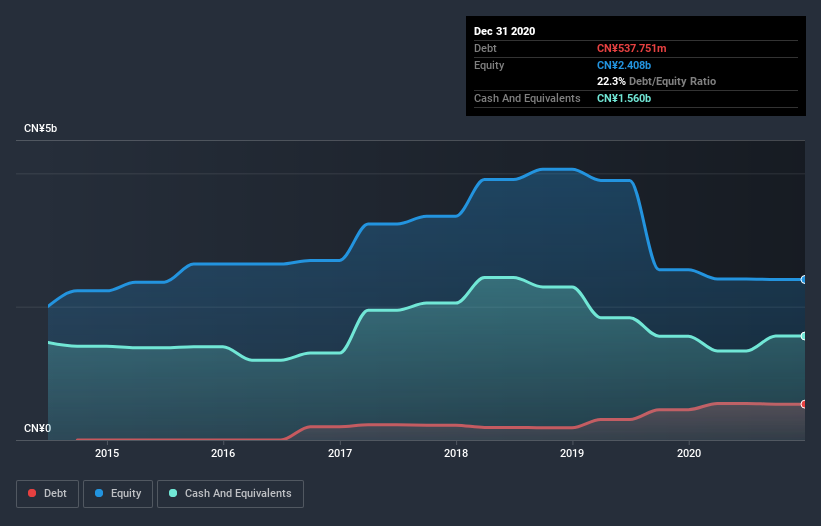

As you can see below, at the end of December 2020, Cosmo Lady (China) Holdings had CN¥537.8m of debt, up from CN¥455.2m a year ago. Click the image for more detail. But on the other hand it also has CN¥1.56b in cash, leading to a CN¥1.02b net cash position.

How Strong Is Cosmo Lady (China) Holdings' Balance Sheet?

We can see from the most recent balance sheet that Cosmo Lady (China) Holdings had liabilities of CN¥1.53b falling due within a year, and liabilities of CN¥556.7m due beyond that. Offsetting these obligations, it had cash of CN¥1.56b as well as receivables valued at CN¥302.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥225.9m.

Given Cosmo Lady (China) Holdings has a market capitalization of CN¥2.25b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Cosmo Lady (China) Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Cosmo Lady (China) Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Cosmo Lady (China) Holdings made a loss at the EBIT level, and saw its revenue drop to CN¥3.1b, which is a fall of 25%. To be frank that doesn't bode well.

So How Risky Is Cosmo Lady (China) Holdings?

While Cosmo Lady (China) Holdings lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow CN¥414m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Cosmo Lady (China) Holdings insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Cosmo Lady (China) Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2298

Cosmo Lady (China) Holdings

An investment holding company, engages in the design, research, development, and sale of branded intimate wear products in the People ‘s Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives