- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2285

Optimistic Investors Push Chervon Holdings Limited (HKG:2285) Shares Up 26% But Growth Is Lacking

Despite an already strong run, Chervon Holdings Limited (HKG:2285) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

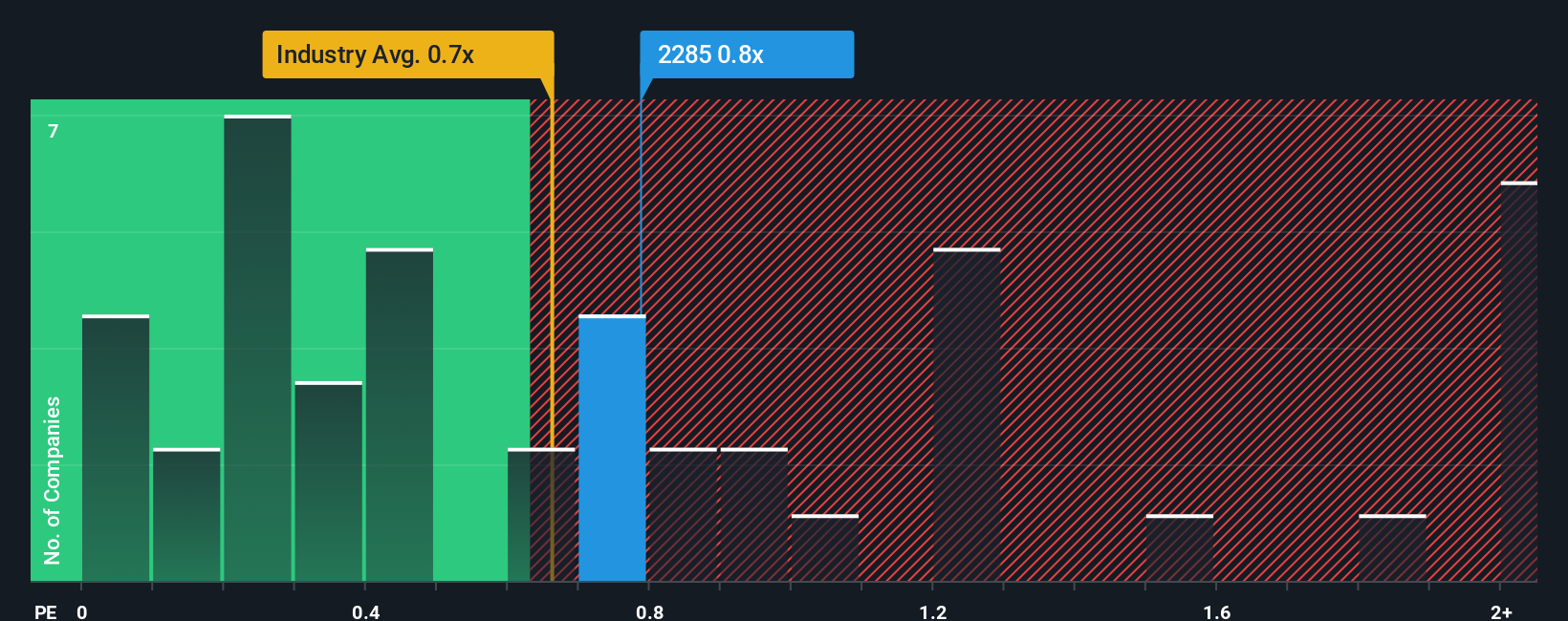

Although its price has surged higher, there still wouldn't be many who think Chervon Holdings' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hong Kong's Consumer Durables industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Chervon Holdings

What Does Chervon Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for Chervon Holdings as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chervon Holdings.Is There Some Revenue Growth Forecasted For Chervon Holdings?

The only time you'd be comfortable seeing a P/S like Chervon Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 1.1% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 4.1% as estimated by the eight analysts watching the company. With the industry predicted to deliver 6.2% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Chervon Holdings' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Chervon Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Chervon Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Chervon Holdings, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Chervon Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2285

Chervon Holdings

Engages in the research, development, manufacture, testing, sale, and after-sale servicing of power tools, outdoor power equipment, and related products in North America, Europe, China, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives