- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2285

Chervon Holdings Limited's (HKG:2285) P/S Still Appears To Be Reasonable

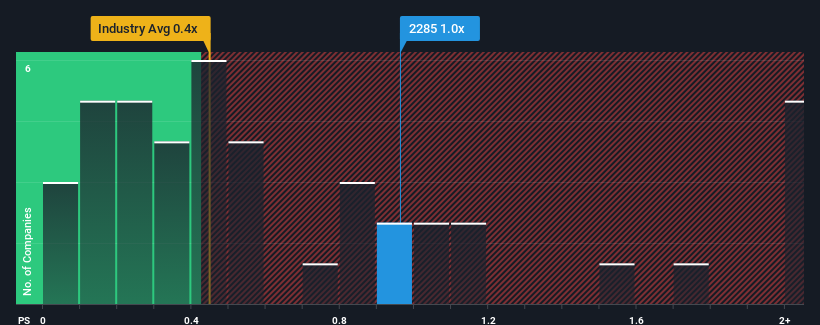

When you see that almost half of the companies in the Consumer Durables industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.4x, Chervon Holdings Limited (HKG:2285) looks to be giving off some sell signals with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Chervon Holdings

How Has Chervon Holdings Performed Recently?

Recent times haven't been great for Chervon Holdings as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Chervon Holdings will help you uncover what's on the horizon.How Is Chervon Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Chervon Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. As a result, revenue from three years ago have also fallen 6.6% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the twelve analysts following the company. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

With this information, we can see why Chervon Holdings is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Chervon Holdings' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Chervon Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Durables industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Chervon Holdings with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2285

Chervon Holdings

Engages in the research, development, manufacture, testing, sale, and after-sale servicing of power tools, outdoor power equipment, and related products in North America, Europe, China, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026