Some Vanov Holdings Company Limited (HKG:2260) Shareholders Look For Exit As Shares Take 34% Pounding

Vanov Holdings Company Limited (HKG:2260) shareholders won't be pleased to see that the share price has had a very rough month, dropping 34% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 41% in the last year.

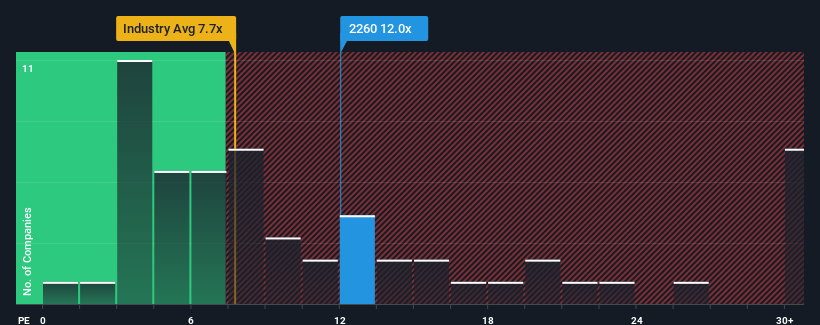

In spite of the heavy fall in price, Vanov Holdings may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 12x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For instance, Vanov Holdings' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Vanov Holdings

Is There Enough Growth For Vanov Holdings?

Vanov Holdings' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. This means it has also seen a slide in earnings over the longer-term as EPS is down 10% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's an unpleasant look.

With this information, we find it concerning that Vanov Holdings is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

There's still some solid strength behind Vanov Holdings' P/E, if not its share price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Vanov Holdings revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Vanov Holdings (at least 1 which is significant), and understanding these should be part of your investment process.

You might be able to find a better investment than Vanov Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2260

Vanov Holdings

An investment holding company, designs, manufactures, and sells papermaking felts under the VANOV and GOBEAR brands in the People’s Republic of China and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.