Do Crystal International Group's (HKG:2232) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Crystal International Group (HKG:2232). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Crystal International Group with the means to add long-term value to shareholders.

View our latest analysis for Crystal International Group

How Quickly Is Crystal International Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Crystal International Group grew its EPS by 7.9% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

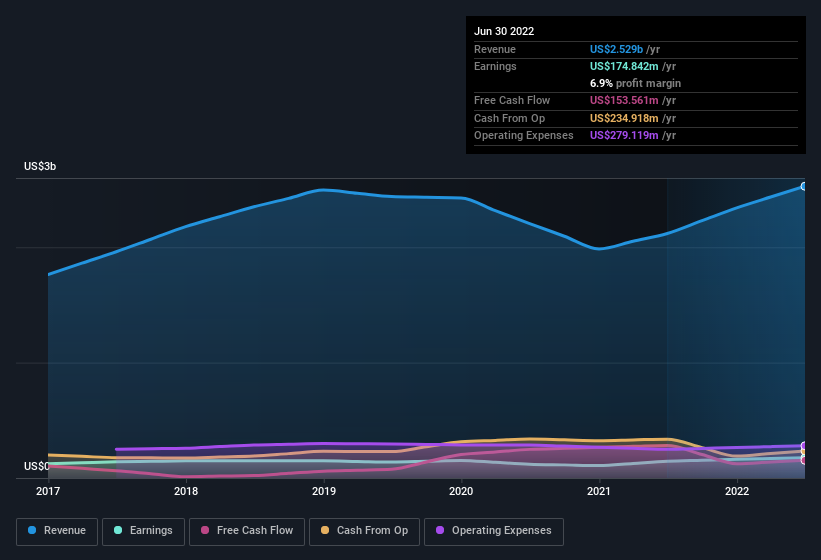

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Crystal International Group maintained stable EBIT margins over the last year, all while growing revenue 19% to US$2.5b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Crystal International Group?

Are Crystal International Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Crystal International Group top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the US$488k that Vice Chairman Choy Yuk Ching Lo spent buying shares (at an average price of about US$2.20). It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Crystal International Group will reveal that insiders own a significant piece of the pie. In fact, they own 81% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. That level of investment from insiders is nothing to sneeze at.

Does Crystal International Group Deserve A Spot On Your Watchlist?

One important encouraging feature of Crystal International Group is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Even so, be aware that Crystal International Group is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Crystal International Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2232

Crystal International Group

An investment holding company, engages in the manufacture and trading of garments in the Asia Pacific, North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives