How ANTA's Sustainable Paris Fashion Debut with Kris Van Assche Has Changed Its Investment Story (SEHK:2020)

Reviewed by Sasha Jovanovic

- On 21 November 2025, ANTA unveiled its ANTAZERO X Kris Van Assche collection at Dover Street Market Paris, highlighting sustainable innovation and a blend of Parisian style with athletic performance wear.

- This collaboration introduces ANTA's environmentally advanced materials and craftsmanship to the global fashion scene, positioning the brand alongside influential international design voices.

- We'll assess how ANTA's sustainable fashion debut in Paris could influence its ongoing international expansion and brand value narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ANTA Sports Products Investment Narrative Recap

To be a shareholder in ANTA Sports, one needs to believe in its ability to extend its brand value and global reach through continued product innovation, strategic international initiatives, and sustainable practices. The recent Paris debut of its ANTAZERO X Kris Van Assche collection elevates ANTA’s profile in global fashion but does not materially affect its most significant short-term catalyst, which remains the potential for increased international sales, nor does it directly mitigate the current margin pressures from high R&D and operational costs. Among recent announcements, the potential bid for PUMA stands out for its possible influence on ANTA’s globalization strategy. If pursued, this acquisition could complement expansion efforts highlighted by the Paris collection, supporting broader catalysts like revenue diversification and growth beyond China. By contrast, investors should closely watch the ongoing margin pressure from elevated R&D and merchandising expenditures, as...

Read the full narrative on ANTA Sports Products (it's free!)

ANTA Sports Products' outlook calls for revenue to reach CN¥101.0 billion and earnings to hit CN¥18.5 billion by 2028. This scenario assumes annual revenue growth of 10.1% and an earnings increase of CN¥3.6 billion from today's CN¥14.9 billion.

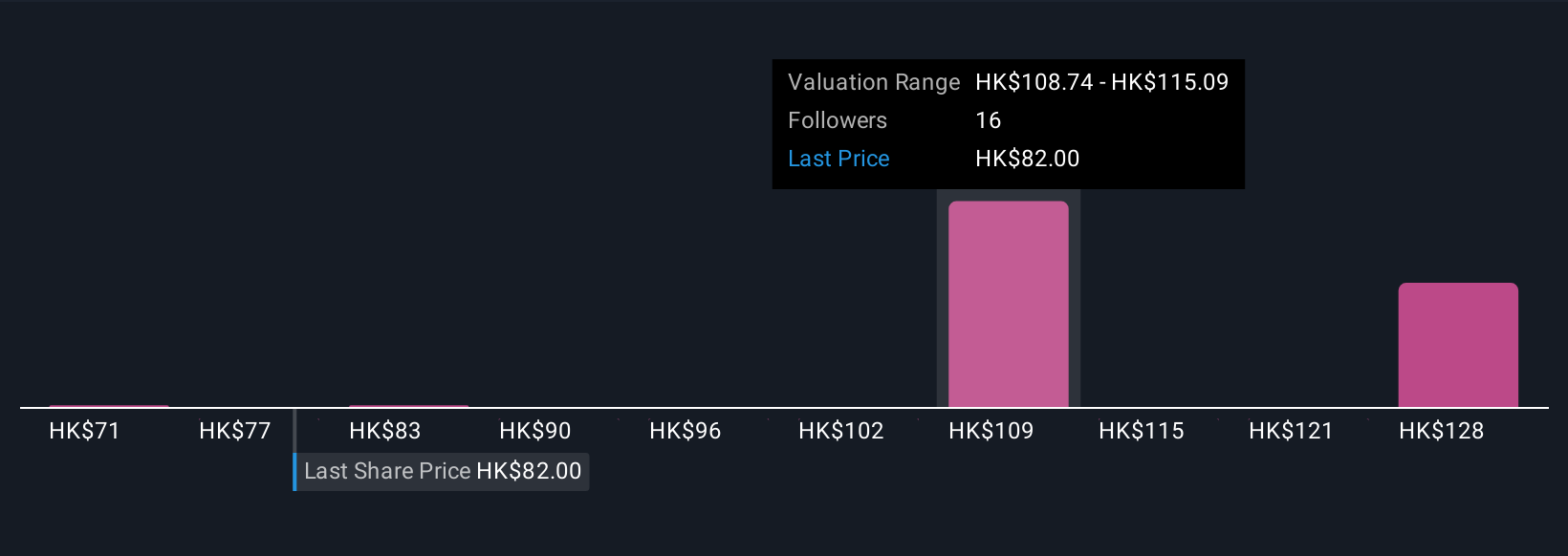

Uncover how ANTA Sports Products' forecasts yield a HK$114.20 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community for ANTA range from HK$70.63 to HK$134.02, reflecting a wide gap in outlooks. Ongoing high R&D and merchandising expenses remain a focal point for many, raising questions about their impact on profitability and the stock’s future direction, consider exploring other analysis to see how these views compare.

Explore 4 other fair value estimates on ANTA Sports Products - why the stock might be worth 18% less than the current price!

Build Your Own ANTA Sports Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ANTA Sports Products research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ANTA Sports Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ANTA Sports Products' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2020

ANTA Sports Products

Engages in the research, design, development, manufacture, market, and sale of professional sports footwear, apparel, and accessories in China and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.