Global markets have been experiencing significant shifts, with U.S. stocks rallying to record highs following a Republican electoral sweep and a Federal Reserve rate cut that has influenced investor sentiment. In this context, penny stocks—often representing smaller or emerging companies—continue to capture attention due to their potential for growth and value. While the term may seem outdated, these stocks can still offer opportunities when backed by strong financials and promising business models.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

Click here to see the full list of 5,745 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Gilston Group (SEHK:2011)

Simply Wall St Financial Health Rating: ★★★★☆☆

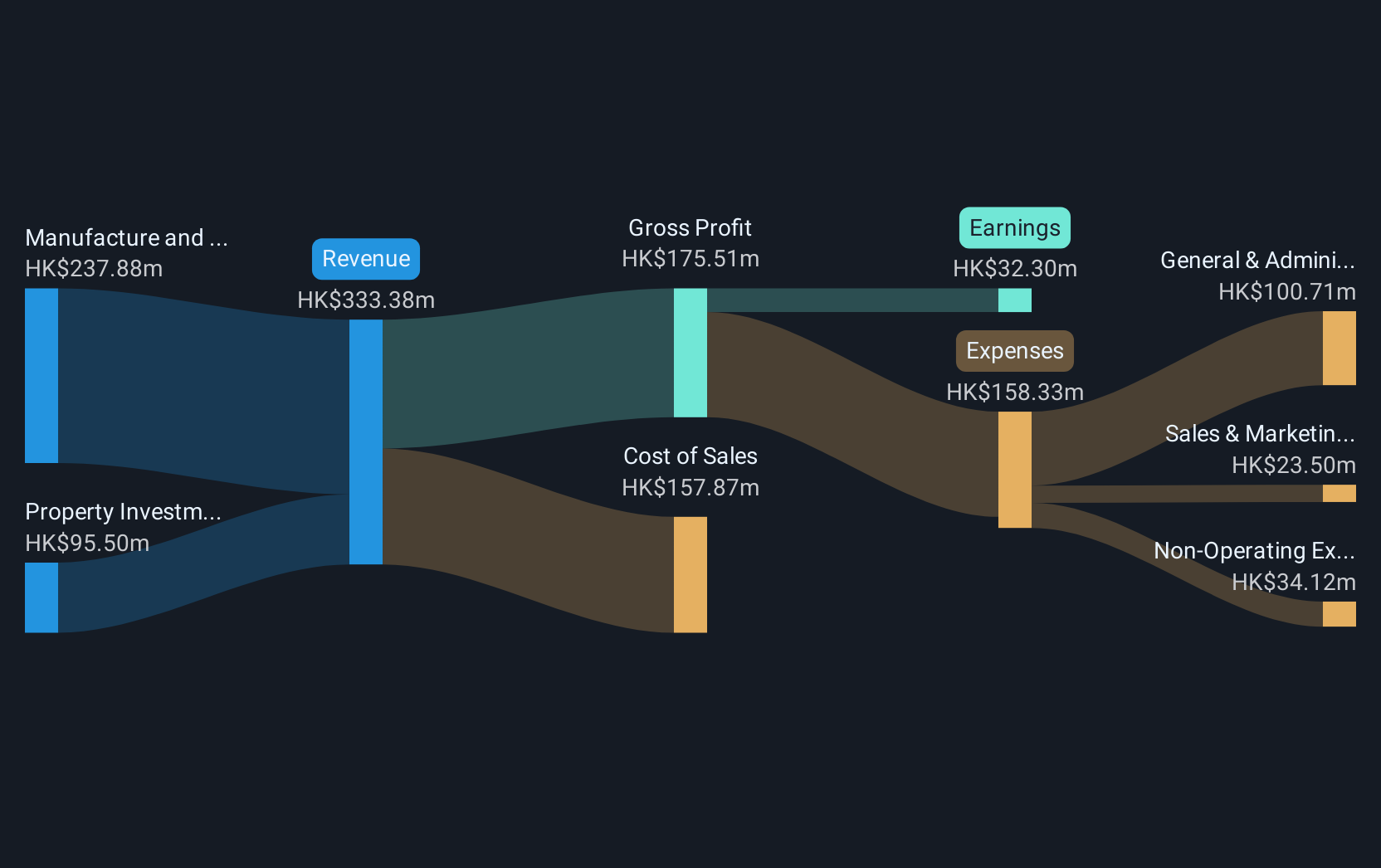

Overview: Gilston Group Limited, with a market cap of HK$775.57 million, is an investment holding company that designs, manufactures, and sells finished zippers and other garment accessories for original equipment manufacturers of apparel brands and labels.

Operations: The company generates revenue primarily from the manufacture and sales of zippers, amounting to HK$225.41 million.

Market Cap: HK$775.57M

Gilston Group Limited has shown a significant increase in revenue, reporting HK$160.39 million for the first half of 2024, up from HK$123.39 million the previous year. The introduction of a property management business contributed HK$45.27 million to this growth, although gains were offset by losses on asset disposals and increased tax expenses. Despite being unprofitable with negative return on equity, Gilston's short-term assets comfortably cover both its short and long-term liabilities. The company benefits from an experienced management team and board but has seen shareholder dilution recently due to an increase in shares outstanding by 3%.

- Dive into the specifics of Gilston Group here with our thorough balance sheet health report.

- Understand Gilston Group's track record by examining our performance history report.

Tianjin TEDA Biomedical Engineering (SEHK:8189)

Simply Wall St Financial Health Rating: ★★★★☆☆

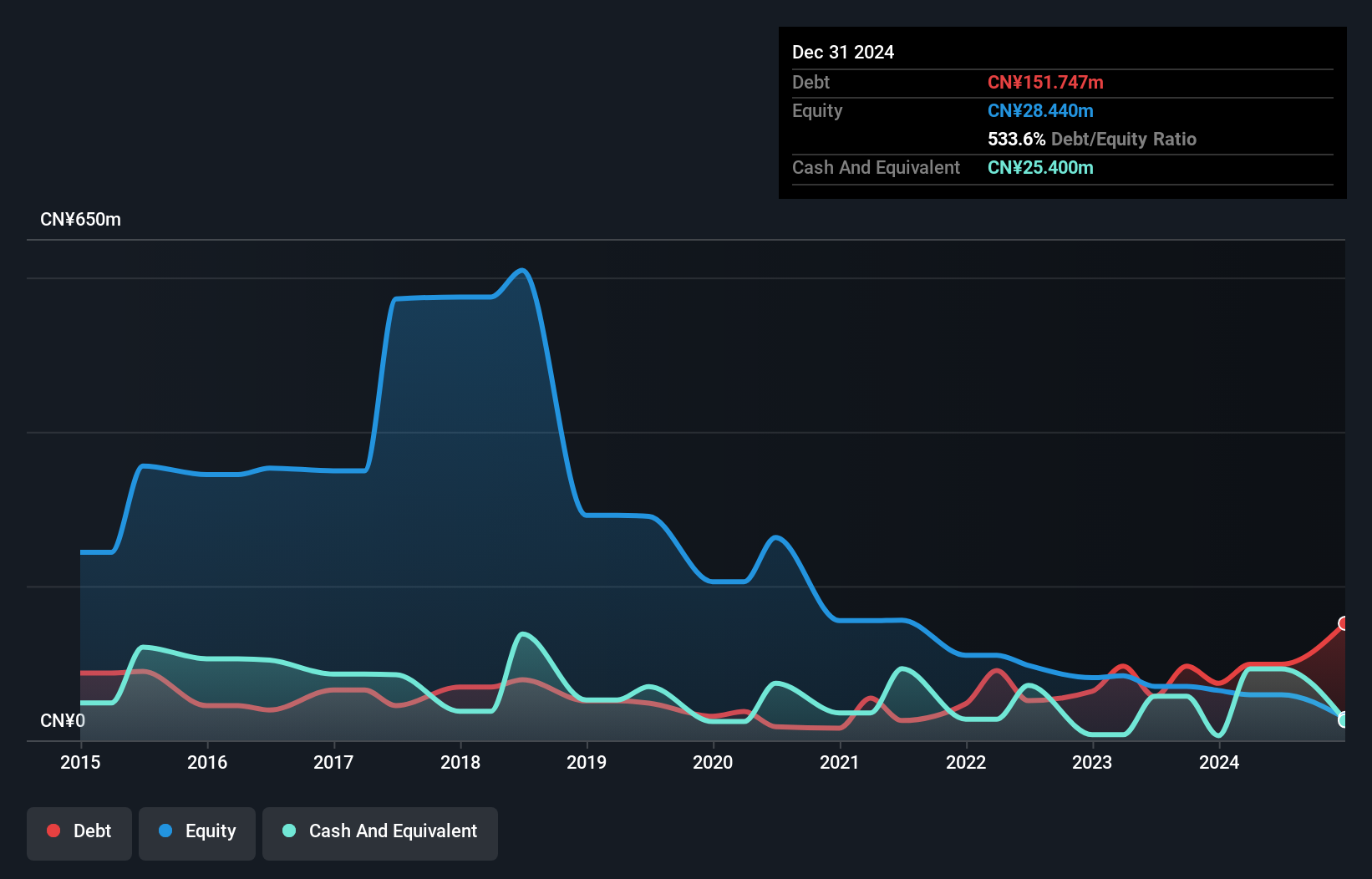

Overview: Tianjin TEDA Biomedical Engineering Company Limited, along with its subsidiaries, focuses on the research, development, manufacture, and sale of biological compound fertilizer products in China and has a market capitalization of HK$435.74 million.

Operations: The company's revenue is primarily derived from its Fertiliser Products segment, which generated CN¥427.18 million, while the Elderly Care and Health Care Services segment reported a loss of CN¥3.53 million.

Market Cap: HK$435.74M

Tianjin TEDA Biomedical Engineering has demonstrated some financial improvement, with half-year sales increasing to CN¥211.57 million from CN¥185.92 million the previous year, and a reduction in net loss from CN¥11.25 million to CN¥4.12 million over the same period. Despite being unprofitable with a negative return on equity of -4.06%, the company shows potential through reduced losses over five years at 41.6% annually and satisfactory debt levels with a net debt to equity ratio of 10%. Recent management changes include Ms. Liu Jinyu's election as Chairman of the Supervisory Committee following Ms. Yang Chunyan's resignation.

- Get an in-depth perspective on Tianjin TEDA Biomedical Engineering's performance by reading our balance sheet health report here.

- Assess Tianjin TEDA Biomedical Engineering's previous results with our detailed historical performance reports.

Archosaur Games (SEHK:9990)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archosaur Games Inc. is an investment holding company that develops and operates mobile games in Mainland China and internationally, with a market cap of HK$1.25 billion.

Operations: The company's revenue is primarily derived from its Computer Graphics segment, which generated CN¥945.67 million.

Market Cap: HK$1.25B

Archosaur Games Inc. has shown a slight improvement in financial performance, with half-year sales rising to CN¥439.43 million from CN¥402.26 million the previous year, and a reduced net loss of CN¥134.04 million compared to CN¥233.02 million previously. Despite being unprofitable, the company benefits from a strong balance sheet with short-term assets of CN¥2.1 billion exceeding both short and long-term liabilities significantly and operates debt-free, enhancing its financial stability. Recent strategic moves include share repurchases aimed at boosting net asset value per share, alongside significant board changes introducing experienced directors to strengthen governance.

- Jump into the full analysis health report here for a deeper understanding of Archosaur Games.

- Understand Archosaur Games' earnings outlook by examining our growth report.

Make It Happen

- Navigate through the entire inventory of 5,745 Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin TEDA Biomedical Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8189

Tianjin TEDA Biomedical Engineering

Engages in the research, development, manufacture, and sale of biological compound fertilizer products in the People’s Republic of China.

Mediocre balance sheet with weak fundamentals.

Market Insights

Community Narratives