- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1999

Man Wah Holdings Limited (HKG:1999) Investors Are Less Pessimistic Than Expected

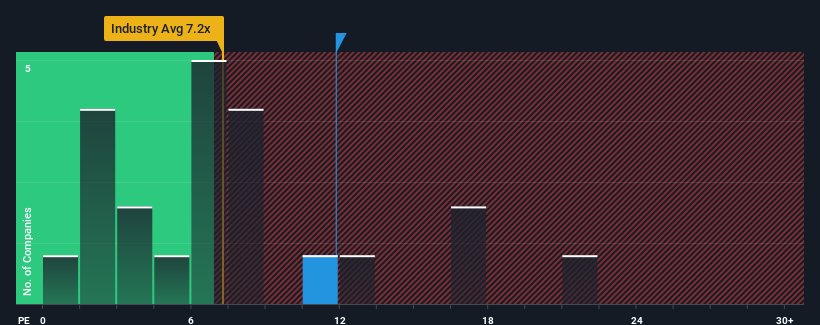

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Man Wah Holdings Limited (HKG:1999) as a stock to potentially avoid with its 11.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Man Wah Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Man Wah Holdings

How Is Man Wah Holdings' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Man Wah Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 16%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 14% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the twelve analysts watching the company. With the market predicted to deliver 16% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Man Wah Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Man Wah Holdings currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Man Wah Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Man Wah Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1999

Man Wah Holdings

An investment holding company, engages in the manufacture and distribution of sofas and ancillary products in the People's Republic of China, Europe, Vietnam, Mexico, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.