- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1920

Hands Form Holdings (HKG:1920) Share Prices Have Dropped 17% In The Last Year

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Hands Form Holdings Limited (HKG:1920) share price slid 17% over twelve months. That's well below the market return of 12%. Hands Form Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's up 3.4% in the last seven days.

Check out our latest analysis for Hands Form Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

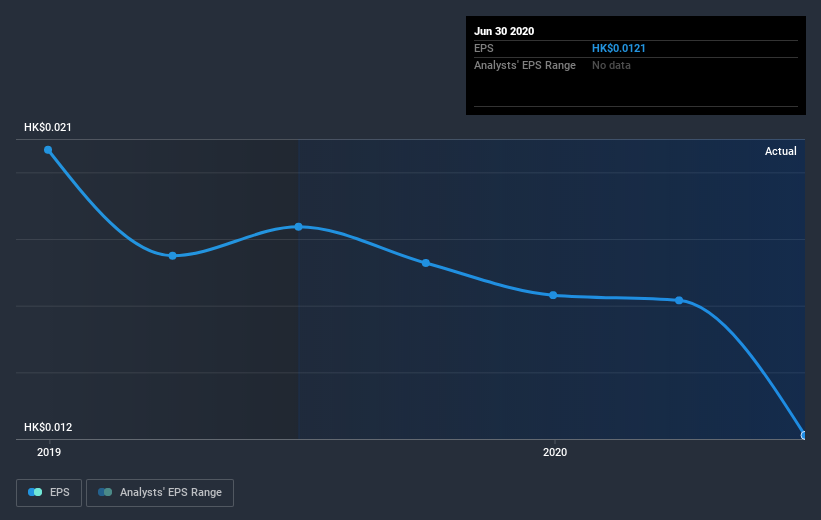

Unfortunately Hands Form Holdings reported an EPS drop of 34% for the last year. The share price fall of 17% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Hands Form Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Hands Form Holdings shareholders are down 17% for the year, the market itself is up 12%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 9.0%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Hands Form Holdings (of which 1 is a bit unpleasant!) you should know about.

We will like Hands Form Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Hands Form Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1920

China Wacan Group

An investment holding company, provides construction services in Hong Kong.

Excellent balance sheet and fair value.

Market Insights

Community Narratives