Deyun Holding Ltd. (HKG:1440) insiders are undoubtedly delighted they bought last year with gains to date at CN¥267m

Insiders who bought Deyun Holding Ltd. (HKG:1440) in the last 12 months may probably not pay attention to the stock's recent 35% drop. After accounting for the recent loss, the CN¥175m worth of shares they purchased is now worth CN¥442m, suggesting a good return on their investment.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

Before we look at these insider transactions though, you might like to know that our analysis indicates that 1440 is potentially overvalued!

Deyun Holding Insider Transactions Over The Last Year

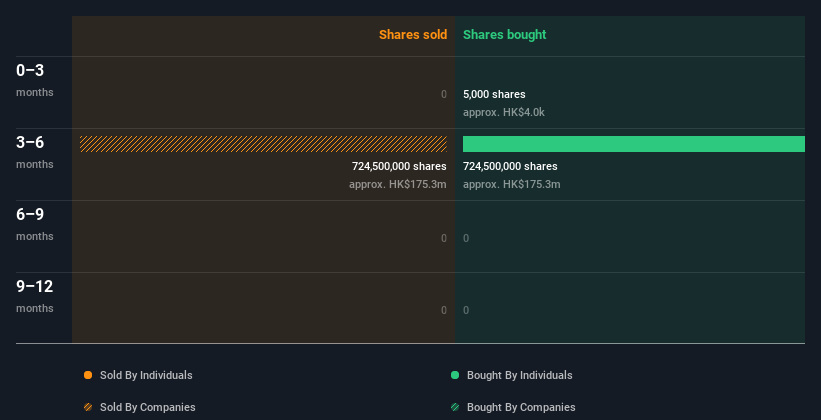

In the last twelve months, the biggest single purchase by an insider was when insider Wing Sing Tsoi bought HK$175m worth of shares at a price of HK$0.24 per share. Even though the purchase was made at a significantly lower price than the recent price (HK$0.61), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

Wing Sing Tsoi purchased 724.51m shares over the year. The average price per share was HK$0.24. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Deyun Holding is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does Deyun Holding Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that Deyun Holding insiders own 67% of the company, worth about HK$515m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Deyun Holding Insider Transactions Indicate?

We note a that there has been a bit of insider buying recently (but no selling). That said, the purchases were not large. On a brighter note, the transactions over the last year are encouraging. Judging from their transactions, and high insider ownership, Deyun Holding insiders feel good about the company's future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 4 warning signs for Deyun Holding you should be aware of, and 1 of them is potentially serious.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1440

Star Shine Holdings Group

An investment holding company, engages in the manufacturing of lace and provision of dyeing services, and footwear business in Mainland China and Hong Kong.

Mediocre balance sheet minimal.

Market Insights

Community Narratives