Pacific Textiles (SEHK:1382) Margin Pressure Deepens, Undercutting Bullish Narratives on Revenue Growth

Reviewed by Simply Wall St

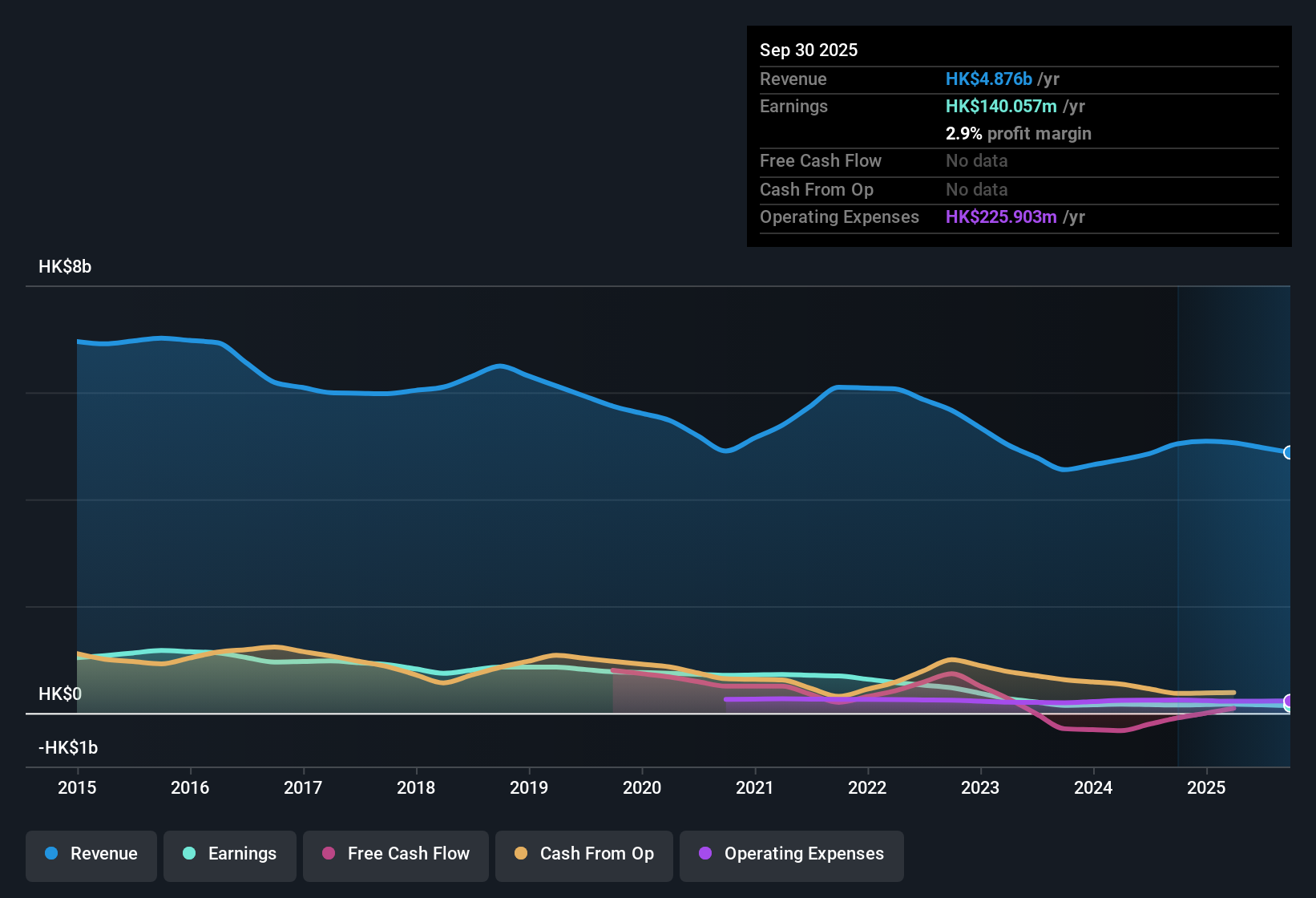

Pacific Textiles Holdings (SEHK:1382) just released its H1 2026 results, posting revenue of $2.5 billion HKD and basic EPS of 0.057012 HKD. Looking at trends, the company has seen revenue fluctuate over recent halves, with $2.7 billion HKD in H1 2025, $2.4 billion HKD in H2 2025, and now $2.5 billion HKD. Margins remain tight as the numbers highlight ongoing pressure on profitability, setting the stage for investors to weigh recent performance in the context of future growth.

See our full analysis for Pacific Textiles Holdings.Next, we will size up these earnings against the major narratives shaping expectations around Pacific Textiles. This will highlight where numbers confirm the story and where surprises have emerged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Income Dips Under Rising Revenue

- Net income (excluding extra items) dropped to $79.3 million in H1 2026, down from $106.9 million in H1 2025, even as total revenue climbed close to $2.5 billion HKD for the period.

- What stands out is that the ongoing decline in profit, a 38.5% annualized decrease over five years, contradicts the optimistic case that robust top-line growth alone can drive sustainable earnings as margin pressures continue to erode the company's bottom line.

- Consensus narrative highlights the challenge: while forecasts see revenue growing 9.94% per year, profit margins slipped to 2.9% over the last twelve months, signaling persistent profitability headwinds.

- Even with revenue beating the Hong Kong market average (8.5% forecast), earnings quality has not translated into net income durability as costs and margin compression weigh on results.

- Curious if this margin squeeze spells trouble or opportunity for future growth? Find out how analysts are dissecting the numbers in the full consensus view. 📊 Read the full Pacific Textiles Holdings Consensus Narrative.

P/E Premium and Dividend Red Flags

- Pacific Textiles shares now trade at a Price-to-Earnings ratio of 12.5x, which is higher than both the Hong Kong luxury industry average of 10.1x and the peer group average of 9.2x, despite net profit margin softening.

- Critics highlight that demanding a valuation premium at a time when the company’s net profit margin fell to 2.9%, just under last year’s 3%, signals caution, especially as the attractive 9.52% dividend yield is flagged as being not well covered by earnings or free cash flow.

- The high yield offers income, but the underlying numbers show the payout’s sustainability is on shaky ground if declining margin trends persist.

- This creates real tension between high investor expectations embedded in the share price and the fundamental risks identified in the latest reporting period.

Revenue Growth Outpaces Industry

- Revenue is forecast to grow at 9.94% annually, outstripping the broader Hong Kong market rate of 8.5%, positioning Pacific Textiles for relative top-line strength within its sector.

- However, consensus narrative notes that this growth advantage faces strong challenges from persistently shrinking profit margins and a five-year earnings CAGR of minus 38.5%, illustrating that headline revenue expansion has not yet translated into stable or growing profits.

- Margins have not kept pace, with net profit margin slipping to 2.9% compared to last year's 3%.

- Market optimism about sales growth remains, but investors have reason to be cautious as recurring cost pressures continue to blunt the effectiveness of that growth story.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pacific Textiles Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Pacific Textiles continues to grapple with shrinking profit margins and a dividend that looks less secure as earnings pressure mounts.

If you want more reliable income streams, check out these 1922 dividend stocks with yields > 3% that consistently deliver stronger yields backed by healthier fundamentals and better dividend coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1382

Pacific Textiles Holdings

Manufactures and trades in textile products in the People’s Republic of China, Vietnam, Indonesia, Bangladesh, Cambodia, Sri Lanka, Jordan, Africa, Hong Kong, India, the United States, Haiti, other Asian countries, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.