- Hong Kong

- /

- Entertainment

- /

- SEHK:136

If You Had Bought HengTen Networks Group Shares Five Years Ago You'd Have Made 39%

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

The simplest way to invest in stocks is to buy exchange traded funds. But the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the HengTen Networks Group Limited (HKG:136) share price is 39% higher than it was five years ago, which is more than the market average. Zooming in, the stock is actually down 22% in the last year.

View our latest analysis for HengTen Networks Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

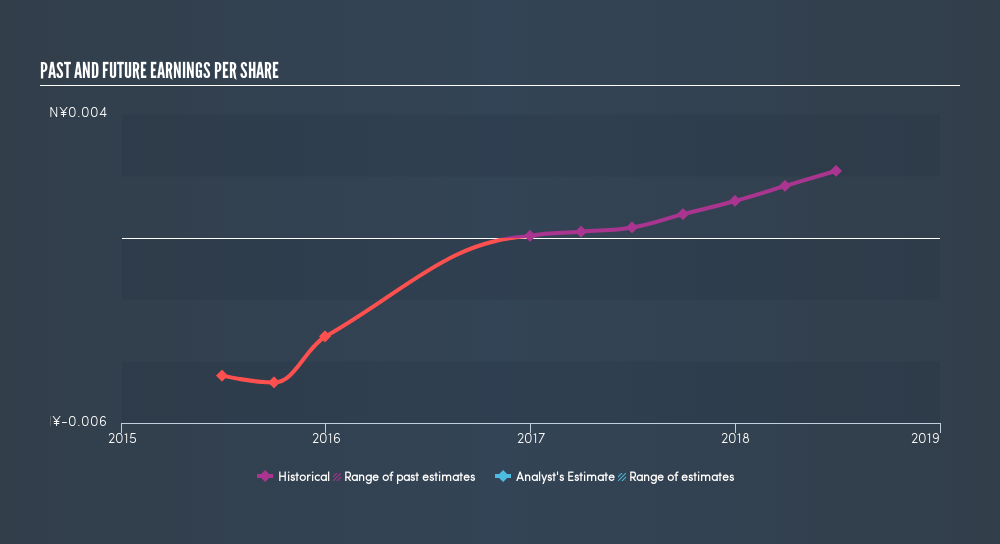

During the five years of share price growth, HengTen Networks Group moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that HengTen Networks Group shareholders are down 22% for the year. Unfortunately, that's even worse than the broader market decline of 7.7%. Having said that, its inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 6.9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of Mainland China, Hong Kong, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives