As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, investors are increasingly looking towards Asia for opportunities, with Chinese markets showing resilience amid hopes for further stimulus. In this environment, dividend stocks can offer a measure of stability and potential income, making them an attractive option for those seeking to balance growth with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.40% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.05% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.07% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.99% | ★★★★★★ |

Click here to see the full list of 1194 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

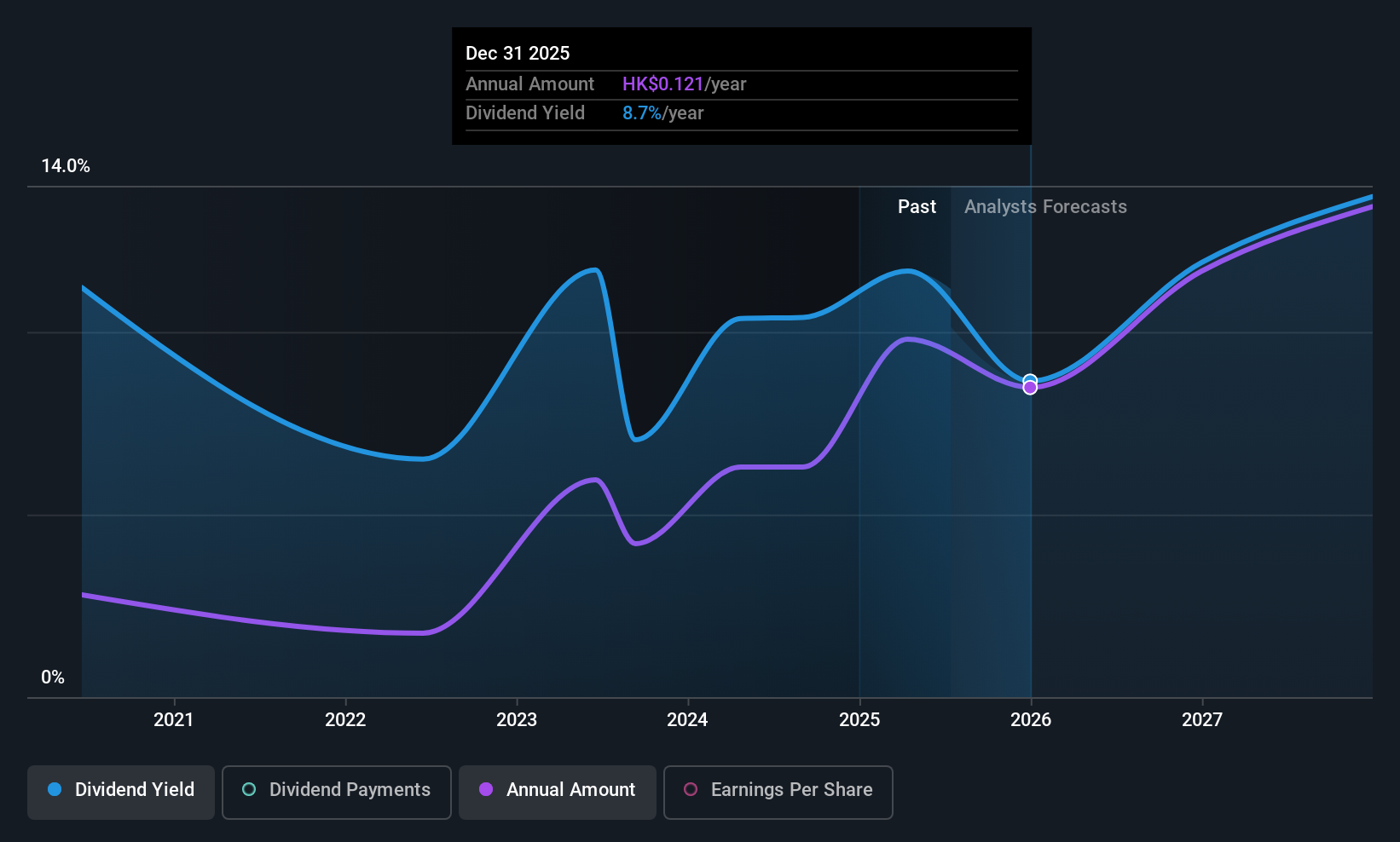

Lever Style (SEHK:1346)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lever Style Corporation is an investment holding company involved in the design, production, and trade of garments across various international markets including the United States, Europe, Oceania, and Greater China with a market cap of HK$883.33 million.

Operations: Lever Style Corporation generates its revenue primarily from providing supply chain solutions in multiple apparel categories for notable brands, amounting to $222.93 million.

Dividend Yield: 10%

Lever Style's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 47.7% and 46.2%, respectively. However, the dividends have been unreliable over the past five years due to volatility in annual payments. Despite this instability, its dividend yield is among the top 25% in Hong Kong at 10%. Recent acquisition activity includes LFX Growth Capital acquiring a 6.88% stake for HK$55.5 million, reflecting investor interest amidst favorable valuation metrics.

- Navigate through the intricacies of Lever Style with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Lever Style shares in the market.

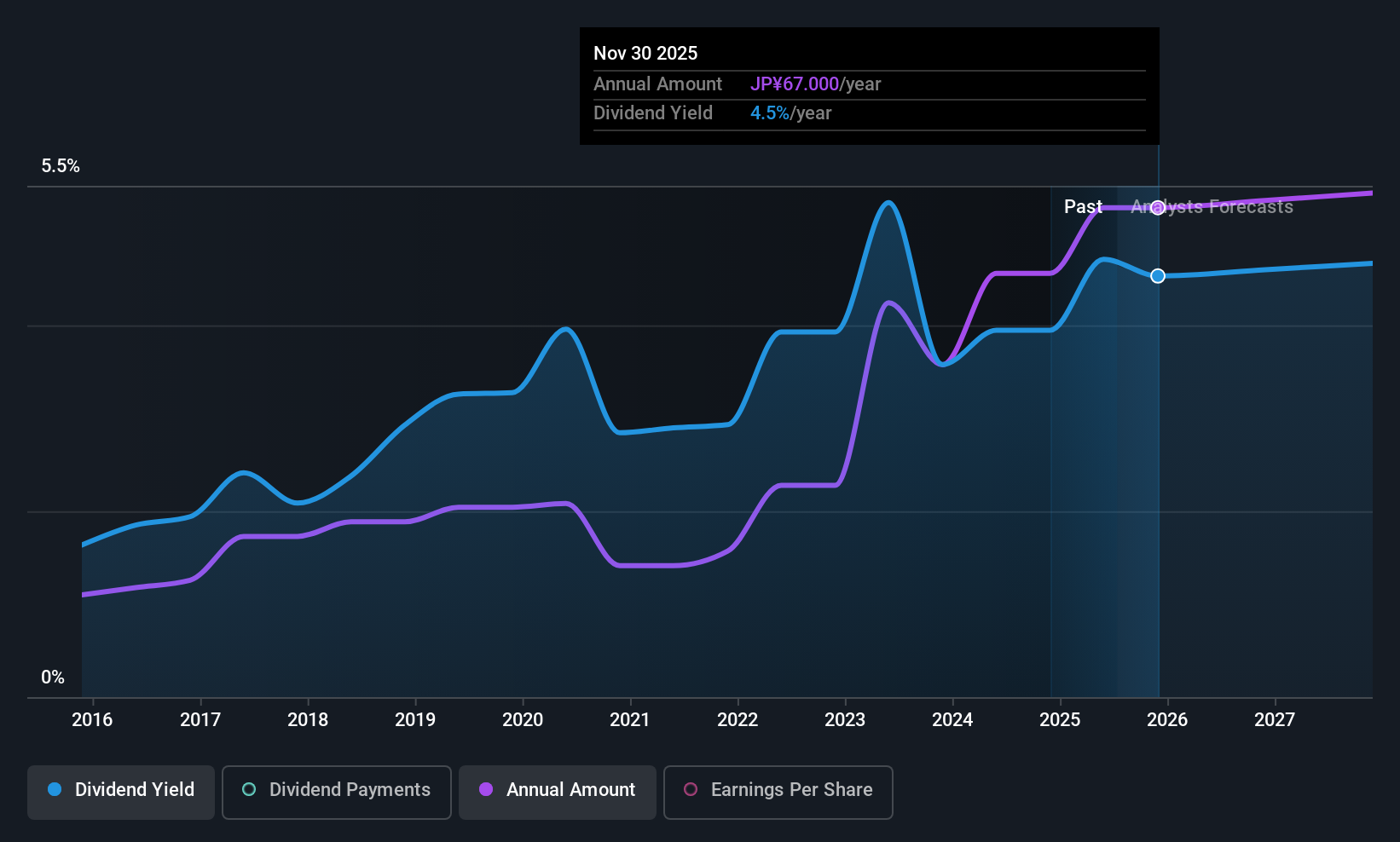

Morito (TSE:9837)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Morito Co., Ltd. manufactures and sells apparel-related materials and household goods across Japan, Asia, Europe, and the United States with a market cap of ¥39.80 billion.

Operations: Morito Co., Ltd.'s revenue segments include the manufacture and sale of apparel-related materials and household goods across various regions.

Dividend Yield: 4.5%

Morito's recent dividend increase to JPY 36.00 per share for the fiscal year ending November 2025 highlights a positive trend, although its dividend history has been volatile over the past decade. The dividends are well-covered by earnings and cash flows, with payout ratios of 25.3% and 44.1%, respectively, suggesting sustainability despite forecasted earnings decline. Trading at a significant discount to estimated fair value, Morito offers an attractive dividend yield of 4.5%, among Japan's top quartile payers.

- Delve into the full analysis dividend report here for a deeper understanding of Morito.

- The valuation report we've compiled suggests that Morito's current price could be quite moderate.

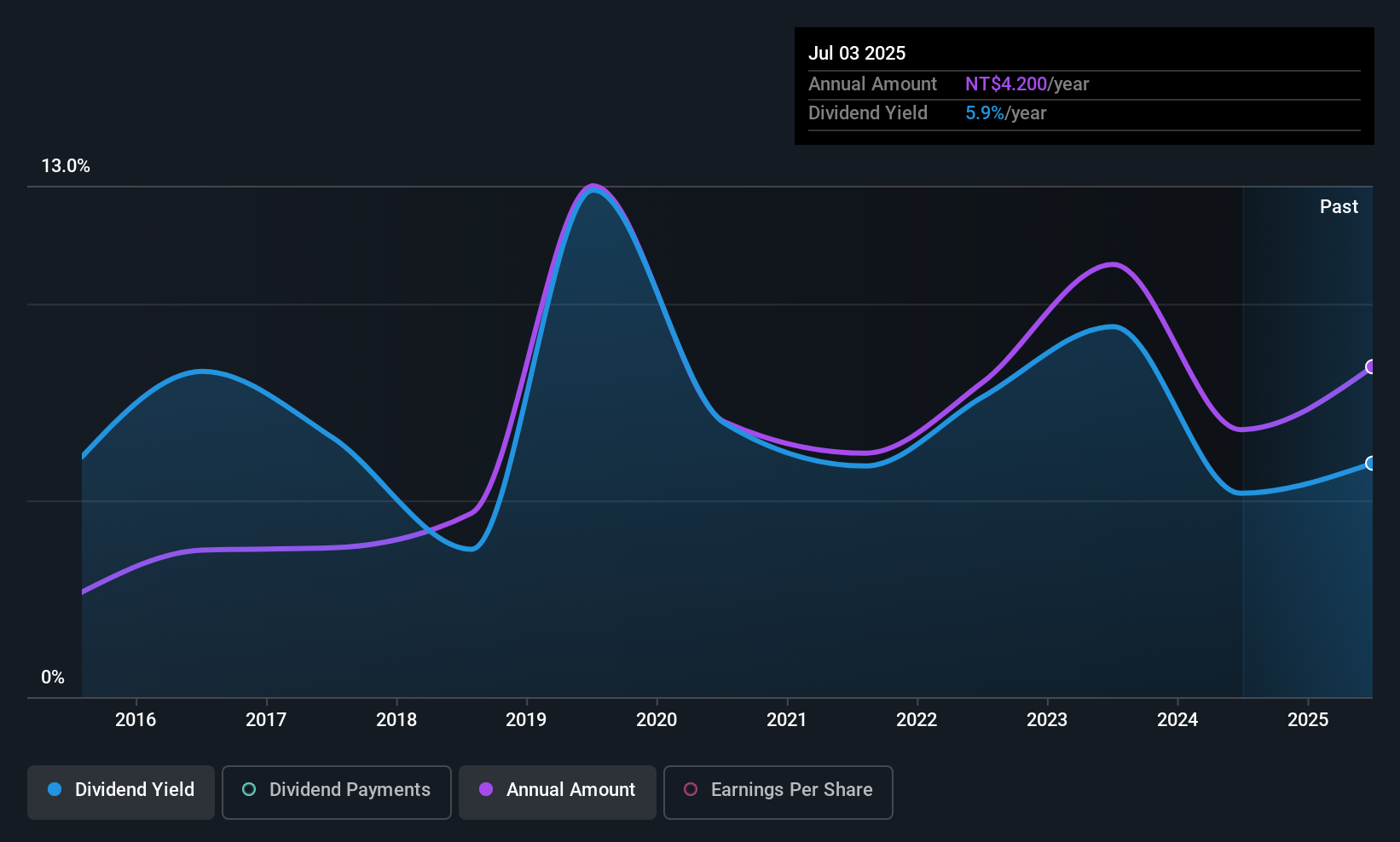

Nichidenbo (TWSE:3090)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichidenbo Corporation is involved in the global distribution of electronic components and has a market capitalization of NT$15.67 billion.

Operations: Nichidenbo Corporation's revenue is primarily generated from Taiwan, contributing NT$14.29 billion, with additional income of NT$845.96 million from other regions.

Dividend Yield: 5.7%

Nichidenbo's dividend of TWD 4.2 per share for 2024, yielding 5.7%, ranks in the top quartile of Taiwan's market. Despite a volatile dividend history and high payout ratio of 84.8%, recent earnings growth of 27.5% supports current payments, though they are not covered by free cash flows. The company's P/E ratio of 15.1x is below the market average, indicating potential value despite concerns over non-cash earnings and sustainability issues highlighted by recent amendments to its Articles of Incorporation.

- Dive into the specifics of Nichidenbo here with our thorough dividend report.

- Our valuation report here indicates Nichidenbo may be overvalued.

Summing It All Up

- Delve into our full catalog of 1194 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9837

Morito

Engages in the manufacture and sale of apparel-related materials and household goods and products in Japan, Asia, Europe, and the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives