Shareholders Will Probably Be Cautious Of Increasing Sun Hing Vision Group Holdings Limited's (HKG:125) CEO Compensation At The Moment

Key Insights

- Sun Hing Vision Group Holdings to hold its Annual General Meeting on 16th of August

- Total pay for CEO Otis Ku includes HK$207.0k salary

- The overall pay is 72% below the industry average

- Sun Hing Vision Group Holdings' three-year loss to shareholders was 53% while its EPS was down 106% over the past three years

Performance at Sun Hing Vision Group Holdings Limited (HKG:125) has not been particularly rosy recently and shareholders will likely be holding CEO Otis Ku and the board accountable for this. At the upcoming AGM on 16th of August, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for Sun Hing Vision Group Holdings

Comparing Sun Hing Vision Group Holdings Limited's CEO Compensation With The Industry

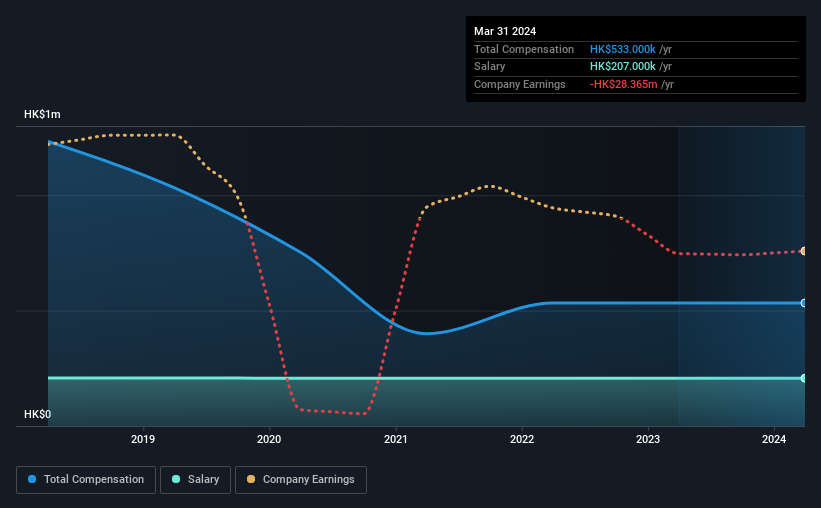

Our data indicates that Sun Hing Vision Group Holdings Limited has a market capitalization of HK$168m, and total annual CEO compensation was reported as HK$533k for the year to March 2024. There was no change in the compensation compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$207k.

On comparing similar-sized companies in the Hong Kong Luxury industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.9m. That is to say, Otis Ku is paid under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$207k | HK$207k | 39% |

| Other | HK$326k | HK$326k | 61% |

| Total Compensation | HK$533k | HK$533k | 100% |

Talking in terms of the industry, salary represented approximately 91% of total compensation out of all the companies we analyzed, while other remuneration made up 9% of the pie. In Sun Hing Vision Group Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Sun Hing Vision Group Holdings Limited's Growth

Sun Hing Vision Group Holdings Limited has reduced its earnings per share by 106% a year over the last three years. Revenue was pretty flat on last year.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue hardly impresses. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Sun Hing Vision Group Holdings Limited Been A Good Investment?

With a total shareholder return of -53% over three years, Sun Hing Vision Group Holdings Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Sun Hing Vision Group Holdings that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:125

Sun Hing Vision Group Holdings

An investment holding company, manufactures and sells eyewear products in Hong Kong, Macau, the People’s Republic of China, Japan, Italy, the United States, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026