As global markets navigate a complex landscape marked by accelerating U.S. inflation and near-record highs in major stock indexes, investors are keenly focused on strategies that can offer stability and income. In this environment, dividend stocks present an attractive option, providing potential for consistent returns through regular payouts while benefiting from the broader market's upward momentum.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.94% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

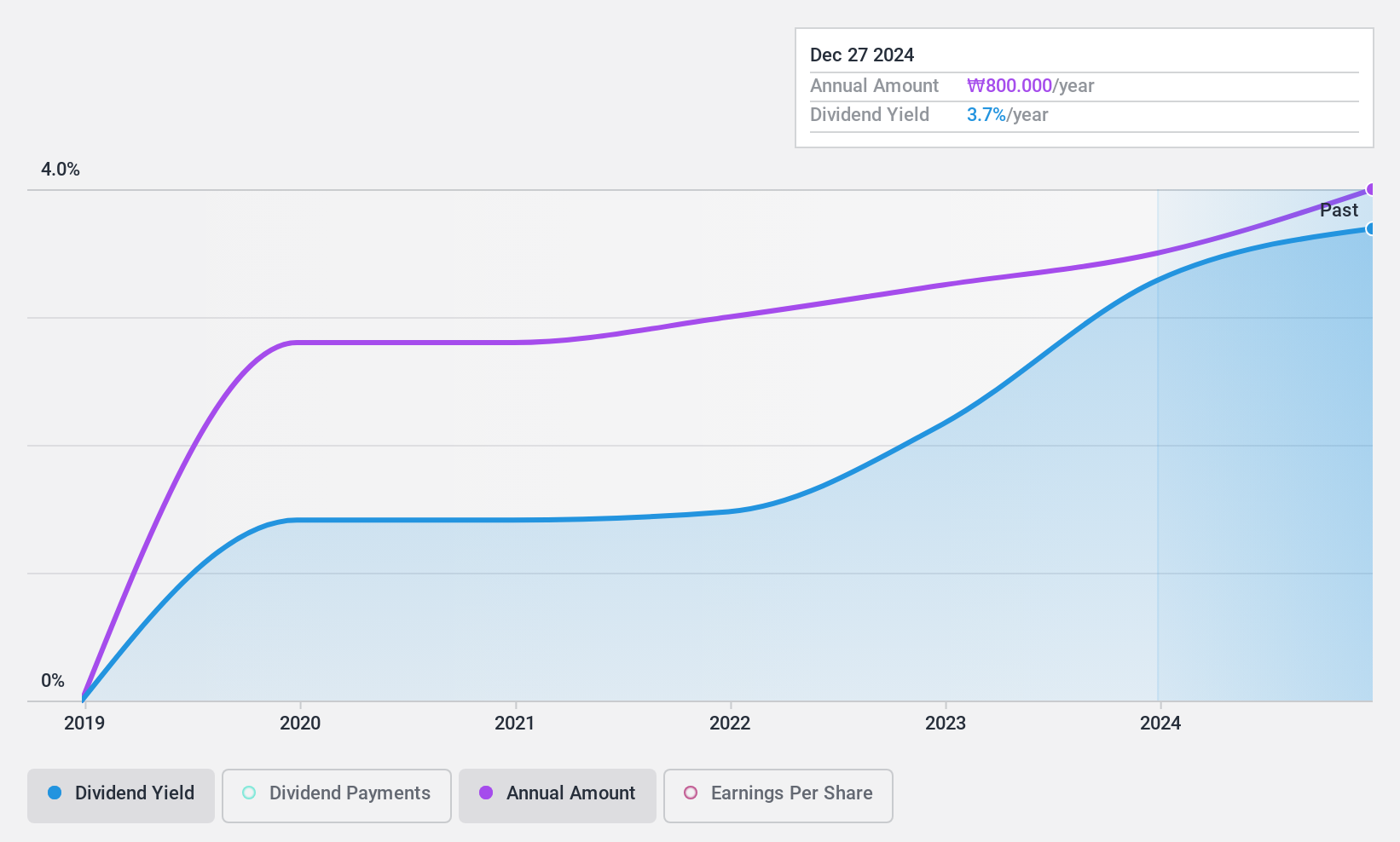

CUCKOO Homesys (KOSE:A284740)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CUCKOO Homesys Co., Ltd. is involved in the manufacture, sale, and rental of household appliances with a market cap of ₩451.81 billion.

Operations: CUCKOO Homesys Co., Ltd. generates revenue primarily from its Rental segment, amounting to ₩1.09 billion, with additional income from IT Services at ₩55.88 million.

Dividend Yield: 4%

CUCKOO Homesys demonstrates strong dividend sustainability with a low payout ratio of 14%, ensuring earnings comfortably cover dividends. The cash payout ratio of 33.3% further supports this stability, indicating robust free cash flow coverage. Despite only five years of dividend history, payments have been reliable and stable, placing its yield in the top 25% of the KR market. Trading at a significant discount to its estimated fair value suggests potential investment appeal.

- Click to explore a detailed breakdown of our findings in CUCKOO Homesys' dividend report.

- The valuation report we've compiled suggests that CUCKOO Homesys' current price could be quite moderate.

Chow Sang Sang Holdings International (SEHK:116)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Sang Sang Holdings International Limited is an investment holding company that manufactures and retails jewellery, with a market cap of HK$4.47 billion.

Operations: Chow Sang Sang Holdings International Limited generates revenue primarily from the retail of jewellery and watches (HK$22.65 billion), followed by the wholesale of precious metals (HK$1.14 billion) and trading of LGD (HK$9.33 million).

Dividend Yield: 8.1%

Chow Sang Sang Holdings International's dividend is well-covered by both earnings and cash flows, with a payout ratio of 50.8% and a cash payout ratio of 19.8%. Despite trading at a substantial discount to its estimated fair value, the company's dividend history over the past decade has been volatile and unreliable, with payments decreasing. However, its current yield ranks in the top 25% of Hong Kong market payers, suggesting competitive returns for investors seeking income.

- Navigate through the intricacies of Chow Sang Sang Holdings International with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Chow Sang Sang Holdings International shares in the market.

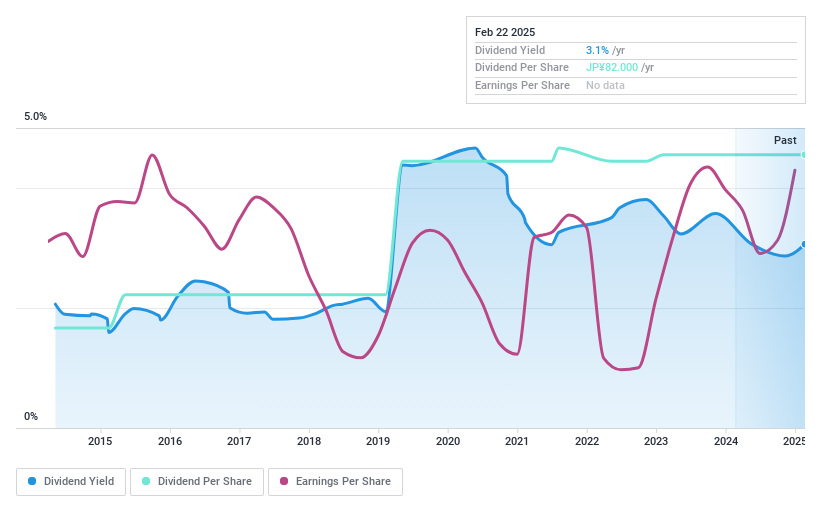

Tenma (TSE:7958)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenma Corporation manufactures and sells plastic products both in Japan and internationally, with a market cap of ¥52.92 billion.

Operations: Tenma Corporation's revenue is derived from the manufacture and sale of plastic products across domestic and international markets.

Dividend Yield: 3%

Tenma's dividend history is stable with consistent growth over the past decade, although its 3.04% yield is below the top quartile in Japan. The payout ratio of 47.7% suggests dividends are well-covered by earnings, but a high cash payout ratio of 389.2% indicates limited coverage by free cash flows, raising sustainability concerns. Recent buybacks totaling ¥2.70 billion and expansion plans in Korea could impact future financial flexibility and dividend sustainability.

- Get an in-depth perspective on Tenma's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Tenma is priced higher than what may be justified by its financials.

Key Takeaways

- Explore the 1982 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tenma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tenma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7958

Tenma

Engages in the manufacture and sale of plastic products in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives