These 4 Measures Indicate That Chow Sang Sang Holdings International (HKG:116) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Chow Sang Sang Holdings International Limited (HKG:116) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Chow Sang Sang Holdings International

How Much Debt Does Chow Sang Sang Holdings International Carry?

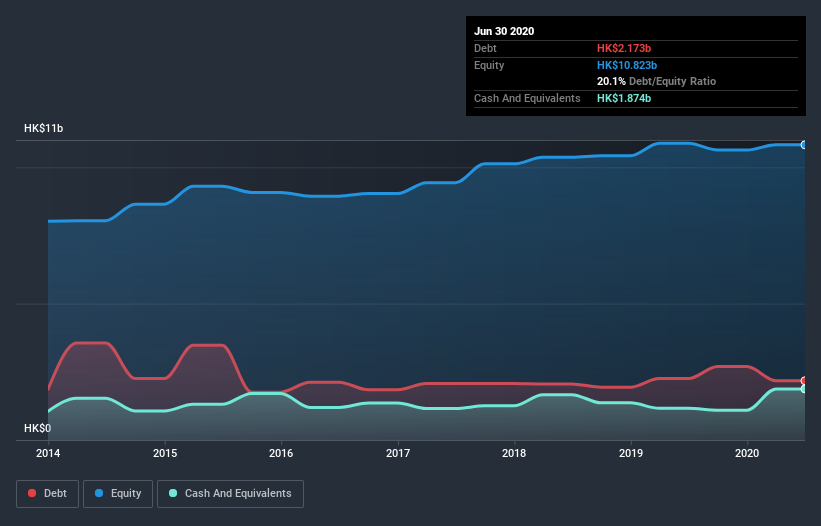

The chart below, which you can click on for greater detail, shows that Chow Sang Sang Holdings International had HK$2.17b in debt in June 2020; about the same as the year before. On the flip side, it has HK$1.87b in cash leading to net debt of about HK$298.6m.

A Look At Chow Sang Sang Holdings International's Liabilities

We can see from the most recent balance sheet that Chow Sang Sang Holdings International had liabilities of HK$3.32b falling due within a year, and liabilities of HK$1.44b due beyond that. Offsetting these obligations, it had cash of HK$1.87b as well as receivables valued at HK$1.30b due within 12 months. So its liabilities total HK$1.59b more than the combination of its cash and short-term receivables.

Chow Sang Sang Holdings International has a market capitalization of HK$5.85b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chow Sang Sang Holdings International has a low net debt to EBITDA ratio of only 0.29. And its EBIT covers its interest expense a whopping 1k times over. So we're pretty relaxed about its super-conservative use of debt. It is just as well that Chow Sang Sang Holdings International's load is not too heavy, because its EBIT was down 44% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Chow Sang Sang Holdings International's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Chow Sang Sang Holdings International generated free cash flow amounting to a very robust 91% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Based on what we've seen Chow Sang Sang Holdings International is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its interest cover. Considering this range of data points, we think Chow Sang Sang Holdings International is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Chow Sang Sang Holdings International (including 1 which is is significant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Chow Sang Sang Holdings International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:116

Chow Sang Sang Holdings International

An investment holding company, manufactures and retails jewellery in the Mainland China, Hong Kong, Macau, and Taiwan.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives